This time, it appears like she’s campaigning for another Biden term by highlighting his economic “success.”

Bullion.Directory precious metals analysis 26 January, 2024

Bullion.Directory precious metals analysis 26 January, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Yellen’s “strategy” isn’t all that novel. She seems to be starting by leveraging Biden’s infrastructure spending, according to a Newsmax article:

Yellen will seek to draw contrasts with the Trump administration’s failure to enact major infrastructure legislation, touting Biden’s $1.2 trillion infrastructure law, his investments in semiconductors and hundreds of billions of dollars in clean energy tax breaks.

Trump also attempted to spend $2 trillion on infrastructure, to no avail. But even Biden’s “success” creates a little “hitch” in Yellen’s campaign strategy…

Inflation is still taxing the wealth of everyday Americans, so touting trillions of dollars in additional spending probably isn’t a very good idea. Especially since Biden is directly responsible for adding $5.1 trillion in debt since he took office.

But that didn’t stop Yellen from trying to manipulate public opinion by declaring that the U.S. economy had already achieved a “soft landing”:

Treasury Secretary Janet Yellen declared Friday the US economy had achieved a long-sought soft landing, a historically unusual event in which high inflation is tamed without significantly damaging the labor market. “What we’re seeing now I think we can describe as a soft landing, and my hope is that it will continue,” Yellen said Friday in an interview with CNN.

As usual, Yellen declaring economic victory is premature.

It’s quite likely she will be proven wrong again, like she has in the past.

But even if she gets lucky and ends up correct (a BIG “if”), unfortunately what she recently called a “soft landing” could end up being an appetizer for what’s coming…

More reasons why Bidenomic “success” is an illusion

Right now, inflation is currently increasing prices at an official rate of 3.4%, a rate that has been easing slowly from a 40-year high of 9% inflation in June 2022.

Not only that, assuming it does keep easing (a big assumption), it could continue robbing the wealth of older Americans for quite a while, according to a CNBC piece:

“The so-called last mile is going to get a lot trickier,” Mohamed El-Erian, chief economic advisor at Allianz and president of Queens’ College at the University of Cambridge, recently told CNBC.

“We’re not going to have the tailwinds that we had, and we’re going to have some headwinds,” he said.

[…] This final disinflationary hurdle will be a challenge without curtailing economic growth and risking recession, a dynamic that would likely crimp consumer demand and rein in prices, economists said.

In fact, we’ve even made a strong case that the next 6-10 years of economic activity could be persistently inflationary.

And it gets even worse…

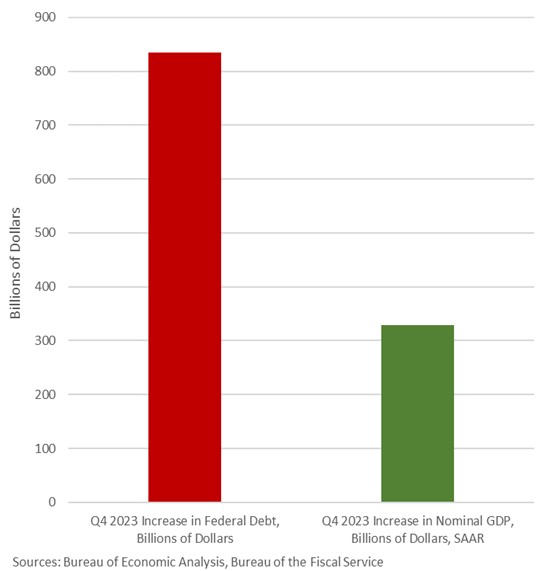

You might think with the “official” unemployment rate of 3.6% repeatedly touted as “historic” by the Biden Administration, that the “net” GDP increases would also be historic. Unfortunately, the 4Q2023 numbers by themselves tell a much different story.

The increase in GDP didn’t even come close to keeping up with the billions of dollars in Federal debt generated by this Administration during the same quarter (which doesn’t even tell the whole story):

So much for Bidenomics, which appears like it can’t keep pace with Government spending for one quarter (the holiday shopping season), let alone boost the economy.

In spite of these facts, White House spokesperson Andrew Bates couldn’t resist some blatant partisanship, and said you should just be happy with the “success” that Biden’s economy has had:

“Republican officials should welcome the economic progress President Biden is delivering.”

If by economic progress he means the potential for Biden to deliver a major recession, we’re pretty sure that most Americans would respond: “No thanks.”

Unfortunately, thanks mainly to Bidenomics, but also Trump’s spending during COVID that preceded it, you’ll have to consider whether to prepare for something to happen.

Guard your retirement savings against the fragile economy

Everything revealed above is already bad enough on its own, but there’s still one more critical fact for you to consider.

The staggering $10 trillion of added debt since 1Q2020, plus the enormous costs of rolling the old debt over, means it won’t matter much who is elected in 2024. It’s quite unlikely that the new POTUS-elect will be able to do anything about the potential disaster just around the corner.

To prepare for that, you might consider different ways to bolster your resistance to inflation. That might mean adding some precious metals to your retirement savings. Getting your hands on some gold and silver could help add stability to your retirement.

Both metals have historically served as safe-haven stores of value, preserving wealth during troubling economic times. In fact, the price of physical gold in 2023 grew almost 13% overall (beating inflation).

You can get all of the information you need to think about diversifying with precious metals in our free information kit.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply