Precious Metals Market Report

Wednesday 26 April, 2017

Fundamentals and News*

Trump’s Tax Cut Proposal Increases Wedge Between Gold and Copper

Speculation about President Donald Trump’s proposed tax cuts is expanding the wedge between the precious and industrial metals.

Gold futures posted their biggest two-day loss in seven weeks amid optimism that a possible plan to cut the U.S. corporate tax rate to 15 percent from 35 percent will boost company earnings. An improving outlook for the U.S. economy is also bolstering the demand prospects for industrial metals used in iPhones, refrigerators and electrical wiring. The 120-day inverse correlation between gold and copper is at the biggest since 2003.

Bullion rallied this year, helped in part by delays in Trump’s pro-growth agenda, tensions between the U.S. and North Korea, and political uncertainties in Europe. With Trump’s team preparing to lay out the details of the tax plan, Goldman Sachs Group Inc. expects the gold sell-off to continue over the near-term as borrowing costs rise and U.S. and global growth looks solid.

“Reports that Trump would propose a sharper-than-expected corporate tax cut have helped to boost U.S. stock prices, which may be helping copper” and curbing gold’s appeal, Tai Wong, a director of commodity products trading at BMO Capital Markets, said in an email.

Gold futures for June delivery declined 0.8 percent to settle at $1,267.20 an ounce at 1:41 p.m. on the Comex in New York, taking this week’s losses to 1.7 percent, the biggest two day slump for a most-active contract since March 3.

Bullion’s fall has also helped spur a sell-off in producers of the metal. A gaugeof 15 big global gold miners tracked by Bloomberg Intelligence fell 3.5 percent, poised for the biggest decline since Dec. 15. Barrick Gold Corp., the world’s largest bullion producer, led declines among miners, slumping 10 percent after missing estimates on earnings and production.

Copper futures for July delivery gained 1 percent to $2.591 a pound on the Comex, after touching $2.5985, the highest in a week.

(*source Bloomberg)

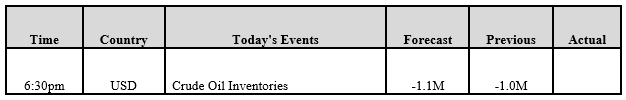

Data – Forthcoming Release

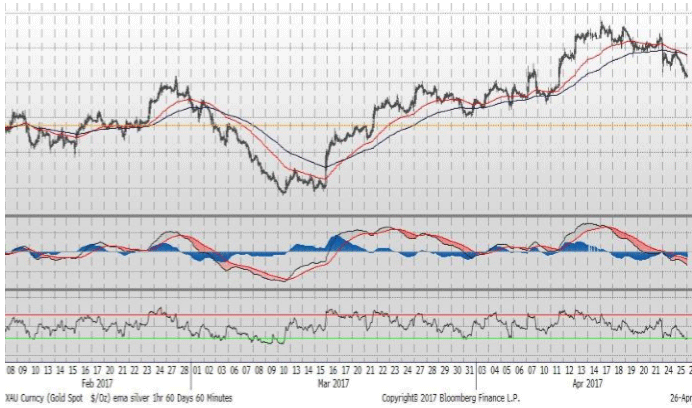

Technical Outlook and Commentary: Gold

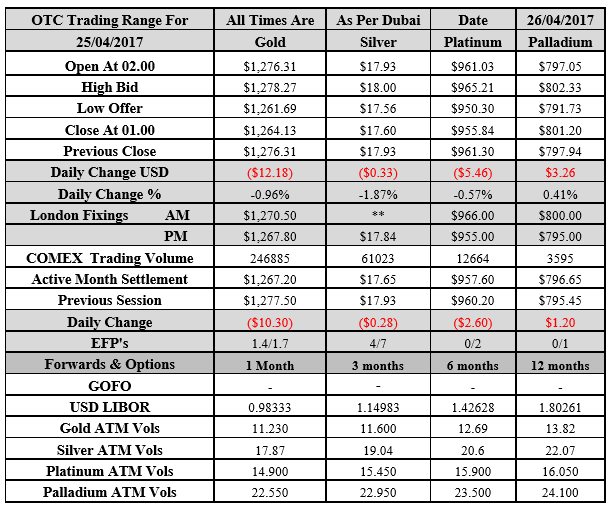

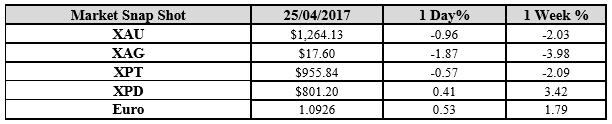

Gold for Spot delivery was closed at $1264.13 an ounce; with loss of $12.18 or -0.96 percent at 1.00 a.m. Dubai time, from its previous close of $1276.31

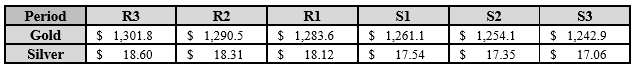

Spot Gold technically seems having resistance levels at 1283.6 and 1290.5 respectively, while the supports are seen at $1261.10 and 1254.10 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.60 an ounce; with loss of 0.33 cent or -1.87 percent at 1.00 a.m. Dubai time, from its previous close of $17.93

The Fibonacci levels on chart are showing resistance at $18.12 and $18.31 while the supports are seen at $17.54 and $ 17.35 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply