Trump’s First 100 Days See Gold Price Most Closely Tied Ever to Dollar’s Value in Yen

Bullion.Directory precious metals analysis 26 April, 2017

Bullion.Directory precious metals analysis 26 April, 2017

By Adrian Ash

Head of Research at Bullion Vault

US Treasury bonds ticked down, nudging 10-year yields up to 2-week highs at 2.34%.

Ahead of President Trump unveiling what he’s trailed as major tax reforms, the US Dollar meantime pushed higher against major currencies, recovering over half-a-cent from its weakest level to the single-currency Euro since late October.

Washington is set to mark Trump’s first 100 days in office this weekend with a government shutdown unless Congress approves an extra $1 trillion in new debt.

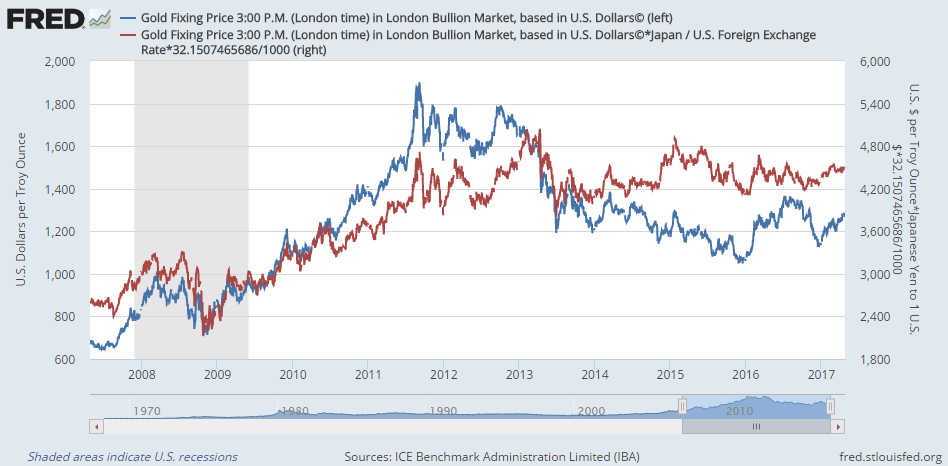

Gold prices have risen 4.3% since 20 January in Dollar terms.

Gold priced in the Japanese Yen, in contrast, has risen only 1.4%.

Benchmark gold prices slipped 0.4% overnight in China, the No.1 consumer nation, falling less than Dollar gold’s drop as the Yuan fell together with Euros, Sterling and most other major currencies versus the greenback on the FX market.

That pushed the Shanghai premium – the incentive to shipping new imports of bullion to China from the world’s key wholesale storage point of London – up to a 2-week high of $10 per ounce.

Gold priced in Yen meantime rose towards a 7-week high as the Japanese currency fell hardest against the Dollar.

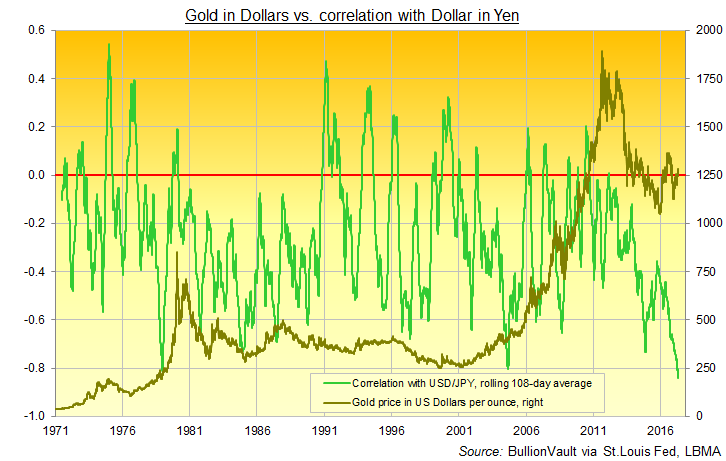

Dollar gold prices have, over the 108 trading days since Trump won the US election last November, shown a stronger relationship with the Japanese Yen than any time since 1971 according to BullionVault analysis today.

Showing an average r-coefficient of -0.45 on a daily basis over the last 5 years, gold’s negative correlation with the Dollar’s value in Yen terms has jumped to -0.85 since Trump was inaugurated.

That beats the previous peak negative correlations of New Year 1979 and summer 2004

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply