Gold pushed above $3,000 an ounce last Friday and has continued to drive higher.

Bullion.Directory precious metals analysis 18 March, 2025

Bullion.Directory precious metals analysis 18 March, 2025

By Mike Maharrey

Journalist, analyst and author at Money Metals Exchange

A lot of mainstream analysts forecast $3,000 gold for this year, but the pace of gold’s climb has been faster than most expected.

The price of gold hit new highs 40 times in 2024. This year, the yellow metal has already broken 14 records.

That Was Fast!

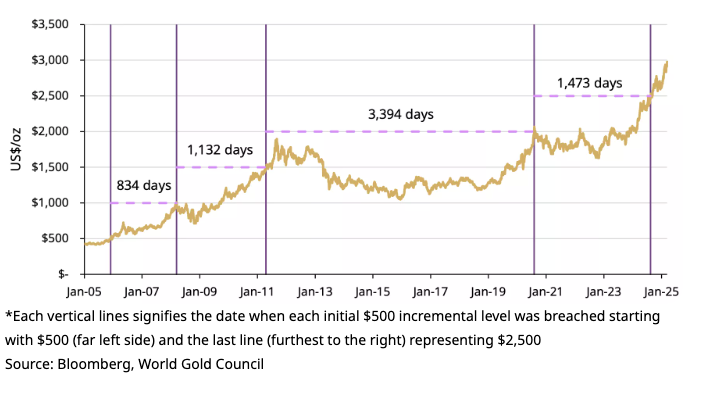

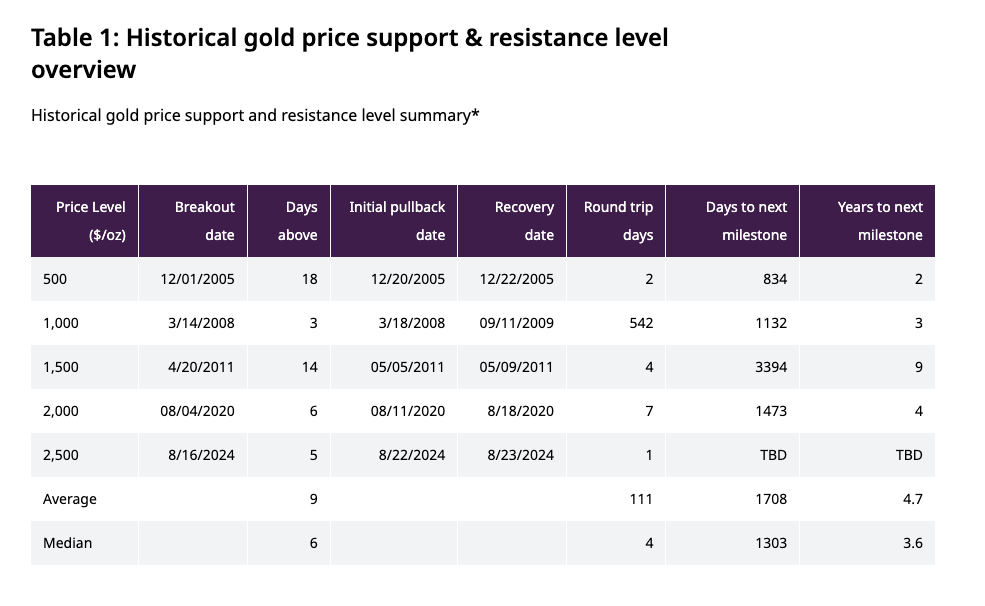

Gold’s meteoric rise is unprecedented. It drove from $2,500 to $3,000 in just 210 days.

To put that into historical context, gold has taken an average of 1,700 days to reach previous $500 milestones.

Of course, each $500 price gain represents a smaller percentage increase. The price had to double to move from $500 to $1,000, while the most recent surge from $2,500 to $3,000 was a 20 percent gain.

Still, the pace of this bull run is impressive. Consider that the price of gold has increased sixfold since it first hit $500 an ounce in 2005. That annualizes to a 9.7 percent yearly rise. Meanwhile, the S&P 500 spot index is up 8.2 percent during that same period.

The speed of gold’s rally is also reflected by the 200-day moving average (200DMA). The recent surge has pushed the price gains three deviations above the 200DMA. The last time we saw this kind of extreme divergence was during the pandemic when gold crossed $2,000 an ounce and then again right before the move above $2,500.

Can Gold Maintain This Momentum?

It wouldn’t be shocking to see some consolidation in the next weeks, given the speed gold overtook $3,000. It’s like a sprinter.

She needs a little time to catch her breath before the next race.

Historically, gold has held above previous multiples of $500 for an average of nine days before pulling back and consolidating. However, those periods of consolidation tend to be short-lived. Four out of five times, gold has rebounded to recover those previous highs within a few days four out of five times.

The World Gold Council pointed out that if gold holds $3,000 over the next couple of weeks, it would likely trigger additional buying from derivative contracts.

“For example, we estimate there is roughly $8 billion in net delta-adjusted notional in options contracts from US gold ETFs that expire Friday 21 March,4 and $16 billion in options on futures that expire on 26 March. While this may create a slingshot effect, it could also trigger short-term-profit taking.”

The World Gold Council speculates that the higher price will continue to create headwinds in the jewelry market, but investment demand should remain robust.

“In view of the speed of gold’s latest move, it would not be surprising to see some price consolidation. But despite potential short-term volatility, the most important determinant for gold’s next move is whether fundamentals can provide long-term support to its trend. As we discussed in our recent Gold Demand Trends, while price strength will likely create headwinds for gold jewelry demand, push recycling up and motivate some profit taking, there are many reasons to believe that investment demand will continue to be supported by a combination of geopolitical and geoeconomic uncertainty, rising inflation, lower rates and a weaker U.S. dollar.”

Most significantly, the fundamentals supporting this gold rally remain in place.

It is likely uncertainty and market volatility stirred up by the trade war will continue. Despite some optimistic February CPI data, price inflation remains elevated and the Federal Reserve is still caught in a Catch-22.

There are growing recession worries. There is no sign that central bank gold buying will slow any time soon.

And most significantly, we still haven’t reckoned with the consequences of monetary malfeasance that began in the wake of the 2008 financial crisis and went on steroids during the pandemic.

Mike Maharrey

Mike Maharrey is a well-known author, journalist, financial analyst and writer at Money Metals Exchange, one of our top-rated US dealers and two-times winner of Bullion Dealer of the Year

He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida. Mike also serves as the national communications director for the Tenth Amendment Center and the managing editor of the SchiffGold website.

This article was originally published here

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply