Gold sold off after Trump’s victory and the red wave – but why? What changed, even before the President-Elect takes office?

Bullion.Directory precious metals analysis 20 November, 2024

Bullion.Directory precious metals analysis 20 November, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

In the short-term, same as all markets, sentiment drives the price of gold.

Greed and fear, to paraphrase Warren Buffett.

If your savings include gold, it always seems like price gains are slow and steady, while price declines are sudden and unexpected. Whether or not that’s true, that’s how it feels.

Let’s remember legendary investor Benjamin Graham’s useful comparison: In the short term, price functions as a voting machine – and in the long term, price functions as a weighing machine. Sentiment drives short-term prices, and sentiment is a manic-depressive news junkie with the attention span of a hyperactive kindergartener.

So what’s the kindergartener watching now?

A less-than-disappointing retail sales report?

Trump’s election and the red wave? Well, it’s no secret that a Harris presidency would’ve been great for gold – bad for the economy, granted. Does it follow that a Trump win is inevitably bad for gold price?

Of course not. Trump and VP-Elect Vance have both gone on record repeatedly for a weaker dollar. A weaker dollar boosts U.S. exports. The downside risks of a weaker dollar are pretty obvious:

- A resurgence of inflation

- More costly import prices (especially raw materials) leading to diminished economic growth

And we all know by now – a weaker dollar means higher gold price.

Do you know what would be some real drivers to push gold’s price down? Excessive gold supply. Superior hedging options. A booming economy. A major central bank gold selloff.

These are the kinds of macroeconomic shifts that would force us to rethink our long-term gold price predictions…

But nothing has changed.

We have a systemically weak U.S. dollar, a faith-based economy and major precious metals supply constraints. Central bank gold buying has been so robust over the last three years that feverish, 100+ ton-per-month sales seem the new normal.

So what really changed? Sentiment. A whole lot of folks who simply don’t understand the deep, structural challenges facing us are relieved we aren’t staring down the barrel of four more years of Bidenomics.

I understand that relief, believe me! Pop the champagne and throw a party.

Then, when the party’s over, after you’ve tidied up, consider this: We’ve yet to see a major bank change its $3,000 gold price forecast for 2025.

Don’t get caught up in short-term sentiment. Keep your eyes on the horizon.

Here’s why we actually like Senator Lummis’s plan to swap gold for bitcoin

Senator Cynthia Lummis (R-Wyoming), the staunch bitcoin advocate, is making headlines again.

WE ARE GOING TO BUILD A STRATEGIC BITCOIN RESERVE 🇺🇸 🇺🇸 🇺🇸

— Senator Cynthia Lummis (@SenLummis) November 6, 2024

My colleagues over at BitIRA are salivating. World’s largest asset manager BlackRock thinks it’s a good idea, too.

Senator Lummis proposes we diversify the nation’s savings account by acquiring one million bitcoins (about 5% of the total supply), some $90 billion worth at current market price. It would’ve cost only $35 billion just one year ago. But that’s irrelevant since we don’t have a time machine.

Recently she’s written legislation that would fund the Strategic Bitcoin Reserve – without adding to the national debt. (Since the federal government has been operating in the red for 23 consecutive years, this is a vital consideration!)

And without raising taxes, or cutting spending on such vital programs as putting shrimp on treadmills or studying the effects of cocaine on the sex lives of quails.

All we have to do is monetize some assets the nation already owns.

She proposes the Department of the Treasury simply sell off some 5% of the national gold reserve.

Wow… Kudos to her for thinking big!

Her logic? Well, no question dealing with the national debt will only become more difficult the longer we wait. Senator Lummis thinks simply owning a rapidly-appreciating asset like bitcoin could theoretically lighten the debt load.

If you’re like me, your knee-jerk reaction to this proposal is something along the lines of, Worst idea ever.

Gold has been money for over 5,000 years. Bitcoin has been money for, what, two decades? Not to say it isn’t an interesting asset – merely to point out that bitcoin has yet to stand the test of time.

Even so, should the U.S. join El Salvador, the only nation on earth, that’s formally integrated bitcoin into its national reserves?

I think the answer is No.

Having said that, I think Senator Lummis’s bill should be heard in Congress, should be voted on and signed into law… Here’s why.

In order to sell a portion of the national gold reserve, the federal government would necessarily need to audit the gold reserve. For the first time in 71 years, fully inspect, audit and account for the entire 8,133 metric tons of gold bullion.

You may be shocked to learn that the legendary United States Bullion Depository at Fort Knox hasn’t been audited since 1971… This is one of the things that our partner Dr. Ron Paul finds both inexplicable and enraging. Here he is back in 2011 trying to get some straight answers:

Here’s a short version of the story, courtesy of Numismatic News.

- 1936: The United States Bullion Depository, a massive fortified vault, was constructed next to the U.S. Army post at Fort Knox, Kentucky. The facility was designed to be impregnable to enemy invasion, and it cost nearly $600,000 to build! Don’t laugh – that was a lot of money back then.

- 1937-1941: Some 417 million troy oz. or 12,960 metric tons of gold was delivered in two massive shipments overseen by – you’ll never guess – the U.S. Post Office! History doesn’t record the employee who signed for the delivery.

- 1943: President Franklin D. Roosevelt toured the facility.

- 1952: By the end of the Truman administration, over 57 million oz. of gold bullion had been withdrawn by foreign governments. To ensure there hadn’t been any hijinks, the incoming Eisenhower administration demanded a comprehensive audit.

- 1953: Eisenhower’s staff declared themselves satisfied by the results of the completed audit. The vaults were sealed and not opened for over two decades.

- 1974: In the aftermath of President Nixon’s abandonment of the gold standard, persistent rumors of missing gold spread. To quash the rumors, the Department of the Treasury and the U.S. Mint finally authorized a public visit to the vault. A gaggle of 120 reporters, members of Congress and a variety of federal officials were led through the bullion depository on September 23, 1974.

Freelance writer Dave Ganz was one of those lucky folks – yet his account is oddly bland. It’s worth reading all the same.

Now, it’s not entirely clear why a press tour 50 years ago is treated as an audit. The Sound Money Defense League describes the visit as “a peek-a-boo glance at the gold in fine Hollywood style.” They continue, pointing out just how much that publicity stunt left to be desired:

Not one bar of gold was assayed for purity during that 1974 charade, not one serial number was checked against official records, and no one counted the bars of gold stacked to the ceiling in the one room that was opened for inspection. Other rooms, said to be filled with gold, were not opened.

The gold hasn’t been audited since 1953. Modern “audits” amount to nothing more than checking the seals on the vault doors – and a shocking seven of those reports are simply missing.

Is it any wonder that 75% of Americans want a Fort Knox audit and only 10% believe the gold is really there?

No, we’re told — the manpower for a proper audit, a full accounting, is something our government can’t afford. Seriously! They can find money to pay for studies of social media’s effects on the mental health of dogs. Or jello wrestling in Antarctica – that’s worth a few million!

But a proper audit of our nation’s emergency fund? Sorry, maybe next year.

Besides (Janet Yellen might ask), what’s the point?

Maybe gold used to be money. But for decades the international financial system relied less and less on gold as a medium of exchange. Former Federal Reserve chair Ben Bernanke went so far as to deny that gold is money!

Things have changed – perhaps it’s more accurate to say they’ve come full circle.

The international financial system has made a complete about-face regarding gold’s role as an asset. Central banks are hoarding gold like never before (and they already own about 17% of all the gold ever mined).

Several nations have now issued gold-backed currencies. Here in the U.S. 42 states have eliminated taxes on precious metals. And six states now recognize physical gold and silver coins as legal tender!

In short, the landscape is quite different today than it was in 1953, or in 1974 – even significantly different than in 2011.

It’s quite possible that the stakes are simply too high for a thorough, detailed and honest audit of the U.S. gold reserve.

Since the last full audit of the gold reserve back in 1953, federal debt has increased 13,398%. (I double-checked the numbers.)

As noted, now is the worst time possible for the U.S. to go digging through its vaults and find a bunch of notes saying “shipped to”, as in the case of like the Bank of Canada did (third story here). And this, far more than anything else, is why Lummis’ proposal won’t happen.

Not to say there won’t be a Strategic Bitcoin Reserve. Just that it’ll be funded in another way.

Rising inflation – blame the Fed, or something else?

Once again, the inflation rate is doing things that should be making headlines.

Apparently, official inflation rose from 2.4% to 2.6% from September to October, while core inflation remained 3.3%. The latter is the one the Federal Reserve aims to keep at 2%. Such overachievers!

Less than good news… Especially as these are the most optimistic measurements, what Wolf Richter calls the “the Fed’s lowest lowball inflation measure.” With 400 Ph.D. economists on staff they still can’t cook up a number that doesn’t spell trouble.

And the Fed’s lowering interest rates now! Sure, 75bps cuts aren’t huge compared to the 550bps increases over the last couple years – but what happens when the Fed keeps cutting?

Here’s what seems likely: A 4% inflation rate as the “new normal.” As so many analysts and pundits are warning.

Well, why not? If they can convince us 2% annual wealth destruction is “for our own good,” maybe they can convince us 4% annual wealth destruction is “even better for you!” By the way, when you look back over the last 50-60 years, inflation under the Fed has averaged 4% per year. Decade after decade, despite the official 2% target, and almost nobody noticed.

These are the kinds of stories that should be occupying every headline, but they’re under-reported and difficult to find.

Amazingly, the story above says that sticky inflation is bad for gold!

The stubborn inflation may serve as a negative catalyst for gold markets in case traders start to worry that inflation may rise again.

This isn’t logic – it’s word salad.

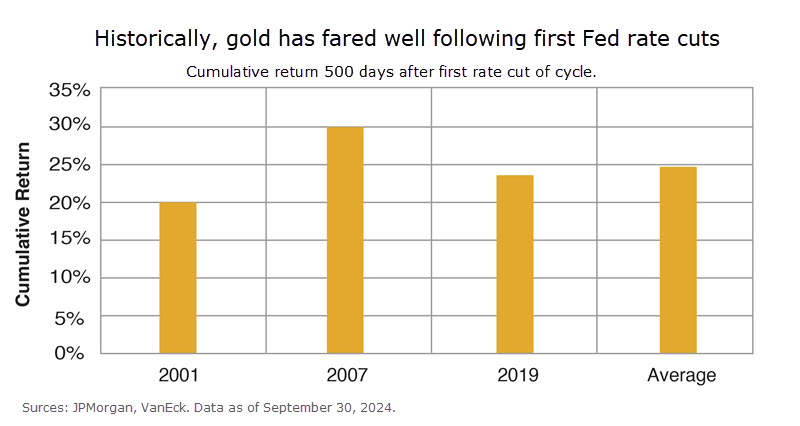

It’s the old narrative of gold underperforming in hiking cycles, when it has gained in nearly every one. See for yourself.

We are fresh off of the biggest interest rate hiking cycle in 50 years, and it paved the way for arguably gold’s best 12-month performance in that timeframe. Inflation is known to be gold’s primary driver, and historical data shows that hiking cycles boost gold prices almost invariably.

The claim to the contrary is not unlike what has kept prices down for the last two weeks: sentiment for the sake of itself.

Hiking rates after cutting them would be a major concession and far from standard course from the Fed, so it’s unlikely to happen.

But if it doesn’t, a 4% inflation seems all but assured.

Either way, this is what gold investors should be watching.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply