Powell testified before the Senate. He didn’t say anything new, but gold rallied a bit.

Bullion.Directory precious metals analysis 14 January, 2022

Bullion.Directory precious metals analysis 14 January, 2022

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

Powell admitted that the Fed wrongly expected a faster easing of supply disruptions and thought that price pressures would be much lower by now. As a consequence, inflation was believed to be only ‘transitory’. Unfortunately, that’s not what happened.

“The supply-side constraints have been very durable. We are not seeing the kind of progress that all forecasters thought we’d be seeing by now. We did foresee a strong spike in demand. We didn’t know it would be so focused on goods,” said

Powell.

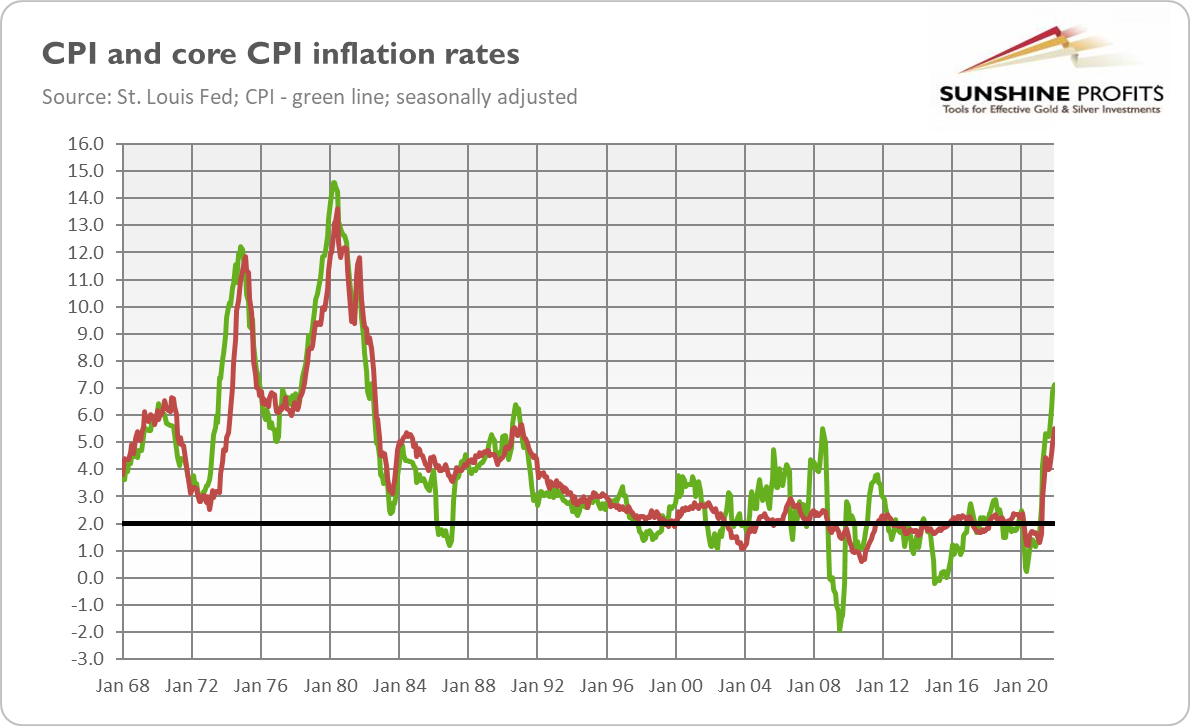

As a result of the Fed’s inaction, inflation has risen 7% in 2021, the fastest pace since February 1982, as the chart below shows. After conducting very complicated calculations, Powell admitted that “inflation is running very far above target.” Bold deduction, Sherlock!

Such high inflation is indeed a troublesome and even central bankers realize that. This is why Powell stated that “the economy no longer needs or wants the very accommodative policies we have had in place,” and that “we will use our tools to support the economy and a strong labor market and to prevent higher inflation from becoming entrenched.”

However, there is a problem here. The main tool the Fed has to fight inflation is raising the federal funds rate, but hiking interest rates may hamper economic expansion and even trigger the next financial crisis. As Powell admitted, “if inflation does become too persistent, that will lead to much tighter monetary policy and that could lead to a recession.”

Thus, the central bank is between a rock and a hard place, between high inflation and the risk of slowing economic expansion or even of an economic crisis.

Implications for Gold

What does Powell’s testimony imply for the gold market? Well, theoretically not much, as it didn’t include any major surprises. However, Powell sounded quite hawkish.

For example, he downplayed the economic consequences of the current surge in coronavirus cases, and said that it’s likely not changing the Fed’s plans to tighten its monetary policy this year. These plans are relatively bold for this year: “We are going to end asset purchases in March. We will raise rates. And at some point this year will let the balance sheet runoff,” Powell said.

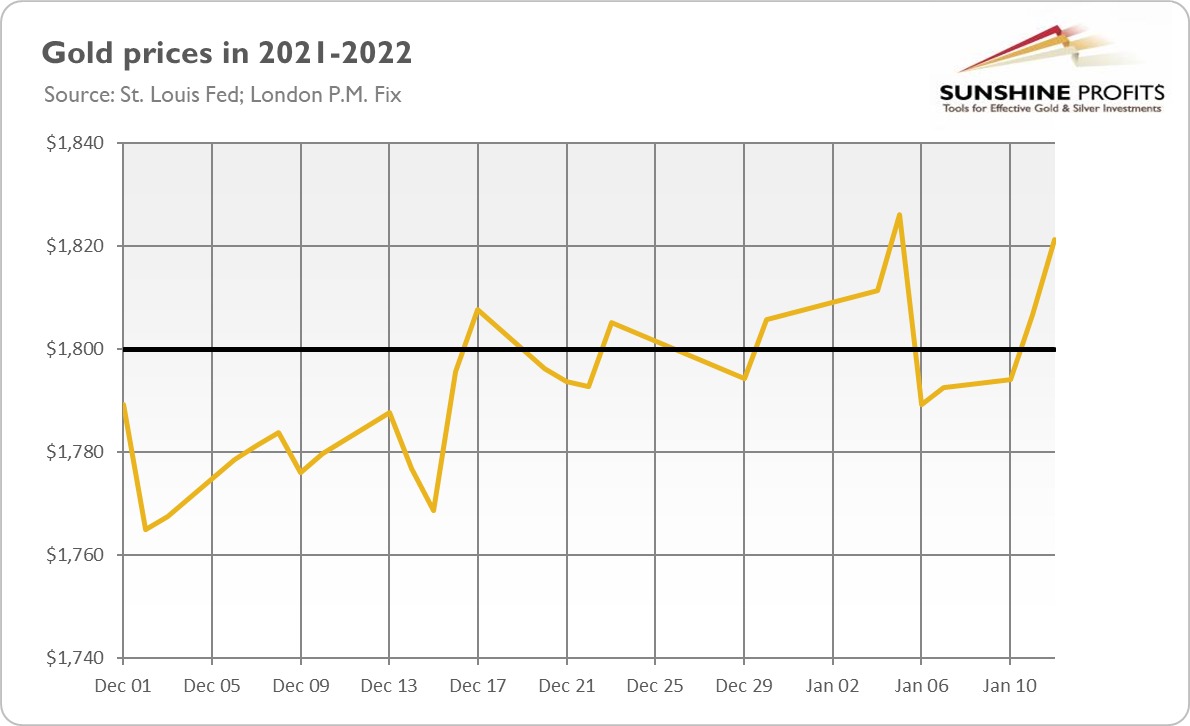

However, it seems that Powell sounded less hawkish than investors were afraid of. Given such worries, the lack of any surprises could be dovish. This is at least what gold’s performance suggests. As the chart below shows, Powell’s testimony triggered a small rally and revived optimism in the gold market.

That’s for sure encouraging. After all, gold jumped above a key level of $1,800, catching some breath, but it’s too early to call a major reversal in the gold market. The yellow metal would have to sustain itself above $1,820 and then surpass $1,850, or even higher levels, to trumpet a bullish breakout.

There are still several headwinds for gold. First of all, the monetary hawks haven’t struck yet. They are growing in strength, as several regional bank presidents have recently called for a rate hike as soon as in March.

Such calls may strengthen the expectations of rate increases, boosting bond yields, and creating downward pressure for gold prices. We’ll find out soon whether it will happen or not, as the January FOMC meeting is in two weeks, and it could be a groundbreaking event in the gold market.

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply