Our present moment is precarious. Like it or not—we don’t—we live in the age of Central Banks.

Bullion.Directory precious metals analysis 03 November, 2022

Bullion.Directory precious metals analysis 03 November, 2022

By Keith Weiner

CEO at Monetary Metals

On the one hand the rhetoric we hear from Fed Chairman Jay Powell and others of the central planning class that they are committed to doing what is necessary to save the economy and contain inflation. On the other hand, their primary weapon tool for accomplishing that agenda is raising the interest rates.

The irony!

In order to save, they destroy. In order to contain, they unleash. In order to stabilize, they destabilize.

It would be comedic, if it wasn’t so tragic.

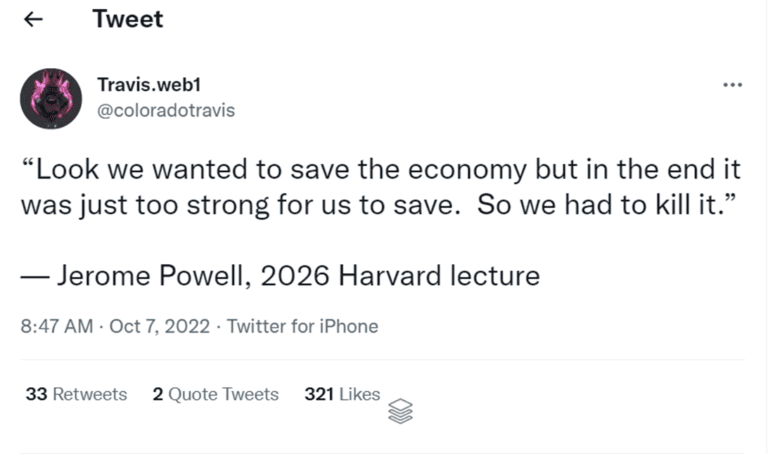

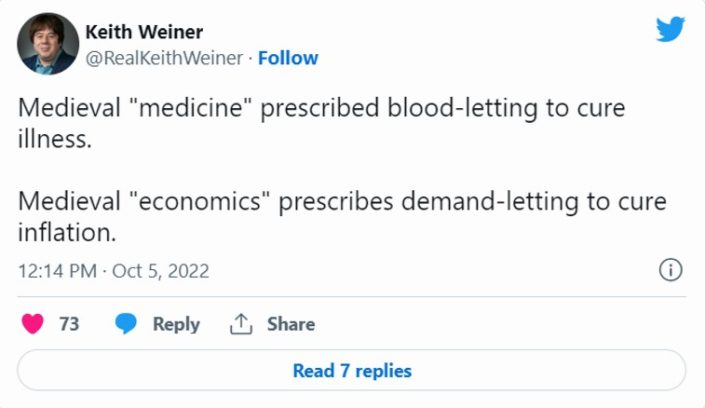

This tweet expresses the irony well:

Let’s explore how the Fed’s blunt instrument will end up adding to inflationary pressures and make things worse for the economy.

Containing Inflation?

Our current inflationary woes go beyond the simplistic “money printer go brrrr” memes. We’ve covered this here, here, and again here. We will spare you those same arguments again.

Here, we simply want to point out that much of this inflation was caused by non-monetary forces. It was supply chain issues from Covid lockdowns, then lockdown-whiplash, plus trade war and tariffs, and energy restrictions, all of which put severe constraints on the ability to produce goods and get them to market, i.e. supply.

Basic economics tells us that when supply decreases in the face of steady or rising demand prices will…go up!

But the Fed is blind to this because of the dogma, “inflation is always and everywhere a monetary phenomenon”. Therefore, the Fed is compelled to seek a monetary remedy.

And the textbook remedy is? Higher interest rates.

But as the interest rate rises, so too does the cost of funding for businesses who are looking to produce something. So, it’s now more costly to produce things than it was, just a few months ago. Does anyone want to take a guess as to what that may do to the supply problems we just outlined?

Anyone? Bueller? Bueller?

That’s right, it will further decrease supply!

Why? Because some companies cannot keep up with the higher costs and will be forced to fold. Whatever those companies were producing will not be produced any longer. So, we’ve got less production, which means less supply.

If demand remains steady or rising, we would expect to see prices to increase further!

However, supply begets demand (remember Say’s Law?). The more likely scenario is that demand falls as the Fed’s interest rate hikes start sucking the life out of the economy.

In short, interest rate hikes will not contain inflation. Inflation will remain, and the pain will get worse.

Saving Hammering the Economy

This principle can never be emphasized enough: interest rates are far and away the most important price signals in markets, period. Nothing else even comes close. Not even the price of gold, and we’re a gold company!

Why? In the words of our Founder, “because every other price and every investment and every enterprise depends on it”.

Stocks, housing, currencies, loans, employment, and everything else in the economy are all impacted by even small changes in the interest rate. That is why a stable interest rate is so critically important. A stable, knowable, dependable, market driven interest rate has a coordinating effect among the (very) wide network of participants. Coordination enables greater business, productivity, cooperation, growth, wealth. You get the picture.

Of course, the opposite is also true. A volatile interest rate, with wild swings from one side to another has a dis-coordinating effect.

With great power comes great responsibility. But there are some powers that are simply too great for any one person to wield (just ask our old friend Aragorn about the power to wield the One Ring).

And yet, in the last 24 months we’ve seen this power wielded rashly, violently, and relentlessly.

One need only look at this chart which shows that the Fed has raised rates faster than any other time in recent history.

We’re writing this the day the Fed just announced another 75bps rate hike. Add that on top of the chart you just saw.

What effect will Interest Rates Have on the Economy?

Keith likes the wrecking ball analogy. Here’s another analogy to make the point.

Interest rates are the Fed’s hammer, and the economy is like a fine china shop. Powell walks in, looking to do some repairs. He starts swinging his hammer wildly, indiscriminately breaking things left and right. He breaks things when he swings one way (raising interest rates) and he breaks things when he swings the other way (lowering interest rates). No matter how earnestly he wishes to repair or fix what’s broken, each swing causes further damage.

Interest rates are the Fed’s hammer. And when the Fed has a hammer, everything becomes a nail, including you. Their hammering is only going to cause more pain, not less. When they say they want to cut demand, they mean cause you to reduce your demand. How do they do that? By causing you to lose your job.

A Desperately Needed Alternative

For those of you who don’t like getting hit with a hammer, having your purchasing power steadily decline, and listening to the economists at the Fed decide what the right interest rate is for you and everyone else, we would love to chat with you about how Monetary Metals is offering an alternative.

It’s a free-market interest rate denominated in and paid in gold and silver. We pay interest on gold in gold, by connecting gold producing businesses with precious metals investors. Please get in touch if you’d like to hear more.

Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply