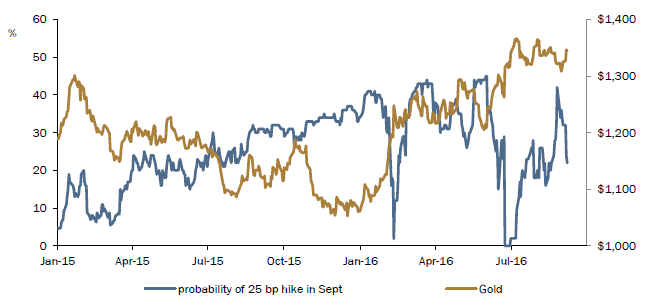

Betting on US Dollar interest-rate futures puts the likelihood of a hike at the Federal Reserve’s September meeting up to 27% from 18%

Bullion.Directory precious metals analysis 09 September, 2016

Bullion.Directory precious metals analysis 09 September, 2016

By Adrian Ash

Head of Research at Bullion Vault

Previously called “a solid dove” in favor of keeping rates low, “There are longer-term risks… compounded if delays in tightening earlier [then] require more rapid increases later in the cycle,” said Boston Fed president Eric Rosengren in a speech in Massachusetts.

Crude oil dropped 2% for the day and silver prices shed the last of this week’s previous 3.5% gains – dropping back to $19.45 per ounce – as the EuroStoxx 50 index lost 0.5% from last Friday.

Ten-year US Treasury bond yields rose to the highest level since the UK’s shock Brexit referendum result in late June at 1.65%.

Betting on US Dollar interest-rate futures today put the likelihood of a hike at the Federal Reserve’s September meeting in 2 weeks’ time up to 27% from 18% yesterday.

“Tighter US monetary policy is still a key risk” for gold investing says Tom Kendall, head of precious metals strategy at Chinese-owned investment and bullion bank ICBC Standard Bank in London, but after the recent run of weaker economic data “the risk has been deferred to December, or more likely Q1 2017.”

Finding “few reasons to be short” of gold or other precious metals right now, Kendall’s latest quarterly outlook predicts “some upside but no fireworks” for the bullion market.

Contrasting gold investing with consumer demand, this year’s strong price gains to date remain “indebted” to US money managers, ICBC Standard’s chief precious metals strategist warns, risking a sharp price drop if investing flows reverse, especially from exchange-traded trust fund vehicles.

Analysis from investment and bullion market-making bank Societe Generale this week said a drop in ETF holdings – driven by shareholder selling – would take gold prices back towards late-2015’s six-year lows if 2016’s inflows were entirely reversed.

Surging at the fastest pace since 2009, “Monthly changes in ETF flows have far exceeded the rate of Chinese gold imports for much of this year,” adds Kendall at ICBC Standard Bank.

But “with the Indian [jewelry] market slowly normalising and the risk of a US rate rise rapidly diminishing again,” he concludes, “we continue to expect gold to break the $1400 level sooner rather than later.”

After China reported stronger-than-expected imports for August and only a 2.8% drop in exports – the slowest annual fall since April – new data today said consumer-price inflation in the world’s largest gold-buying nation eased to 1.3% last month, the slowest pace in well over a year.

Germany’s exports sank 10% year-over-year in July, while France’s industrial output shrank 0.6% from June but its government budget deficit widened.

The Euro erased half of this week’s earlier gains on the FX market, pushing prices for currency-union savers wanting to start gold investing back up to last Friday’s finish at €1188 per ounce.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply