Just Why the Cost of Living Is Quickly Becoming Impossible to Cope With?

Bullion.Directory precious metals analysis 18 April, 2024

Bullion.Directory precious metals analysis 18 April, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

In addition to the already bad news we revealed last week, it looks like there is even more bad news for Biden.

It appears like it’s becoming even more expensive to live in this country, no matter where you decide to put down roots or try to save for your retirement.

So let’s take a quick look at why that could be…

No matter how the administration tries to spin the last few years of inflation, the fact is, it’s persistent and heating up again. On top of that, it looks like even more people are starting to come to grips with that reality.

A recent AP survey put a spotlight on the newest developments:

An AP/NORC survey showed 58% of respondents said Biden has “hurt” the cost of living.

Years of relentless price increases on gas, groceries, and other necessary items tend to support the perfect storm of economic impacts the poll respondents could be feeling.

In fact, according to a recent update by Charlie Bilello, the rate of price inflation has been both high and persistent for the first time in over 30 years:

The U.S. Inflation Rate has now been above 3% for 36 consecutive months, the longest period of high inflation since the late 1980s/early 1990s.

By comparison, the same AP survey surprisingly revealed that 40% of respondents thought Trump’s administration hurt the cost of living. It’s understandable that they think that way. After all, he was in charge when the Fed lit the spark for higher inflation during the initial COVID-19 panic.

But the fact is, the inflation rate didn’t actually start heating up at a noticeable rate until a few months into Biden’s tenure. It eventually reached a historic pace in June 2022 not seen in the last 40 years (officially as high as 9% year-over-year).

In addition, a news release by the Associated Press revealed that some Americans have long memories of exactly who was in charge when it comes to the price they’re paying at the grocery stores and gas pumps:

“Considering the price of gas, the price of groceries, the economy – I did very well during those four years,” 60-year-old Christina Elliott, a Texas Republican, told the AP of Trump’s tenure. “I didn’t have to worry about filling up my tank or losing half of my paycheck to the grocery store.”

With all of that in mind, here are three more data points to consider, that add to the heap of data that show how Bidenflation is affecting people.

More bad news about price increases in three charts

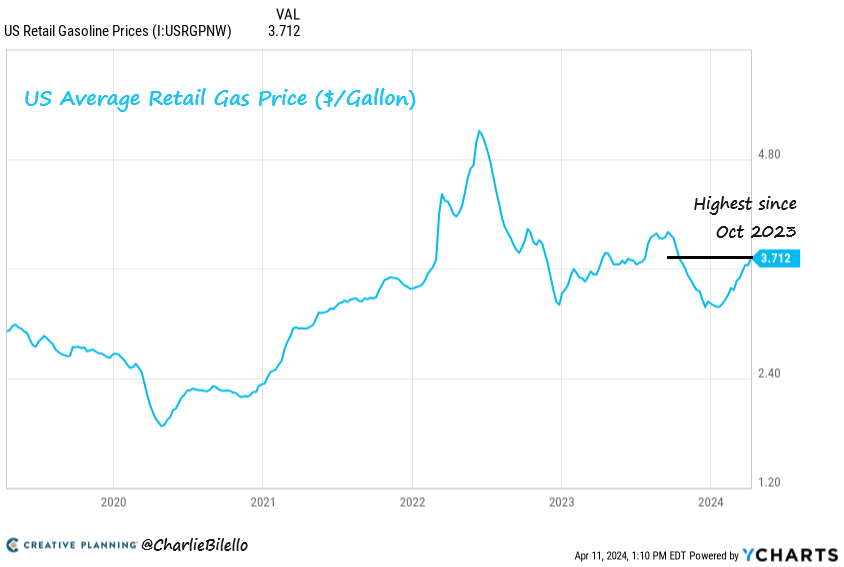

While the “price at the pump” has risen and fallen over the last few years, it hasn’t fallen back down to “Trump-era” pricing.

In fact, since 2021 the average retail gas price hasn’t fallen below $2.40 a gallon, and hasn’t fallen below $3.00 a gallon since 2022. It’s also on the rise again:

via Charlie Bilello

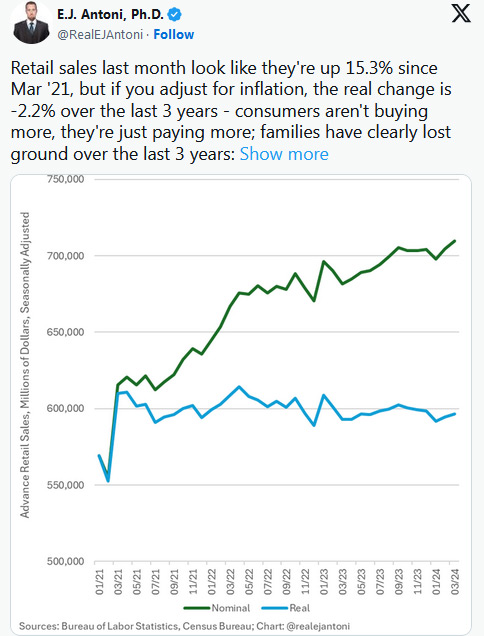

Heritage Foundation economist E. J. Antoni, PhD took to X and revealed more bad news about the impact that Bidenomics has had on hardworking families:

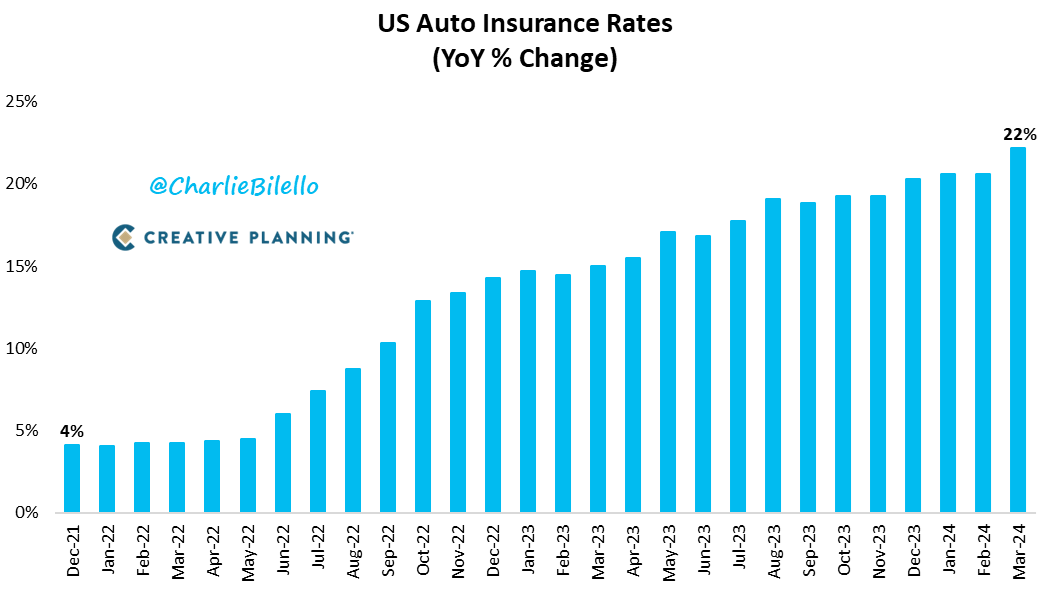

Finally, if you feel like your car insurance company is performing some sort of “highway robbery” on your bank account since October 2022, then you would be right:

via Charlie Bilello

To put this in perspective, average comprehensive car insurance premiums jumped from $2,000 per year to more than $2,400 per year in March 2024 alone. That’s like adding two full month’s worth of premium payments.

And don’t forget, inflation’s impact is cumulative, not static like most people think. That lost purchasing power doesn’t come back.

Once prices go up like this, they just don’t come back down.

We can’t get back what we’ve already lost – but we can take steps right now to prevent it from getting even worse…

Insulating your savings from the rising cost of living

Here’s the good news: Physical precious metals like gold and silver have historically provided a hedge against inflation. (There are also several other inflation-resistant investments to consider alongside metals).

In fact, the price of gold has soared more than 25% since October of last year (as of April 17th, 2024). Take a look at the current interactive prices on most physical precious metals including gold right here.

There’s a reason gold has been hitting all-time high prices recently.

More and more American families are desperate to preserve their purchasing power from inflation.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply