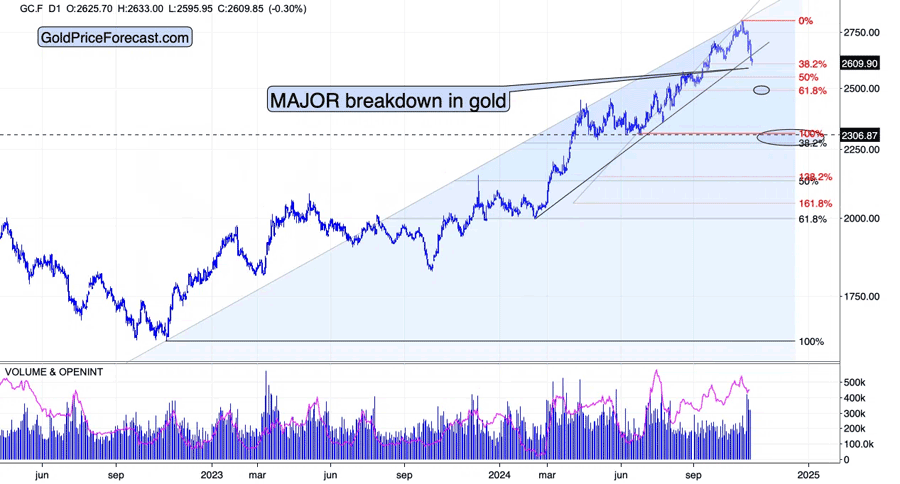

Gold plunged by almost $80 yesterday… And it doesn’t look like the decline is going to end (!) anytime soon.

Bullion.Directory precious metals analysis 12 November, 2024

Bullion.Directory precious metals analysis 12 November, 2024

By Przemysław K. Radomski

Founder of GoldPriceForecast.com

Sure, there will be corrections, but the bearish train appears to have finally left the station, as I’ve been expecting it too previously.

Gold broke below its rising support line, which is a strong sign that the trend has changed. Since the rally that we saw previously started back in 2022, at much lower prices, it means that gold has a lot of room to fall before it reaches even its first of the classic Fibonacci retracement levels at about $2,270.

As this level (approximately) corresponds to gold’s previous lows, it seems that it would be enough to trigger at least a sizable short-term rally.

There are two other notable support levels that I’d like to feature.

One is right now – as gold just reached its 38.2% Fibonacci retracement based on the mid-2024 – late-2024 rally. The other is the 61.8% retracement based on the same rally – at about $2,500. This level, being a very round number, might trigger a rebound, especially that it’s strengthened by the Fibonacci retracement.

Gold reaching its 38.2% Fibonacci retracement implies that we might get a rebound soon – or it might even be taking place right now. In fact, given that the USD Index moved higher today, but gold first moved lower and then back up, it suggests that the correction might already be underway. Anyway, I don’t think that this correction will be able to do anything more than to take gold back to the previously broken rising support line (at about $2,645) and verify it as resistance.

Some might consider shorting gold here, but in my view mining stocks present a much better opportunity for it. The full version of this analysis includes targets for miners (and for silver), and over here, I’d like to show you how it looks like on the long-term HUI Index (proxy for gold stocks) chart.

When we look at the long-term chart featuring the HUI Index, it becomes obvious that the decline is small so far, and that the nearby targets are not necessarily going to stop the medium-term decline.

Based on several charts (long-term gold chart, USD Index, world stocks, copper etc.) the current situation might be similar to 2008 and 2012. In this case, the decline in mining stocks could be really profound.

I copied the 2008 and 2012-2013 declines to the current situation. If these declines are to be repeated to a considerable extent, we’re looking at a decline that would be likely to take miners at least (!) back to their 2020 low – and perhaps back to their 2016 low.

Yes, really.

The target areas above are based on other support levels that miners will encounter during their slide. The 61.8% Fibonacci retracement is based on the 2022-2024 decline, the rising, long-term support line, and the 2022 low.

For the USD index, the next targets are at about 106.7 and at about 108.5. Then, at about 114 – the 2022 high. And then even higher.

Also, please note that copper is moving lower once again today.

This further confirms the bearish outlook for the entire commodity sector.

Also, please note that the S&P 500 Index closed slightly above 6,000 yesterday, and it just moved back below it in today’s trading. We might get an invalidation of this move in terms of the daily closing prices, which could lead to further sales and a decline. This would be very bearish for the prices of junior mining stocks.

If you’ve been shorting the junior mining stocks (as my subscribers did) in recent weeks – congratulations – your patience is being rewarded, but – in my opinion – much bigger rewards await in the following weeks and months.

Przemyslaw Radomski

Przemyslaw K. Radomski, CFA, has over twenty years of expertise in precious metals. Treating self-growth and conscious capitalism as core principles, he is the founder of GoldPriceForecast.com

As a CFA charterholder, he shares the highest standards for professional excellence and ethics for the ultimate benefit of society and believes that the greatest potential is currently in the precious metals sector. For that reason it is his main point of interest to help you make the most of that potential.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply