Why Gold Is the Safe Haven Investors Are Flocking To (and How You Can Copy Them)

Bullion.Directory News – April 25, 2025

Bullion.Directory News – April 25, 2025

By Alison Macdonald – Commercial Editor at Bullion.Directory

Note: Our articles may contain affiliate links. If you make a purchase, we may receive a small commission at no additional cost to you.

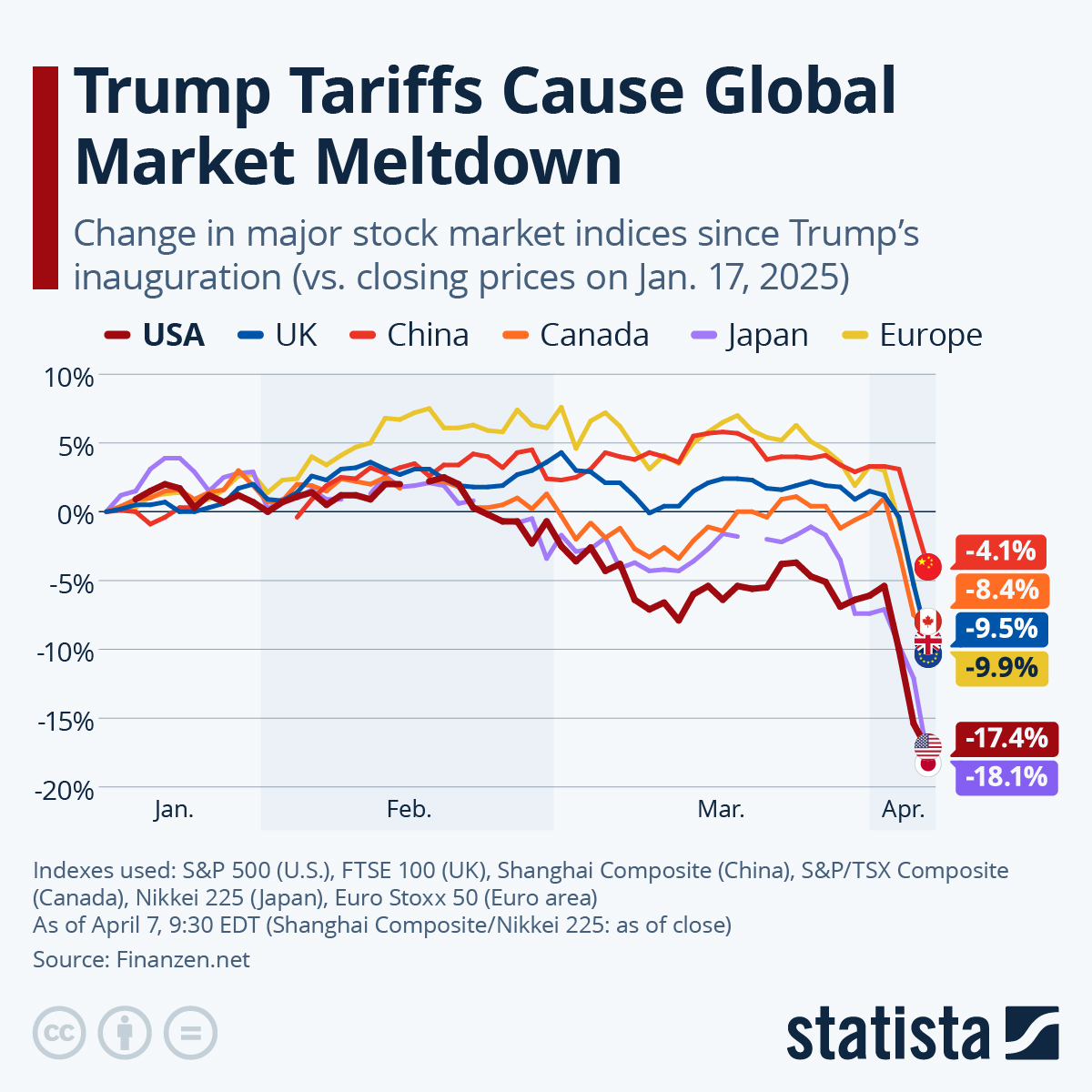

His aggressive tariffs targeted allies and enemies alike, sparking instantaneous market collapse and widespread concerns among economists – with ordinary consumers like you and me, looking on in disbelief.

Already, steep price rises are filtering through – and analysts warn that the full impact may only just be beginning.

Yet amid all of this turmoil, one asset class is standing tall: gold.

Economic Warning Signs Are Flashing

Trump’s latest tariff escalation – affecting trillions of dollars in goods – has sent shockwaves through financial markets.

Major stock indexes have cratered. Consumer goods companies are sounding the alarm over price hikes. Central banks are struggling to contain this never before seen level of inflationary pressures.

Ordinary savers and investors now face growing uncertainty about their future financial security.

Pension funds, ISAs, and traditional investment portfolios – once considered stable – now look dangerously exposed to these unprecedented market swings.

For many, it feels like a chilling echo of 2008. But post-2008, our trust in financial institutions is lower than ever, and traditional safety nets look dangerously frayed.

Gold: A Timeless Refuge in Turbulent Times

In times of political and economic upheaval, gold has always been a key refuge for those seeking stability.

In times of political and economic upheaval, gold has always been a key refuge for those seeking stability.

Unlike stocks, bonds, or even cash savings – all of which depend on government or corporate promises – gold is a tangible asset with intrinsic value.

It cannot be printed, devalued, or defaulted on.

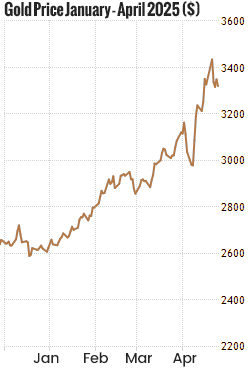

It’s no surprise, then, that since the start of the year, gold has broken all-time price records more than seventy times – a staggering signal of growing demand from those seeking safety outside the financial system.

The Flight to Gold Is Accelerating

Billionaires, hedge funds, pension funds, and sovereign wealth funds have all been increasing their gold holdings aggressively.

Institutional demand for gold has surged to levels not seen in decades, with central bank buying at highest levels in 50 years – a clear indication that those with the best financial intelligence are preparing for rough waters ahead.

And this time around, thanks to better financial education and highly tax-advantaged treatment in the UK – ordinary investors are now following suit, determined not to be left behind if – as is looking likely – inflation or recession takes a deeper hold.

Access to Gold: It’s FAR Easier Than You Might Think

Up until recently, owning physical gold – safely and securely – was always seen as the domain of the wealthy elite.

Today, however, top bullion dealers such as The Pure Gold Company are now making it simple and accessible for anyone who wishes to protect their savings – to make a move into gold.

Their educational approach, and excellent free guide, completely remove the complexity and confusion that often surround gold investing.

Their educational approach, and excellent free guide, completely remove the complexity and confusion that often surround gold investing.

Based in London, but working with customers across the UK, The Pure Gold Company offers a fully insured and discreet service, helping clients purchase physical gold bars and coins either for home storage or secure vaulting.

SPONSORED

Why Education Is Your First Line of Defence

In times like these, getting the correct information is as valuable as gold itself.

Before making any financial decision, it’s critical to understand how gold fits into a broader strategy of wealth protection – and what common pitfalls to avoid.

That’s why I highly recommend this free, no-obligation guide to investing in gold, specially designed for UK residents.

Inside, readers will discover:

- Why gold has outperformed many traditional investments during past crises

- How to buy gold safely, discreetly, and securely

- The differences between home storage and professional vaulting

- How to ensure your gold remains 100% under your legal ownership

- Tips to avoid the most common (and costly) beginner mistakes

In fact, we’d consider it an essential first step for anyone serious about protecting their wealth during uncertain times like these.

If you’re concerned about where the economy is heading, what trade-shattering policies Trump will introduce next – or simply want to explore alternative ways to safeguard your hard-earned savings – now is the time to act.

Gold is once again proving its role as a reliable store of value when faith in financial systems falters.

Why Now? What Powers Gold’s Stratospheric Rises?

Gold has already risen 26% since January and is up over 42% in a year – with experts predicting it has significantly more room to run.

Gold has already risen 26% since January and is up over 42% in a year – with experts predicting it has significantly more room to run.

This is because when markets fall, currencies weaken, or inflation surges, gold historically moves in the opposite direction – acting as a form of financial insurance.

An added benefit is that unlike stocks or bonds, gold isn’t tied to the performance of companies or governments. It has intrinsic value recognized worldwide, regardless of economic conditions.

This means, in times of crisis (like now) gold doesn’t just hold its value – it often rises sharply, helping to offset losses elsewhere in your investments.

Just don’t wait until after this trade war really gets going to consider your options.

The information contained within this article is for informational purposes only and does not constitute investment advice, financial advice, or tax advice. Bullion.Directory does not offer regulated financial services and accepts no liability for any loss or damage arising from reliance on the information provided, including market data, commentary, or buy/sell recommendations.

Please be aware that physical gold is not a regulated investment under the Financial Conduct Authority (FCA) and therefore does not benefit from protections offered by the Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS).

We strongly recommend consulting with an independent, qualified financial adviser who is authorised and regulated by the FCA before making any investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply