Are Central Bankers Astute of Reality?

Bullion.Directory precious metals analysis 2 December, 2014

Bullion.Directory precious metals analysis 2 December, 2014

By Christopher Lemieux

Senior FX and Commodities Analyst at FX Analytics

Central bankers are nothing more than politicians. They must sway public opinion during very interesting, but worrisome times. We’ve see the collapse of crude over the last several months, following economic data that continuously misses economists’ expectations. The propaganda is that lower crude prices equal more consumer spending. This is a complete fallacy.

New York Fed President William Dudley said that “the sharp drop in oil prices will help boost consumer spending and underpin an economy that still requires patience before interest rates are increased,” during today’s speech at Bernard M. Baruch College. He further states that lower energy costs “will lead to a significant rise in real income growth,” which in turn will spur spending. How does income grow with lower energy costs? The income dose not change. If anything, consumers can be relieved of higher gas prices and save extra discretionary income or pay down debt.

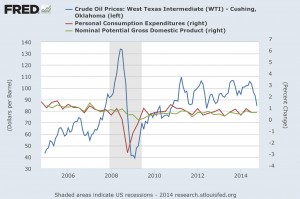

The Fed Vice Chair Stanley Fischer said this was a “phenomenon that is making everyone better off.” According to Kevin Logan, US chief economist at HSBC Securities, “for some time now, policy makers at the Fed have decided the thing to do is to look through commodity price changes.” As they did in 2007/8.

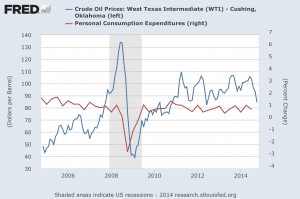

Here is proof that lower West Texas Intermediate (WTI) crude prices does not reflect higher personal consumption. In fact, it may even be the opposite. It looks to me, on a quarterly basis, a reduction in consumption tracks lower oil prices.

The last several months of gas price declines, consumers “real” income growth contributed to a 11 percent decline in Black Friday sales, which is shaping up to be a disappointing holiday sales indication.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply