A futures contract is not an asset with intrinsic value. It is nothing more than a wager on the price of the metal on a particular future date. There is ultimately a winner and a loser for each wager.

Full Article →The Final Curtain for Silver and Gold Eagles

The Silver and Gold Eagles, considered to be the most popular bullion coins in the world, will finally be getting a face lift… or least a “tail” lift.

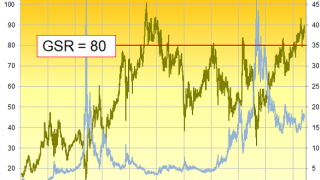

Full Article →Getting on Board the Silver Express!

Over the last half year or so, a number of analysts, well-heeled individuals, and mega-hedge fund managers have been taking a shine to silver. So far the “restless metal” hasn’t been letting on that it’s noticed.

Full Article →Silver’s Coiling Like a Spring

The Dollar Index is now facing some significant resistance in the 99-100 zone. If the buck turns lower from here, that should help hard asset prices continue to recover

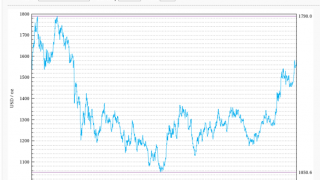

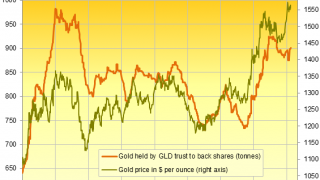

Full Article →GOLD prices ticked higher in London trade Friday, rising against the US Dollar for the 6th of 7 weeks so far in 2020 and setting fresh all-time highs against the Euro currency as global stock markets struggled despite a drop in new cases of coronavirus reported by world No.2 economy China.

Full Article →Gold Price Sets Fresh Euro Record as ETF Investing ‘Offsets’ China’s Coronavirus Slump Bullion.Directory precious metals analysis 13 February, 2020 By Adrian Ash Head of Research at Bullion Vault GOLD […]

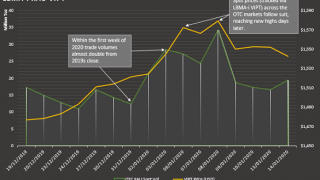

Full Article →GOLD PRICES struggled $5 below last week’s closing level in London’s bullion market on Wednesday, trading at $1565 per ounce as world stock markets rose yet again, nearing last month’s fresh all-time highs on the MSCI World Index

Full Article →Over the last 2 years, gold bullion accounted for 7.0% of all UK imports of goods by value, and 5.9% of all exports according to source data from the HMRC tax authorities.

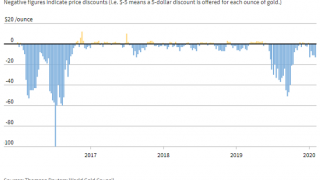

Full Article →Prosecutors Target JPMorgan in Price Rigging Probe

The road to full accountability for JPMorgan remains long and full of obstacles. But it is certainly nice to see prosecutors treating the bank without the usual kid gloves.

Full Article →THIS Is What a Run on the Bank for Precious Metals Looks Like…

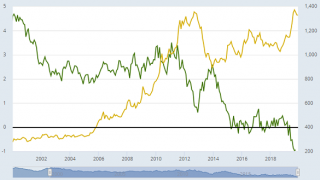

Put simply, available inventories are failing to keep up with demand largely from the automotive industry. According to Refnitiv GFMS, the palladium market will be under-supplied by 883,000 ounces this year.

Full Article →GOLD PRICES headed for their first weekly drop in 9 on Friday, but held onto a $25 rally from Wednesday’s 2-week lows despite the United States reporting much stronger-than-expected January jobs data as the coronavirus outbreak and lockdown in China saw the death of a whistleblower spark anger with the authorities on social media

Full Article →GOLD PRICES struggled to regain half of this week’s $40 losses in London on Thursday, trading below $1565 per ounce as world stock markets rose yet again despite a fast-worsening economic outlook amid the coronavirus outbreak spreading from China.

Full Article →GOLD INVESTING prices steadied above 3-week lows of $1550 in London trade Wednesday, rallying $6 per ounce as world stock markets surged for a second day after Chinese TV claimed scientists have developed an effective treatment for coronavirus.

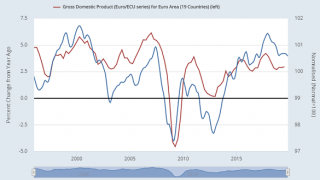

Full Article →Central Bankers Try to Avert Coronavirus Crash

The emerging coronavirus pandemic is already crimping global commerce. In response, the S&P 500 has put in two weeks’ worth of declines since making new highs to start the year.

Full Article →Gold Down and Safe Havens Fall Despite China Virus

GOLD fell from 3-week highs, as risk sentiment recovered – and Western stock markets rallied despite plunge in Chinese equities as Beijing vowed to ensure financial stability amid coronavirus emergency.

Full Article →GOLD and SILVER PRICES rose trading at $1579 and $17.85 per ounce respectively as the WHO met to decide whether the coronavirus outbreak marks a global emergency and the Bank of England followed the US Fed in keeping its low-rate unchanged yet again

Full Article →“Going forward, gold is likely to continue benefiting from supportive central bank policies” forecasting an annual average gold price of $1515 per ounce – a rise of 9% from last year’s daily average – with a peak of $1650 to hit late in 2020.

Full Article →In Germany buying anything more than one and one-half troy ounces of gold will now activate customer ID paperwork, and for businesses – a criminal background check…

Full Article →GOLD eased back Tuesday, below yesterday’s new 7-year US Dollar highs at London’s benchmarking, as confirmed cases of the deadly coronavirus spread, Hong Kong closed its borders with mainland China.

Full Article →Why Palladium is on a Tear

Physical palladium and rhodium markets are buzzing with reported prices for both metals leaping higher in recent days. The story behind palladium’s move is that a physical shortage has developed in London…

Full Article →Gold Jumps to 3-Week Highs on China’s New Year Crisis

GOLD PRICES jumped 1% at the start of Asian trading before easing back on Monday as the Chinese coronavirus death-toll rose 81 with almost 3,000 confirmed sick.

Full Article →How to Protect My Rare Coin Collection

Your rare coin collection is something you should be proud of. It is likely part of your “nest egg.” You have spent some of your hard-earned money to build a unique and impressive coin collection, so it is important that you keep it safe.

Full Article →Ultimately it will be very easy,” Trump told Fox, “because if we can’t make a deal, we’ll have to put 25% tariffs on [European-made] cars.”

Full Article →Gold Prices Firm as ECB Seeks ‘Robust Inflation’ with Negative Rates, Deadly Virus Hits Chinese New Year Bullion.Directory precious metals analysis 23 January, 2020 By Adrian Ash Head of Research […]

Full Article →Are Pre-1933 Gold Coins a Buy Right Now?

Years ago, premiums over spot gold were significantly higher than they are today. Premiums over spot for common date $20 Saint Gaudens, Gold Liberties, and Gold Indians were sometimes north of 20-30%. Now, they can be found for less than a 10% markup over spot.

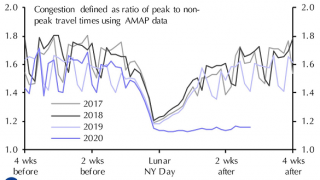

Full Article →Already killing 17 and infecting 440 people in China, the coronavirus outbreak “is threatening to wreak havoc on Lunar New Year travel plans,” says the South China Morning Post, “at a time when many Chinese people journey to their hometowns for family reunions.

Full Article →Former Fed Head Says Government Can Borrow a LOT More

Narayana Kocherlakota, the former President of the Federal Reserve bank of Minneapolis wants you to know the Federal Government can never borrow too much money. How? By taxing the very people it owes the money to…

Full Article →Is U.S. Mint Setting Collectors Up for Silver Eagle Rarity?

Could we be looking at modern rarities in their infancies? Why are we seeing such low mintage Silver Eagles? The answer is simple. Many coin collectors are either buying less of each type of Silver Eagle or are only choosing to buy one over the other.

Full Article →

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.