The US economy generated 315,000 jobs in August, but the unemployment rate increased. What does it imply for the gold market?

Bullion.Directory precious metals analysis 09 September, 2022

Bullion.Directory precious metals analysis 09 September, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

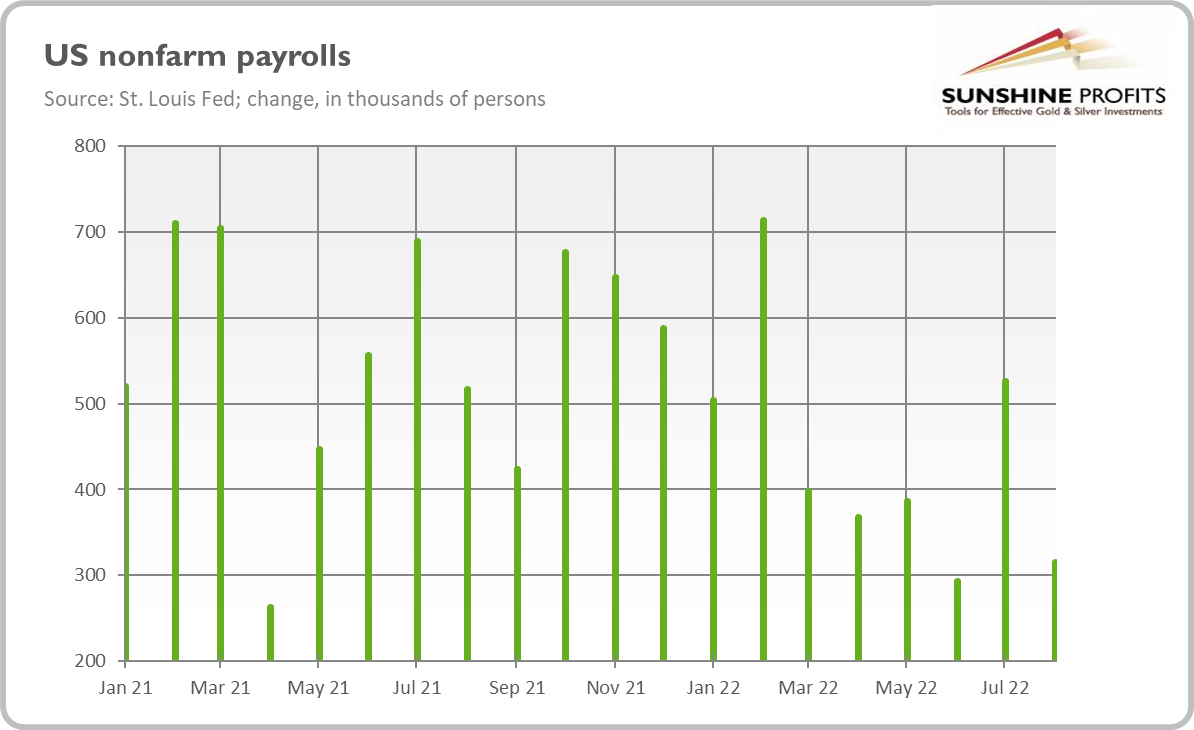

It seems to be, but it’s not! After all, as one can see in the chart below, the U.S. economy created 315,000 jobs last month, roughly in line with expectations, although less than 526,000 jobs added in July. Notable job gains occurred in professional and business services, health care, and retail trade.

What’s more, the rise in the unemployment rate was accompanied by an increase in the labor force participation rate from 62.1% in July to 62.4% in August, which means that more people entered the labor market looking for a job. On the other hand, after revisions, employment in June and July combined is 107,000 lower than previously reported.

However, the headline increase in the unemployment rate is mostly due to the rise in the labor participation rate, so it’s not terrible news. Actually, August’s employment report was strong enough to enable the Fed to continue its tightening cycle at the current hawkish pace.

Indeed, the market odds of a 75-basis point hike at the September FOMC meeting rose from 75% to 82% over the last week, according to the CME FedWatch Tool.

The Fed’s commitment to a decisive fight against inflation through hikes in the federal funds rate was also confirmed by recent remarks from the central bankers.

Fed Vice Chair Lael Brainard said that the Fed will maintain tight monetary policy “for as long as it takes to get inflation down” and that the U.S. central bank’s stance “will need to be restrictive for some time to provide confidence that inflation is moving down.” Similarly, the new Boston Fed President, Susan Collins, in her first media interview at this job, said that although the Fed has raised interest rates significantly, “there’s more to do.”

All this is bad news for the gold bulls, who are waiting for the Fed’s pivot.

The Dollar Strengthens Further

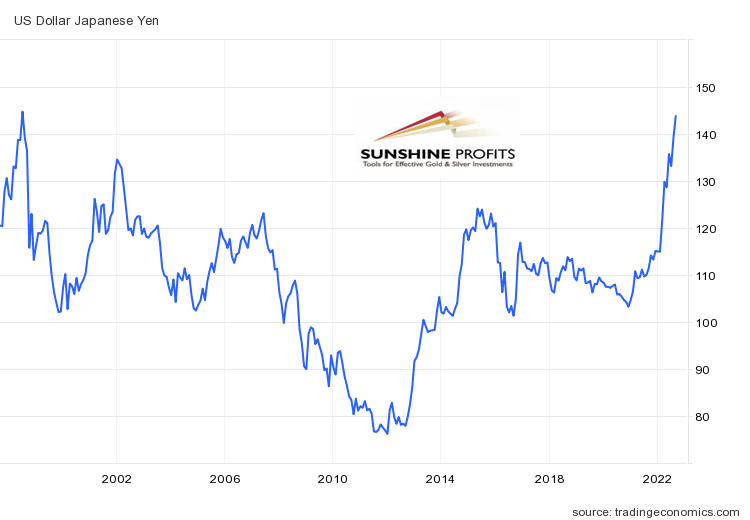

The Fed’s tightening cycle is not the only reason behind the current strength of the U.S. dollar. Another is the relative dovish stance of other major central banks as the ECB and Bank of Japan.

As a consequence, the Japanese yen plunged to the level of 143 per dollar, the lowest level since July 1998, as the chart below shows.

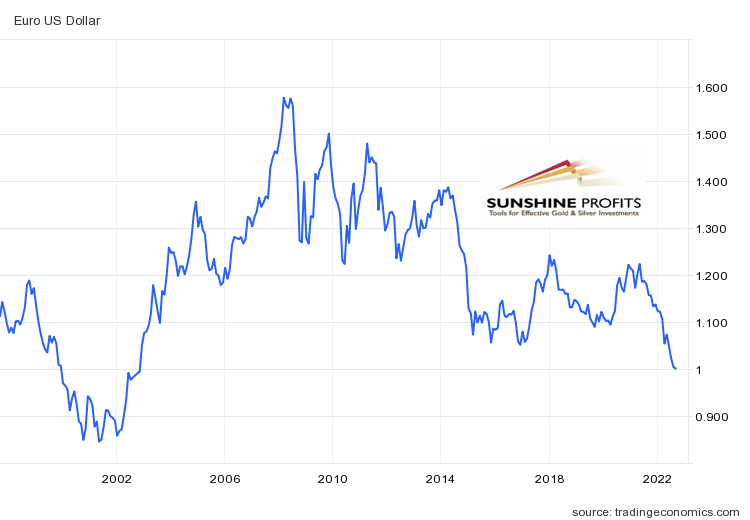

Similarly, the EUR/USD exchange rate has recently tumbled below parity, and also the lowest level since October 2002, as one can see in the chart below. The ECB is not as dovish as the BoJ, but the euro is suffering due to the European energy crisis.

The common currency slumped this week after Russia shut the key Nord Stream 1 pipeline into Europe, sending gas prices higher and boosting concerns about a recession.

Implications for Gold

What does it all mean for the gold market? Well, the recent employment report was strong enough to make the Fed feel comfortable with the continuation of its hawkish monetary policy and with further interest rate hikes. The Fed’s tightening cycle is supporting the U.S. dollar, which is weighing on gold. As the chart below shows, the price of the yellow metal remains below $1,700 and continues its struggle to find bullish momentum.

Unfortunately for the gold bulls, prices can decline further, given the Fed’s stance and the dollar’s strength.

Gold will start a new rally only if either the recession fears intensify, boosting the safe-haven demand for the precious metal, or if the Fed pivots (which won’t happen until the economy seriously slows down).

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply