“Silver is nature’s finest germ killer. Simply by being silver, this most precious metal’s elemental properties are toxic to pathogenic microorganisms while simultaneously being non-toxic to healthy cells and probiotic bacteria. “

Full Article →The disconnect between paper prices for precious metals and demand in the bullion markets has never been clearer as nervous investors are frantically buying coins, rounds, and bars.

Full Article →Crashing Markets And the Next Great Inflation

Before investors jump on the deflation bandwagon, they should carefully consider the monetary and political forces that could be deployed to reverse a whiff of deflation.

Full Article →Covid-19 Financial Doomsday – The Time Is Nigh

We appear to be entering the sort of scenario that doomsday preppers have been warning about for years. A pandemic is spreading death and panic around the world. Markets are crashing. Store shelves are emptying…

Full Article →Stocks have long been priced for perfection and suddenly conditions are looking far from perfect. The coronavirus may be the pin which pricks the latest Fed-blown bubble.

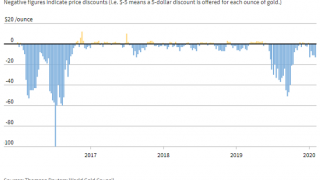

Full Article →During turbulent times like these, markets can be melting down one day… and zooming higher the next. Gold may serve as a fantastic safe-haven asset one day… but get hammered by futures traders the next.

Full Article →A futures contract is not an asset with intrinsic value. It is nothing more than a wager on the price of the metal on a particular future date. There is ultimately a winner and a loser for each wager.

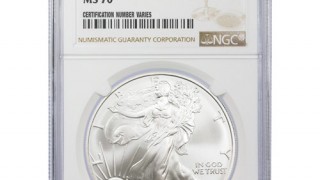

Full Article →The Final Curtain for Silver and Gold Eagles

The Silver and Gold Eagles, considered to be the most popular bullion coins in the world, will finally be getting a face lift… or least a “tail” lift.

Full Article →Getting on Board the Silver Express!

Over the last half year or so, a number of analysts, well-heeled individuals, and mega-hedge fund managers have been taking a shine to silver. So far the “restless metal” hasn’t been letting on that it’s noticed.

Full Article →Silver’s Coiling Like a Spring

The Dollar Index is now facing some significant resistance in the 99-100 zone. If the buck turns lower from here, that should help hard asset prices continue to recover

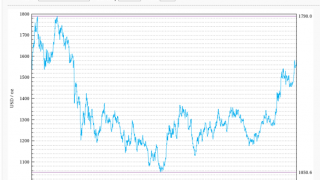

Full Article →GOLD prices ticked higher in London trade Friday, rising against the US Dollar for the 6th of 7 weeks so far in 2020 and setting fresh all-time highs against the Euro currency as global stock markets struggled despite a drop in new cases of coronavirus reported by world No.2 economy China.

Full Article →Gold Price Sets Fresh Euro Record as ETF Investing ‘Offsets’ China’s Coronavirus Slump Bullion.Directory precious metals analysis 13 February, 2020 By Adrian Ash Head of Research at Bullion Vault GOLD […]

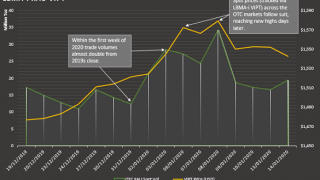

Full Article →GOLD PRICES struggled $5 below last week’s closing level in London’s bullion market on Wednesday, trading at $1565 per ounce as world stock markets rose yet again, nearing last month’s fresh all-time highs on the MSCI World Index

Full Article →Over the last 2 years, gold bullion accounted for 7.0% of all UK imports of goods by value, and 5.9% of all exports according to source data from the HMRC tax authorities.

Full Article →Prosecutors Target JPMorgan in Price Rigging Probe

The road to full accountability for JPMorgan remains long and full of obstacles. But it is certainly nice to see prosecutors treating the bank without the usual kid gloves.

Full Article →THIS Is What a Run on the Bank for Precious Metals Looks Like…

Put simply, available inventories are failing to keep up with demand largely from the automotive industry. According to Refnitiv GFMS, the palladium market will be under-supplied by 883,000 ounces this year.

Full Article →GOLD PRICES headed for their first weekly drop in 9 on Friday, but held onto a $25 rally from Wednesday’s 2-week lows despite the United States reporting much stronger-than-expected January jobs data as the coronavirus outbreak and lockdown in China saw the death of a whistleblower spark anger with the authorities on social media

Full Article →GOLD PRICES struggled to regain half of this week’s $40 losses in London on Thursday, trading below $1565 per ounce as world stock markets rose yet again despite a fast-worsening economic outlook amid the coronavirus outbreak spreading from China.

Full Article →GOLD INVESTING prices steadied above 3-week lows of $1550 in London trade Wednesday, rallying $6 per ounce as world stock markets surged for a second day after Chinese TV claimed scientists have developed an effective treatment for coronavirus.

Full Article →Central Bankers Try to Avert Coronavirus Crash

The emerging coronavirus pandemic is already crimping global commerce. In response, the S&P 500 has put in two weeks’ worth of declines since making new highs to start the year.

Full Article →Gold Down and Safe Havens Fall Despite China Virus

GOLD fell from 3-week highs, as risk sentiment recovered – and Western stock markets rallied despite plunge in Chinese equities as Beijing vowed to ensure financial stability amid coronavirus emergency.

Full Article →GOLD and SILVER PRICES rose trading at $1579 and $17.85 per ounce respectively as the WHO met to decide whether the coronavirus outbreak marks a global emergency and the Bank of England followed the US Fed in keeping its low-rate unchanged yet again

Full Article →“Going forward, gold is likely to continue benefiting from supportive central bank policies” forecasting an annual average gold price of $1515 per ounce – a rise of 9% from last year’s daily average – with a peak of $1650 to hit late in 2020.

Full Article →In Germany buying anything more than one and one-half troy ounces of gold will now activate customer ID paperwork, and for businesses – a criminal background check…

Full Article →GOLD eased back Tuesday, below yesterday’s new 7-year US Dollar highs at London’s benchmarking, as confirmed cases of the deadly coronavirus spread, Hong Kong closed its borders with mainland China.

Full Article →The 1964 Kennedy Half Dollar was met with tremendous success as many Americans wanted to save the coin as a memento. As a result, the Kennedy Half Dollar became one of the most successful half dollar coin programs in the history of the U.S. Mint.

Full Article →Why Palladium is on a Tear

Physical palladium and rhodium markets are buzzing with reported prices for both metals leaping higher in recent days. The story behind palladium’s move is that a physical shortage has developed in London…

Full Article →Will the U.S. Mint Stop Producing it’s Burnished Silver Eagles in 2021? Bullion.Directory precious metals guest post 27 January, 2020 By Nick Adamo President at Bullion Shark LLC The Burnished […]

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.