Euro Price Hits 16-Month Low Amid Stock Market’s ‘Daily Bull Market’

Bullion.Directory precious metals analysis 03 July, 2017

Bullion.Directory precious metals analysis 03 July, 2017

By Steffen Grosshauser

European Operations Executive at Bullion Vault

With gold dropping to $1226 per ounce, silver and platinum also reached their lowest Dollar values since early May at $16.29 and $908 per ounce respectively.

The US Dollar Index bounced against a basket of other major currencies but stayed close to a 9-month low after new data said activity in the 19-nation Eurozone’s manufacturing sector accelerated to a 6-year high last month.

European stocks advanced for the first time in five days and Asian stocks started the new month close to 2-year highs.

Investing in gold for Euro citizens fell to its cheapest since March 2016 beneath €1080 per ounce.

Oil prices meantime rose for the eight straight day – their longest rally since February 2012 – on what analysts called “tightening” supply amid the Opec oil cartel’s agreement on output caps.

“The safe-haven buying that had pushed gold to an eight-month high earlier [last] month has slowly petered out, with risk-appetite improving in recent days,” according to a note from Australia’s ANZ Bank.

For equities in contrast, “Every day seems like a bull market,” says Terence Hanlon, president of Dallas-based precious metals wholesalers Dillon Gage.

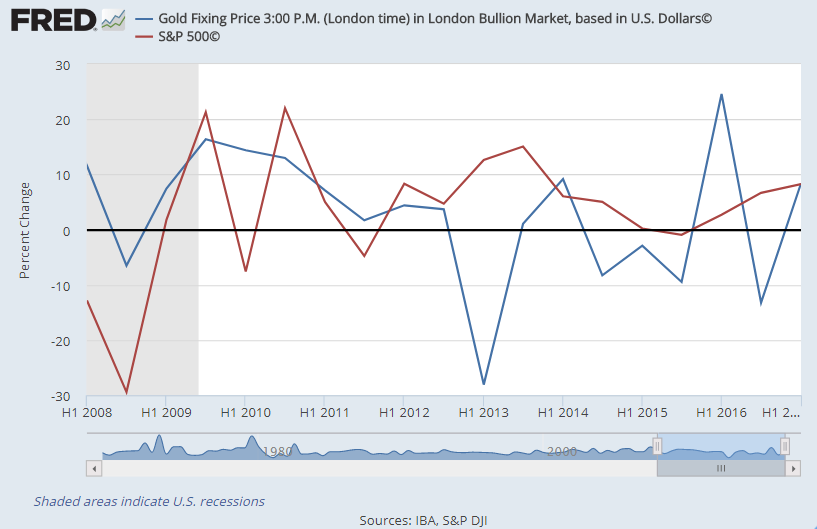

While the S&P500 index gained 8.2% in the first half of 2017, gold priced in Dollars gained 8.4%.

Retailer demand for American Eagle gold coins fell in January to June 2017 to record the weakest first-half investing total since 2007, sales data from the US Mint show.

This year’s sales to date fell 92% from the same period last year, when concerns over China’s growth were followed by the UK’s shock Brexit referendum vote.

Competitor coin and bar producer the Perth Mint in Western Australia said today its sales of retail gold-investment products fell 35% last month from May, also pulling down the year-on-year comparison.

Chinese gold prices fell overnight to their lowest Yuan value since mid-March, but their premium over comparable quotes in London – heart of the world’s wholesale bullion trade – held near $10 per ounce, just above the typical incentive to new imports into the world’s No.1 consumer nation.

World No.2 India saw gold imports through the key hub of Ahmedabad sink 60% last month from May, the Times of India reports, as dealers enjoyed a surge in demand but stopped stockpiling ahead of last weekend’s imposition of 3% GST sales tax, now widely expected to temper household purchases already weakened by the seasonal summer lull in Hindu wedding and festival dates.

The new rules – now applied to goods and services across the world’s second most populous nation – risk distorting India’s gold market, the Association of Gold Refineries & Mints (AGRM) warns, because the 3% General Sales Tax introduces a “huge pricing disadvantage” for its members working outside the country’s excise-free enterprise zones.

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply