Sri Lanka is now running out of petrol, with citizens being implored not to line up, and that petrol will be available within the next two days.

Bullion.Directory precious metals analysis 19 May, 2022

Bullion.Directory precious metals analysis 19 May, 2022

By Paul Engeman

Director at Ainslie Bullion

The sovereign nation is expected to be placed into default by rating agencies after not making interest payments on their sovereign bonds. The government is now officially printing money to pay government employee salaries as the monetary crisis gathers steam.

The nation has been struggling economically since the pandemic began two years ago as foreign remittances dried up and tourists stopped visiting the island due to worldwide lockdowns.

Incredibly, despite four other ministers being sworn in over the last week, the country still doesn’t have a finance minister at present, although ‘poisoned chalice’ doesn’t do the role justice.

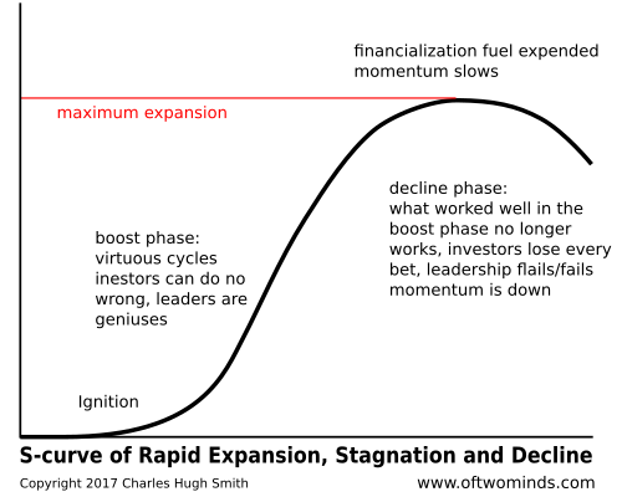

The Prime Minister narrowly survived a no-confidence motion yesterday. Protests have continued every day for more than a month. This chaos echoes yesterday’s chart (below) showing how leaders and the wealth effect positively reinforce themselves on the way up, with political leaders seemingly capable of doing no wrong. With the currency crashing and shortages leading to riots and wealth destruction, almost no leader can survive for long.

Shortages are far from confined to Sri Lanka with Bank of England Governor, Andrew Bailey, warning MPs on Monday that the Central Bank has warned of ‘apocalyptic’ food price hikes and that the central bank was helpless in fighting food shortages driven by external shocks such as the Russian-Ukrainian conflict and supply chain issues caused by the zero covid policy in China.

Speaking to the Treasury select committee, Bailey stated that “[An inflation risk factor] I am going to sound apocalyptic about is food. Ukraine does have food in store but can’t get it out at the moment.”

Ukraine’s grain exports have plummeted from 5 million tonnes per month down to 500,000 tonnes. India is one country feeling the supply pinch. They have now instituted an export ban.

Ukrainian production represented approximately 30% of all wheat supply globally prior to the conflict.

In response to warnings, British MPs have argued that the Bank needs to ‘reassure markets, consumers and savers’ that the money still has value. Official Inflation is due to pass 9 per cent next week as consumer price index figures climb from 7% in March.

The Bank of England has signalled that inflation may peak out at 10.2% later this year as energy prices level off.

Last night saw deep losses on Wall Street as more stagflation confirmation emerged with US credit card debt surging, consumer spending falling (Target & Walmart shares down 29% and 17% over the last 2 days!) and both home builder and home buyer sentiment tanking all against this backdrop of high inflation.

Just as we saw in Australia yesterday, inflation is far outstripping wage growth and the US is turning to credit cards.

This only ends with inflation reinforcing wage growth (and the spiral Morrison talks of) or more and more unsustainable debt.

On a completely related note… gold held strong overnight and jumped $28 in Aussie terms against our falling AUD!

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply