Lets Take a Closer Look at Understanding Assets and Liabilities

Bullion.Directory precious metals analysis 21 January, 2025

Bullion.Directory precious metals analysis 21 January, 2025

By Keith Weiner

CEO at Monetary Metals

“Rich people acquire assets. Poor and middle-class people acquire liabilities, but they think they are assets.”

“An asset, whether you’re working or not, is something that puts money in your pocket.”

“A liability takes money out of my pocket.”

“You must know the difference between an asset and a liability and buy assets.”

Kiyosaki defines an asset as anything that puts money in your pocket and a liability as anything that takes money out of your pocket. In other words, does this asset make my “cash flow” or my “cash go?”

Interestingly, Kiyosaki is also a vocal advocate for owning gold. But the problem with owning gold in Kiyosaki’s framework is that nearly all conventional gold investments do not generate income. In fact, most gold investments require the investor to pay regular fees (storage fees, expense ratio fees, account maintenance fees, etc.) in order to own it.

So where does gold, traditionally a non-income-generating investment, fit into this framework? Let’s explore:

- Different ways to own gold

- How gold can generate income

- Why income-generating gold best fits the definition of an asset under Kiyosaki’s framework

Privately stored gold

One common way to own gold is to purchase it from a bullion dealer and then store it at home. While this approach avoids recurring costs like storage fees, it isn’t without significant upfront costs (high purchase fees), and risks.

Gold stored at home is:

- Vulnerable to theft, damage, or loss.

- Uninsurable

- Often purchased with high fees

Due to the problems above, privately stored gold is only an option for someone who may be just starting to accumulate gold but would be too risky for anyone buying in size.

Professionally stored gold

Another option is to buy and store gold in a professional vault depository, or to buy a publicly listed vehicle such as a gold-backed exchange traded fund (ETFs). Both options provide exposure to gold prices, but they also come with recurring costs.

Professional vault accounts incur annual storage fees that can be as high as 2% annually.

And even the largest, most popular ETF’s have annual expense fees of 0.40% or more.

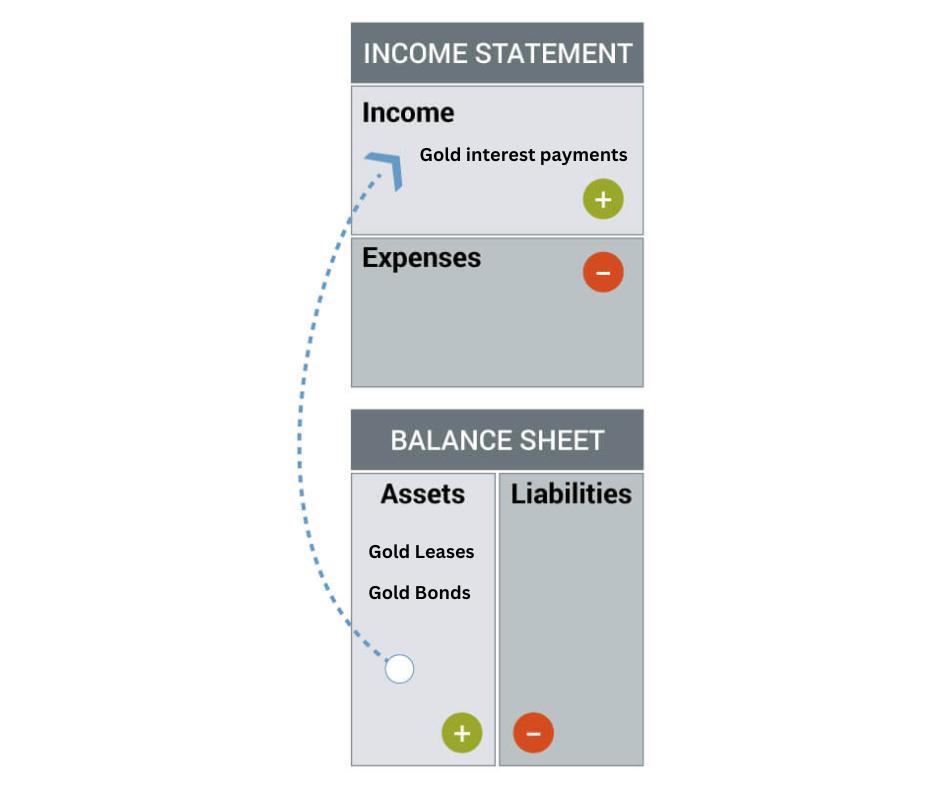

Having to pay annual fees sounds more like a liability than an asset under Kiyosaki’s framework. Your cash is going, not flowing. His income flow chart makes it clear:

Sure, the price of gold may rise more than the fees you pay. But in order to “realize” those gains, you have to sell for dollars, which would defeat a lot of the reasons for owning gold in the first place. Not to mention, you could incur a tax liability on the gains.

Can gold be an income-generating asset?

What if there was a way to own gold that had zero storage fees– and actually paid you monthly income to own it?

This would mean that gold truly represents an asset according to Kiyosaki’s framework. It would generate income in the same way as other assets like real estate, stock dividends, bank CDs, etc.

This is exactly what Monetary Metals offers–A Yield on Gold, Paid in Gold®

Let’s explore how Monetary Metals makes gold an income-generating asset.

How to earn income on gold and silver

Monetary Metals allows gold and silver owners to turn their metal into assets that work for them to produce cash flow. But how does it work?

Well, it works the exact same way it works with other assets like real estate or cash. In fact, Monetary Metals offers a product that corresponds to each of those dollar-denominated assets.

Let’s start with Kiyosaki’s favorite asset, real estate.

Gold leases

To make real estate an asset in Kiyosaki’s framework, you need to own a property that you rent to a qualified tenant who pays you monthly rental income. Gold leases with Monetary Metals work similarly.

Clients choose to lease their gold to qualified businesses in the industry (jewelers, bullion dealers, refiners, manufacturers etc.) who pay a monthly fee to use that gold in their business, either as inventory or as work-in-progress to make their finished products.

The benefit to the companies leasing the gold is that they get the gold they need for their business without the risks and complexities of a constantly fluctuating gold price.

Lease rates on gold and silver leases have historically been between 2% and 5% annually. Meaning if you had 100 ounces of gold, and you earned 4%, you would have a total of 104 ounces at the end of the year (after 12 monthly payments of 0.333 oz). Learn more about gold leases.

Gold bonds

Gold bonds are another product Monetary Metals offers which deliver income on gold. They work the same way a cash loan or a dollar-denominated bond works.

Cash becomes an income-generating asset when loaned to a qualified company that uses it to grow its business revenues. And the company uses those increased revenues to pay you back the principal and interest. Gold bonds work in the exact same way.

They are gold-denominated loans to gold businesses, such as gold mining companies, who use the proceeds to grow and expand their businesses and pay back the principal and interest (in gold) through increased revenues.

Gold bonds offer significantly higher rates of return than leases and are available to accredited investors only. Learn more about gold bonds.

Let’s revisit Kiyosaki’s framework with gold as an income-generating asset through Monetary Metals.

Kiyosaki’s definition of an asset is clear: “An asset is anything that puts money in your pocket.” The problem is that today “money” means dollars. And dollar-denominated assets, even when they are generating cash (more dollars) for you, are losing value over time due to inflation.

Not so with gold.

Gold has maintained and increased in value over the centuries, making it a potentially more powerful income-generating asset than the ones that flow paper.

Make gold an income-generating asset again

Robert Kiyosaki transformed the lives of millions with his investing framework. With Monetary Metals, you can transform your gold into an income-generating asset that aligns with Kiyosaki’s investing framework.

Have you been holding gold as a shiny liability?

Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply