Time and time again we are seeing fraud taking place in the precious metals’ market.

Bullion.Directory precious metals analysis 15 May, 2017

Bullion.Directory precious metals analysis 15 May, 2017

By Egon Von Greyerz

Founder Matterhorn Asset Management & Board Member at GoldBroker.com

No, this is blatant manipulation by governments and bullion banks as well as speculators. And since governments are involved, it is sanctioned by them with no consequences for the traders who are rigging the market.

BULLION BANKS FEAR THE DAY THEY MUST TURN PAPER GOLD INTO PHYSICAL

What is happening has nothing to do with real markets or real supply and demand. What we are seeing is governments trying to obfuscate their total mismanagement of the economy and the currency.

So far, the bullion banks have been fortunate that gold and silver paper holders haven’t called their bluff and asked for physical delivery.

Because we know and the banks know that the day they will need to come up with the real gold and silver bars, it is game over. Because they haven’t got physical gold or silver to cover even a fraction of their paper shorts.

Between futures exchanges, bullion banks, including precious metals derivates contracts, there are hundreds of ounces of paper gold and silver outstanding for every ounce of physical backing.

The problem is that it is not only the bankers that are the culprits in this game. No, governments are just as culpable. Western banks officially hold 30,000 tonnes of gold. Virtually no Western central bank has ever had a physical audit of their gold. The US had their last audit during Eisenhower’s reign in 1953?

Western central banks have in the last few decades been liquidating a major part of their gold holdings. For example, he UK sold half of their gold holdings at the end of the 1990s and Switzerland sold over half. Norway sold ALL their holdings in the early 2000s.

What the central banks didn’t sell, they lent or leased to the market. They did this to earn a return on their gold. Most of the lending took place through LBMA (London Bullion Market Association) banks in London and some in New York. So a central bank would lend part of its gold to the market and the gold would stay within the London or New York pool.

But that changed in the 2000s.

The big buyers of gold are now China and India. Neither of these countries is interested in keeping their gold in London or New York. Instead they want physical delivery. The normal pattern is for the 400 oz bars to be sent from primarily London to the Swiss refiners to be broken down into 1 kg bars.

The kilo bars are then exported from Switzerland to the buyers in China and India plus other major buyers like Russia. This is why the UK appears as a major exporter of gold.

ACCUMULATE PHYSICAL GOLD BEFORE THE MARKET RUNS OUT

The consequences of these transactions are very serious for Western central banks. Their gold which was leased to the market doesn’t exist anymore.

It has been broken down into new 1 kilo bars and gone to Silk Road buyers. Western central banks will of course never get their physical gold back. All they have is an IOU from a bullion bank. And since the gold has left the West, the bullion bank will never be able to deliver physical gold against their paper commitment.

Since there have never been any audits, nobody knows how much unencumbered physical gold is still left in Western central banks.

It is very unlikely to be even 50% of the 30,000 tonnes that they officially hold. The people and nations that understand that this Ponzi scheme is going on are not panicking. Because they know that the ones who hold the physical gold also have the power.

But it is not only a question of power but also confidence that physical gold will protect the people who understand the significance of holding it.

At times like we are seeing now in the precious metals markets, the weak hands are shaken out. Weak hands are speculators who buy gold on margin. Let me make it very clear. You must never buy a wealth preservation asset to leverage it or borrow against it.

When you borrow against your gold and silver, it doesn’t belong to you anymore. Instead it belongs to the bank or the lender. Buying physical gold and pledging it serves no purpose. That is pure speculation. In that case, it makes no sense to go via physical gold.

You might as well just buy gold futures which of course has nothing to do with wealth protection.

Speculators are weak hands. They buy gold when it goes up and sells when it goes down. This has nothing to do with wealth preservation. Gold and silver is bought as insurance to protect against all the major risks in the world economy and financial system. It is bought for wealth protection purposes and should form the bottom of your wealth pyramid.

In an era when governments print unlimited amounts of money and expand credit ad infinitum, precious metals is the only asset that will maintain purchasing power and preserve wealth. But is must of course be stored in a politically safe country and outside the banking system.

We now hear about major liquidations of gold and silver, especially in the retail market. The people who sell do not understand the purpose of holding gold and silver.

They are in it for a quick buck and will have nothing left when the real crisis starts. And it is absolutely guaranteed that we will have the biggest financial crisis in history in the next few years.

CONTINUED STRONG DEMAND FROM ASIA

Since our company is very close to the real physical gold market, let us report that we are seeing no selling of physical gold or silver.

Our investors understand precious metals and they know why they are holding physical gold and silver. They are not fickle or nervous because manipulators are trying to frighten them into selling their gold and silver. They know that in the next few years their precious metals will not just maintain purchasing power.

They also know that, as most assets crash including paper money, gold and silver will vastly outperform all investments.

We also speak to our friends the Swiss refiners who produce 60-70% of all the gold bars in the world. They are seeing continued strong demand from Asia and particularly China and India.

The West has been selling physical gold for a few decades whilst the East has continued to buy massive quantities.

FOLLOW THE WISDOM OF THE EAST

China started accumulating gold seriously in 2008, during the Great Financial Crisis. They knew what was coming and they knew that the Western financial system would not survive the massive money printing that the West had embarked on in their futile attempts to save the system.

The Chinese also know that the 2006-9 crisis was just a rehearsal. This is why they have increased their gold holdings substantially since then.

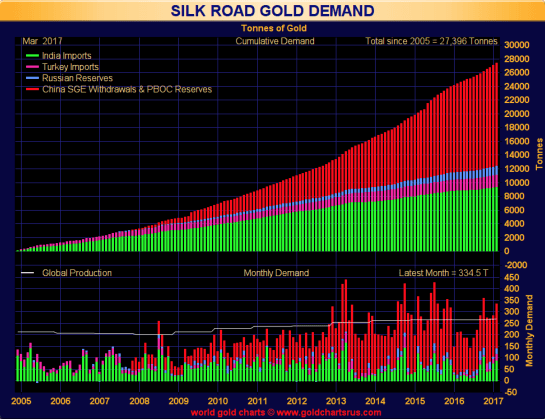

Of the Silk Road countries, only India and Turkey had substantial holdings at the beginning of the crisis in 2006 of just below 2,000 tonnes in total.

China started buying gold on a bigger scale in 2008. Since then China has accumulated a substantial 15,000 tonnes. The total purchases of the four Silk Road countries, China, India, Russia and Turkey since 2005 has been 27,400 tonnes.

This means that 4 countries have in the last 12 years absorbed all the gold mine production in the world. These countries totally understand the uncontrollable risks in the global financial system and they also know that gold is the best protection against these risks.

Investors should follow the wisdom of the East and continue to accumulate gold and silver at the current very advantageous prices. There is no doubt in my mind that in the next few years, gold and silver will be multiples of today’s price.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply