With each day of the Russian invasion, gold confirms its status as the safe-haven asset. Its long-term outlook has become more bullish than before the war.

Bullion.Directory precious metals analysis 10 March, 2022

Bullion.Directory precious metals analysis 10 March, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

Two weeks of destruction, terror, and death that captured the souls of thousands of soldiers and hundreds of civilians, including dozens of children.

Just yesterday, Russian forces bombed a maternity hospital in southern Ukraine. I used to be a fan of Russian literature and classic music (who doesn’t like Tolstoy or Tchaikovsky?), but the systematic bombing of civilian areas (and the use of thermobaric missiles) makes me doubt whether the Russians really belong to the family of civilized nations.

Now, for the warzone report. The country’s capital and largest cities remain in the hands of the Ukrainians. Russian forces are drawing reserves, deploying conscript troops to Ukraine to replace great losses. They are still trying to encircle Kyiv. They are also strengthening their presence around the city of Mykolaiv in southern Ukraine. However, the Ukrainian army heroically holds back enemy attacks in all directions.

The defense is so effective that the large Russian column north-west of Kyiv has made little progress in over a week, while Russian air activity has significantly decreased in recent days.

Implications for Gold

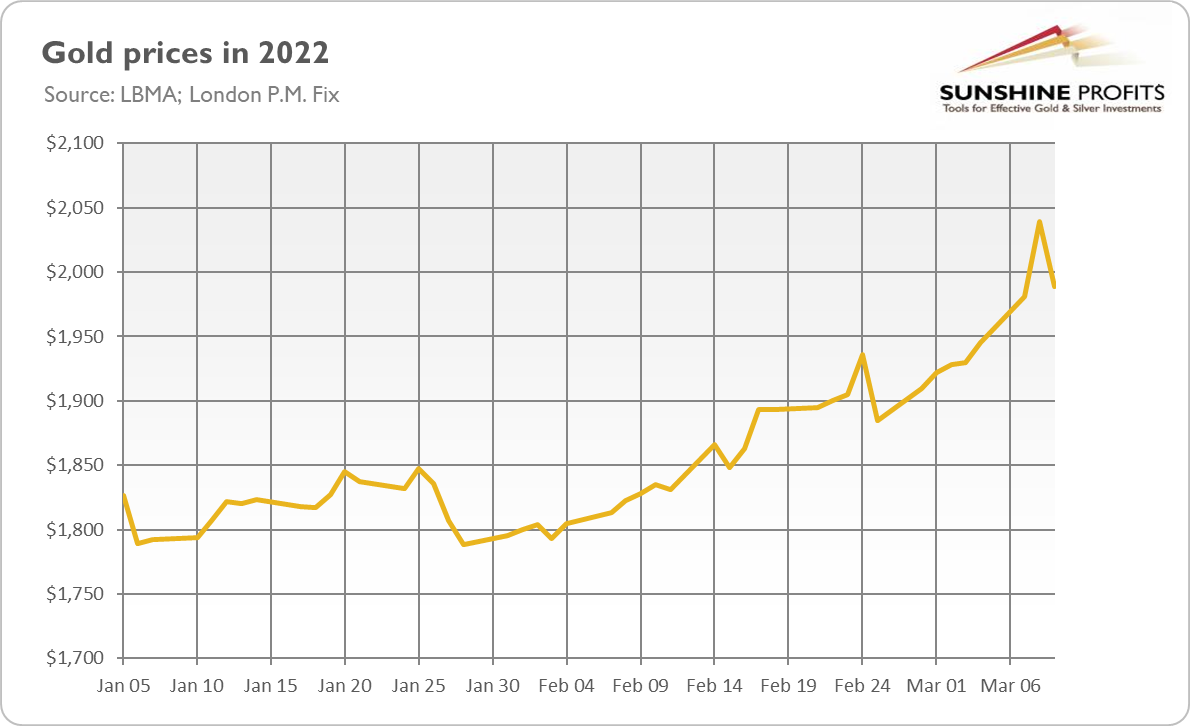

How has the war, that has been going on for already two weeks, affected the gold market so far? Well, as the chart below shows, the military conflict was generally positive for the yellow metal, boosting its price from $1,905 to $1989, or about 4.4%.

Please note that initially the price of gold jumped, only to decline after a while, and only then rallied, reaching almost $2,040 on Tuesday (March 8, 2022).

However, the price has retreated since then, below the key level of $2,000. This is partially a normal correction after an impressive upward move. It’s also possible that the markets are starting to smell the end of the war. You see, Russian forces can’t break through the Ukrainian defense. They can continue besieging cities, but the continuation of the invasion entails significant costs, and Russia’s economy is already sinking.

Hence, they can either escalate the conflict in a desperate attempt to conquer Kyiv – according to the White House, Russia could conduct a chemical or biological weapon attack in Ukraine – or try to negotiate the ceasefire.

In recent days, the President of Ukraine, Volodymyr Zelensky, said he was open to a compromise with Russia. Today, the Russian and Ukrainian foreign ministers met in Turkey for the first time since the horror started (unfortunately, without any agreement).

However, although gold prices may consolidate for a while or even fall if the prospects of the de-escalation increase, the long-term fundamentals have turned more bullish. As you can see in the chart below, the real interest rates decreased amid the prospects of higher inflation and slower economic growth.

Russia and Ukraine are key exporters of many commodities, including oil, which would increase the production costs and bring us closer to stagflation.

What’s next, risk aversion increased significantly, which is supportive of safe-haven assets such as gold. After all, Putin’s decision to invade Ukraine is a turning point in modern history, which ends a period of civilized relations with Russia and relative safety in the world.

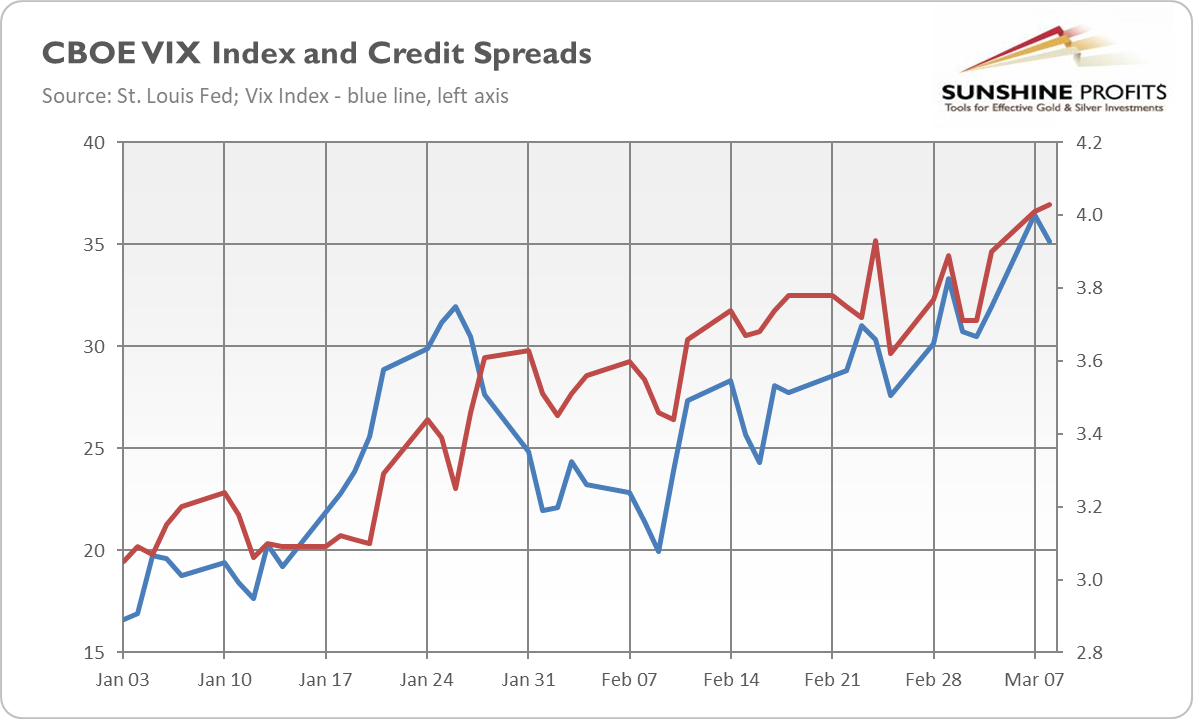

Although Russia’s army discredited itself in Ukraine, the country still has nuclear weapons able to destroy the globe. As you can see in the chart below, both the credit spreads (represented here by the ICE BofA US High Yield Index Option-Adjusted Spread) and the CBOE volatility index (also called “the fear index”) rose considerably in the last two weeks.

Hence, the long-term outlook for gold is more bullish than before the invasion. The short-term future is more uncertain, as there might be periods of consolidation and even corrections if the conflict de-escalates or ends.

However, given the lack of any decisions during today’s talks between Ukrainian and Russian foreign ministers and the continuation of the military actions, gold may rally further.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply