The very recent hours in gold were calm, but don’t let that fool you.

Bullion.Directory precious metals analysis 08 December, 2023

Bullion.Directory precious metals analysis 08 December, 2023

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

After testing new highs, gold is likely to move far, up or down.

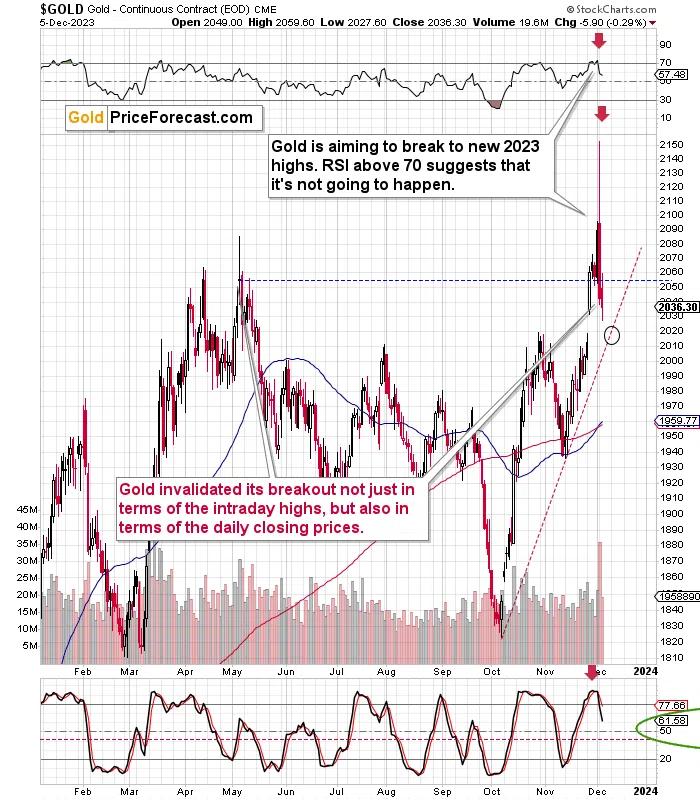

Previously, I wrote that the price of gold was about to decline after its massive reversal and that’s exactly what happened. The decline is now likely to continue, but there’s a good chance that we’ll see at least a small rebound from $2,000 or slightly higher levels.

The above chart shows why. The rising support line and the July and October highs are there, and $2,000 is a very round number, making it important psychologically, so the odds are that we’ll see some rebound from the $2,000 – $2,020 area.

Now, whether it will just be a tiny blip on the radar screen or another massive rally that takes gold to new highs is a different pattern. For now, the bearish scenario remains more probable, but if we see the bullish signals that I had outlined in my previous Gold Trading Alerts, the rally could be much bigger.

Remember when I wrote that silver was known for fake breakouts and that its move above the early January 2023 high was likely to be invalidated?

That’s exactly what we just saw. The white metal went back below this year’s highs. And you know what happened next in each previous case after this happened? Silver price plunged.

The first pause was at about $23. That’s where we might see some short-term support also this time, but if gold moves below its rising support line, silver is likely to slide as well. In consequence, silver’s pause is unlikely to be anything more than just that. Not a major bottom, not the start of a new, powerful rally, but a pause.

Yesterday, I wrote that junior mining stocks have just invalidated their breakout above the 61.8% Fibonacci retracement level, and we didn’t have to wait for the GDXJ to move below its 50% retracement, too.

Yes, the decline will likely continue and take mining stocks to new yearly lows. It’s often difficult to see a big decline as a real possibility after a short-term rally, especially if it was sharp, but that’s exactly what is likely now. In particular, when you look at the red arrows that mark moments when junior miners were similarly – extremely – overbought.

The RSI above 70 is something suggesting that stocks are topping here as well. As it was the case previously, miners are declining more than other stocks (same with FCX). This is in tune with what’s been happening for months (marked with a red rectangle) – it’s simply been more visible in the last few days.

When stocks decline much more (as they are likely to based i.a. on the high interest rate environment and problems that it is causing), miners’ prices are likely to truly slide.

Meanwhile, the USD Index corrected to its 61.8% Fibonacci retracement after rallying profoundly earlier this year, and it now appears to be ready to soar once again. In fact, it’s already moving higher.

The RSI that was just at 30 suggests that the size of this rally is not going to be minor. The last time we saw RSI this low was when the yearly bottom formed, and then the USDX rallied by about 7 index points.

So far, it has rallied by just 2 index points.

Summing up, the situation now is very bearish for the mining stocks, but – as I emphasized earlier – it’s possible that we’ll see a bullish turnaround, and the same indications that I described previously might launch a big rally.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply