Jerome Powell Begs Washington to Save the American Economy

Bullion.Directory precious metals analysis 09 February, 2024

Bullion.Directory precious metals analysis 09 February, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

Since August, total debt has piled on more than $1 trillion in only a few months, establishing another record total of $34 trillion.

There really is no way to sugarcoat the current debt trend…

It’s already insane (and it’s going to get worse)

Following is even more data that further confirms the fact that the total debt load for the American economy is unsustainable.

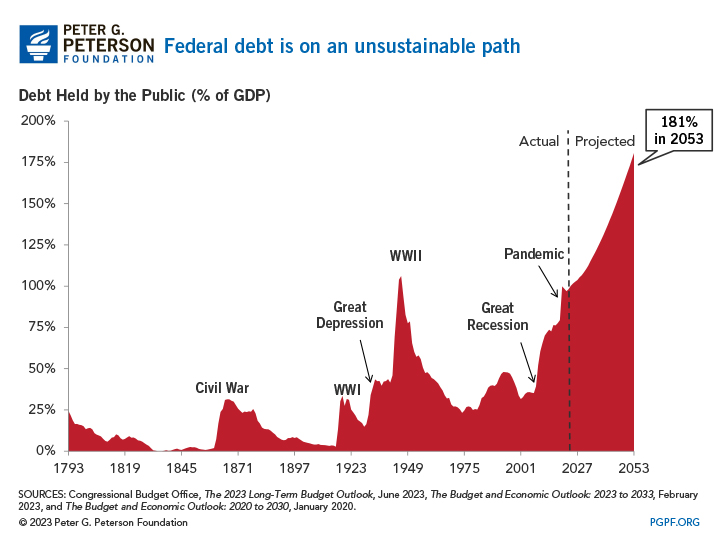

According to the Peterson Foundation, Federal debt as a percentage of GDP is on an “unsustainable path,” and debt is projected to almost triple GDP by 2053.

This ratio is also projected to widen further than it was during World War II:

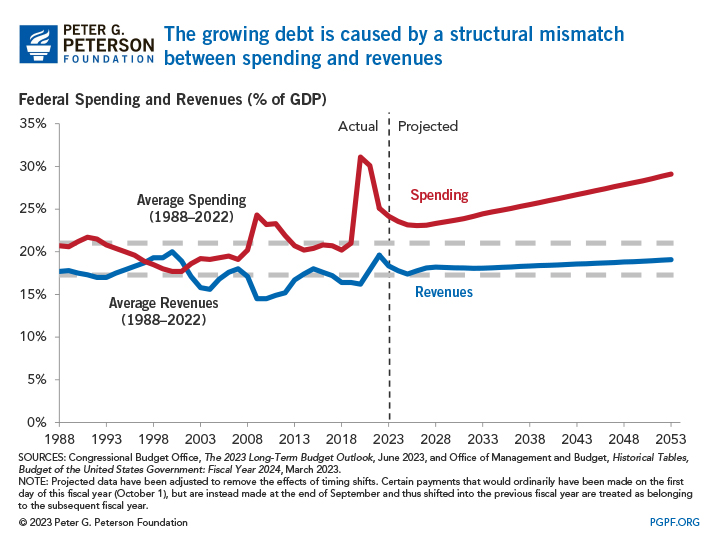

Since 2003, government spending as a percentage of GDP has overtaken revenue by the same measurement every single year. This metric shows no signs of slowing down by any stretch of the imagination:

These two charts show that government spending from both sides of the aisle has increased the debt at a pace that could be permanently insurmountable.

The debt also appears to have caught the attention of central bankers (in a meaningful way this time).

Federal Reserve Chair Jerome Powell is finally as worried as we are

In a recent interview given to CBS News, Powell finally admitted to being worried about the debt in the same way most Americans are worried about it.

He also accurately called the debt load “unsustainable”:

PELLEY: But is the national debt a danger to the economy in your review? You are this country’s central banker.

POWELL: So, I would say this. In the long run, the U.S. is on an unsustainable fiscal path. The U.S. federal government’s on an unsustainable fiscal path. And that just means that the debt is growing faster than the economy. So, it is unsustainable. I don’t think that’s at all controversial.

PELLEY: I have the sense this worries you very much.

POWELL: Over the long run, of course it does. You know, we’re effectively — we’re borrowing from future generations. And every generation really should pay for the things that it needs. It can cause the federal government to buy the things that it needs for it, but it really should pay for those things and not hand the bills to our children and grandchildren.

In other parts of the interview, Powell called for putting a priority on fiscal sustainability:

It’s time for us to get back to putting a priority on fiscal sustainability. And sooner is better than later… You could say that it was urgent, yes.

It’s pretty obvious from the statements above that Powell is in a bind. He’s had to raise rates for the last year and a half to keep inflation from heating up again.

Raising interest rates is an attempt to put out the inflationary fire that’s destroyed some 16% of the dollar’s purchasing power over the last three years. (To be clear, these efforts cannot improve the dollar’s lost purchasing power – that would require deflation, which gives central bankers nightmares. The dollar’s lost purchasing power is gone forever.) But at least higher interest rates deprive the inflationary fire of its oxygen.

On the other hand, higher interest rates make debt refinancing quite a bit more expensive. Especially for the world’s largest debtor, the U.S. government – which owes as much money as the next nine most indebted nations in the world combined.

Ongoing deficit spending means the government isn’t paying its outstanding debts. When an old debt comes due, the Treasury Department borrows to pay it off – at today’s rates, the highest in over a decade.

Some $6 trillion in government debt is due this year – mostly borrowed when rates were near zero. Refinancing this year, if the Fed keeps interest rates high, will add hundreds of billions of dollars in debt service payments for years.

Remember: Higher interest rates are good for savers and bad for debtors.

“Bad for debtors” in the sense that a huge number of variable interest rates are indexed to the Effective Federal Funds Rate (EFFR): New mortgages, adjustable-rate mortgages, auto loans, credit cards…

When interest rates are high, it makes sense to pay off your debts as quickly as you can.

Unless you’re a member of the Biden administration…

Biden’s budgets are a big part of Powell’s problem

Since Biden moved into the White House, the federal government’s debt has grown a staggering $6 trillion. That’s a LOT of money.

To put it in perspective, that $6 trillion by itself would be the world’s #3 largest national debt.

Here’s why this is a problem for Powell…

Deficit spending creates new dollars – which lowers the value of every other dollar in the world. (We see this as inflation.)

So what’s the solution? Ask any grade-schooler – the obvious solution is to spend less money. Start paying off the debt!

And what’s Biden’s solution? Another $1.7 trillion budget deficit…

Don’t worry though – there’s a plan to pay for it!

Sort of.

The newest Biden budget started by claiming that wealthy corporations and individuals aren’t paying enough in taxes.

Clearly, too many of our political leaders (and many Americans) believe the nation’s fiscal problems stem from a lack of revenue.

Don’t have enough money? Well, get some more! Not by creating economic value, though – not through productivity increases. By taking it away from those who’ve already done the hard work.

So what is the Bidenomic solution? To go after billionaire tax-dodgers and profitable corporations. (By the budget’s own numbers, that increased taxation will bring in about $120 billion in additional tax revenue.)

Increase revenue by $1 so you can spend another $14 – that’s Bidenomics in action!

Meanwhile, the 93% of Biden’s budget deficit that can’t be confiscated from top earners and corporations will have to be borrowed.

Borrowed at interest rates far above zero percent…

Janet Yellen must be praying for Powell to slash interest rates back to zero. Unfortunately for her, the Fed doesn’t seem to be considering an imminent rate cut, according to PBS:

The central bank kept its key rate unchanged at about 5.4 percent, a 22-year high. In a statement, it marked a policy shift by dropping previous wording that had said it was still considering further rate hikes.

Still, the Fed cautioned that it “does not expect it will be appropriate” to cut rates “until it has gained greater confidence that inflation is moving sustainably” to its 2 percent target. That suggests that a rate reduction is unlikely at its next meeting in March.

So, for the time being, it looks like the debt will continue to be financed at higher interest rates. So the debt pile grows faster and faster.

Borrowing grows faster and faster.

Meanwhile, every dollar in existence continues to lose purchasing power…

But that doesn’t mean your financial future is doomed to the same downward spiral.

Diversifying away from the debt-doomed dollar

Remember: More government debt doesn’t create wealth. It just creates more dollars.

The law of supply and demand tells us that increasing supply lowers the value (in other words, the purchasing power) of every dollar in existence.

That’s why Powell is worried. He doesn’t want to be remembered in the history books as the man in charge on the day the dollar died…

Don’t wait for the purchasing power of the dollar to hit zero. Diversify your finances with assets whose value doesn’t depend on a promise to pay, or on the value of a dollar…

Consider getting some physical gold and silver.

The price of physical gold has been relatively stable in the face of the economic turmoil that is plaguing everyday Americans right now. In fact, the price of gold grew almost 13% overall in 2023 (easily beating inflation).

You can get the rest of the story behind dollars, inflation, and diversifying with precious metals in our free information kit.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply