The Two Worst Retirement Savings Traps – and How to Avoid Them

Bullion.Directory precious metals analysis 24 January, 2024

Bullion.Directory precious metals analysis 24 January, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

But there could be a silver lining here…

There are two things that you can start to manage today, which could help to improve the stability in your retirement portfolio. Those two things are: Risk and expectations.

Kiplinger’s published a column that succinctly addressed what realistic expectations might look like (although the specific percentages could vary). Here’s a paraphrase:

While quite a few personal finance pundits have suggested that savers can expect a 12% annual return, when you incorporate the impact of volatility and inflation, 7% is a more accurate historical estimate for an aggressive investor and 5% would be more realistic for a more conservative saver.

So, put simply, once you factor in things like the following:

- Fees and costs from assets and financial advice

- The dollar’s steadily weakening purchasing power

- Volatility (the rise and fall of asset prices)

…then the picture of generating substantial returns in your retirement savings becomes more complete. Once those other factors are considered, the expectations revealed in the quote above appear more realistic.

Here’s the thing: Almost no one factors inflation into their thinking. When we compensate for inflation, we’re discussing real returns. Like this:

- Savings account APY: +4%

- Annual inflation rate: -3.4%

- Real return (after one year): +0.6%

After adjusting for inflation, your actual return on investment is 1/6th as much as you expect.

You can see why it’s a mistake to focus on “returns” rather than “real returns.”

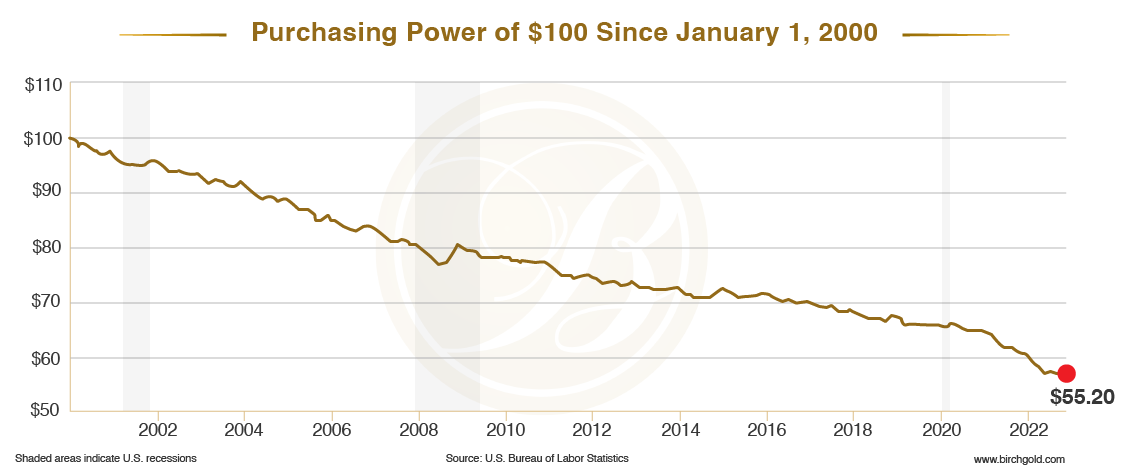

To make things even clearer, you can see the dollar’s continually weakening buying power reflected on the chart below:

Data via St. Louis Federal Reserve

This illustrates that dollars withdrawn from your retirement savings aren’t going to buy as much as they used to, nor will they buy as much in the future.

As for inflation, it’s currently increasing prices at an official rate of 3.4%, a rate that is easing from a historic 9% in June 2022. That’s a rate which keeps robbing your purchasing power, permanently.

That’s a huge risk most people never consider.

Now let’s discuss managing both risk and expectations…

The Lake Wobegon effect

Many Americans from all walks of life tend to overestimate how strong their retirement portfolio is, while overestimating their investing ability.

It’s something called the Lake Wobegon effect:

The Lake Wobegon effect is the human tendency to overestimate one’s achievements and capabilities in relation to others. It is named for the fictional town of Lake Wobegon from the radio series A Prairie Home Companion, where, according to Garrison Keillor, “all the children are above average”. In a similar way, a large majority of people claim to be above average; this phenomenon has been observed among drivers, CEOs, analysts, college students, and state education officials, among others. Experiments and surveys have repeatedly shown that most people believe that they possess attributes that are better or more desirable than average.

It’s like that statistic you may have heard thrown around: “90% of Americans believe they’re above-average drivers.” Nonsense!

It’s really smart to remain humble when dealing with complex subjects like finance. Overconfidence is at least as dangerous, if not more dangerous, than incompetence.

Keep that in mind, especially when we discuss the next point…

Mental accounting and avoiding overconfidence

In addition to avoiding the “Lake Wobegon effect,” there is also the issue of avoiding loss.

That means understanding exactly how a negative period ends up affecting the net performance of your savings.

Here’s a hypothetical example that illustrates this nicely. It was explained by David Blanchett, managing director and head of retirement research at PGIM DC Solutions:

…if you have $100 and your portfolio goes up 100%, you now have $200. But if it then goes down 50%, that brings you back to $100. The average return, by taking the 100% and negative 50% returns and dividing by two, would be positive 25%. Yet your realized return would be 0%, as you are back to your original $100 balance…

When considering your savings, it’s important not to mistake average return and realized return.

Why? In Blanchett’s words:

It’s just the impact of negative returns that hurt you so much.

Now, if your savings are well-diversified, it’s highly unlikely that all your assets will rise in price together. Individual prices don’t matter so much as your overall return. Concentration, the opposite of diversification, can lead to the unhappy situation where all your assets fall in price together.

That sums up the vital importance of BOTH diversification and confusing average returns with realized returns.

So how can you increase the stability and the diversification of your retirement savings?

Diversify, reduce volatility and increase your financial stability – all at the same time

One way to potentially mitigate the economic impacts of the last 15 years, while at the same time reducing volatility and bolstering resistance to inflation, is to consider adding physical precious metals to your savings.

Most savers have little or no exposure at all to tangible assets like gold and silver. And that’s a shame!

They’re one of the very few financial assets in existence that have been valuable for all of human history. They’re inflation resistant and don’t derive their value from the whims of a central banker.

Unfortunately, most people don’t consider buying gold or silver except in times of crisis. That’s because physical precious metals have historically served as safe-haven stores of value, preserving wealth during even the most troubled economic times.

In fact, the price of physical gold in 2023 grew almost 13% overall (beating inflation). That’s not unusual; the World Gold Council calculates that gold outperformed cash fourfold over the last 10 and 20 years.

Are physical precious metals right for you? That’s not a decision I can make for you.

If you’re curious, though, you can get all of the information you need to learn about the benefits of diversifying with precious metals in our free information kit.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply