Lets compare conventional bank leasing with a true gold lease from Monetary Metals.

Bullion.Directory precious metals analysis 27 February, 2025

Bullion.Directory precious metals analysis 27 February, 2025

By Keith Weiner

CEO at Monetary Metals

Gold markets are notoriously opaque. We can’t always understand what is happening in those markets. While this presents obvious problems and has led to a never-ending flow of absurd takes on what drives gold markets, opacity is also an advantage. Many investors and market participants don’t want everyone to know what they’re doing and how they’re doing it. There is one corner of the gold market where this is especially true – leasing.

Markets for leasing gold and silver have been around for decades. But typically, only large institutions, such as central banks and bullion banks, could participate in leasing metal for a return.

Due to the opacity described earlier, it’s notoriously difficult to get a real sense of how bank lease agreements work and function in the real world. It gets worse when you realize there is no uniformity in metals leasing contracts. Two contracts can have the same title, “Precious Metals Lease Agreement,” but look completely different from one another.

Instead of remaining the exclusive activity of large banks, Monetary Metals has opened the door for anyone to lease their metals for a return, albeit in a very different manner than how banks do it (more on that later).

We’ll start by addressing some of the issues with bank leasing and end with why our Gold Yield Marketplace™ offers a transparent alternative for investors who want to earn a return on their gold and silver, paid in more ounces.

Bullion Bank and Central Bank Leasing

The main problem with bullion bank and central bank leasing is that it isn’t leasing at all.

Unlike true leases, these bank leases often involve selling leased gold while papering a promise to pay it back later; unclear title and ownership of gold; extension of credit and financial exposure; and the need for futures and forwards to hedge gold price exposure.

In short, “leasing” by central banks and bullion banks often resembles lending more than leasing.

The lack of uniformity across these kinds of contracts makes it difficult to analyze. The pattern that emerges, however, is that the leased gold undergoes various degrees of financial engineering. This raises questions around ownership, credit and financial exposure, and price exposure amongst other concerns.

In other words, RISK.

In one agreement we reviewed the lessee could liquidate gold so long as they repaid the same amount later. Imagine leasing a car to someone and telling them they could sell it, as long as they buy the same car and return it to you later. There are obvious problems with this model.

Thankfully, there’s another way to lease metal that’s clear, transparent, and designed specifically with gold investors in mind.

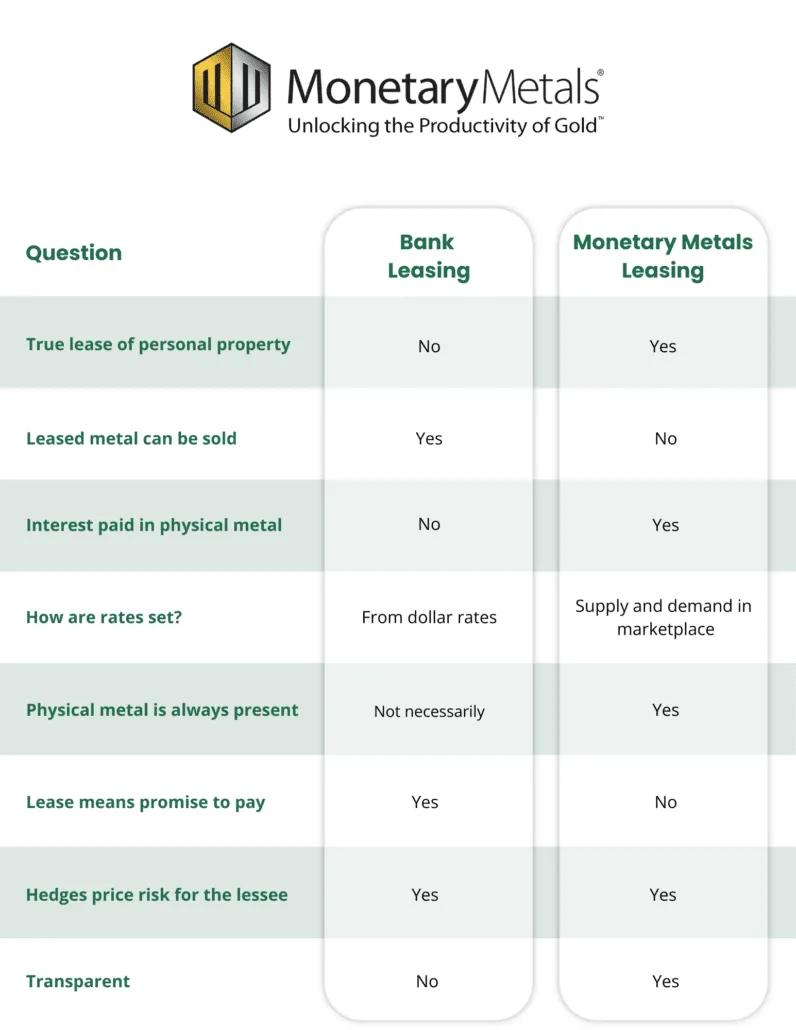

Let’s compare Monetary Metals’ lease products to what the modern central bank and bullion bank leases offer.

How is a Monetary Metals lease different than a bank lease?

We’ve developed a chart for quick and easy reference to understand some of the main differences between a bank lease and a Monetary Metals lease:

A true lease, not a loan

Monetary Metals’ gold and silver leases are structured as a true lease of personal property. This is the same kind of lease you might have with any other tangible property, like an apartment or a vehicle.

Because it’s a true lease, a Monetary Metals lease is NOT a promise to pay gold later. That would be a loan. We offer those too. We call them gold bonds.

Gold leases with Monetary Metals are an agreement to rent your physical gold, for an agreed upon annual rate, to a qualified business, for a pre-defined term, paid in gold.

Physical metal, not paper

Because it’s a true lease, gold is physically present for the entire term of the lease. Just like your apartment is physically there when you rent it, so too is your gold physically there when you lease it through Monetary Metals to a third-party lessee.

To drive this home, we continuously monitor the gold in all leases through tying into lessee ERP systems or partnering with secure logistics providers to track leased gold in real-time using RFID technology. We ensure every ounce is accounted for, all the time.

No selling of leased metal

A lease agreement with Monetary Metals strictly prohibits the selling or removal of leased metal by the lessee. Whether fabricating, refining, or selling at retail, lessees must replenish gold simultaneously — ensuring the leased amount of metal never falls below the amount specified in the lease.

Interest paid in metal, not dollars

In Monetary Metals’ leases the interest is paid in ounces of physical metal. Gold leases pay interest in gold. Silver leases pay interest in silver.

Typically, interest is paid monthly. Clients can see their ounces grow every month as new interest payments hit their account. This gold and silver interest can be withdrawn for delivery, sold for dollars, or reinvested in additional lease opportunities.

Gold interest rates set by the market

The lease rates charged by bullion banks are derived from dollar funding markets (historically LIBOR, now SOFR) and heavily influenced by the Fed Funds rate. If dollar rates rise, lease rates will typically rise, and vice versa.

In contrast, Monetary Metals’ leases are true gold leases and therefore have true gold interest rates. Rates are set by the supply and demand of gold owners and qualified gold businesses that come together in our Gold Yield Marketplace ™.

Monetary Metals employs a team of deeply experienced, in-house originators who work to qualify, vet, and price lease and bond opportunities. Clients have the right, but not the obligation, to participate in those opportunities. If you don’t like a deal, you don’t have to put your gold in it. This is remarkably different from how the dollar world operates. Imagine trying to do something like that at your bank or the Federal Reserve!

Leases designed with you in mind

With Monetary Metals, you retain clear ownership of your gold while earning a yield. You know where your gold is, and no ounce goes anywhere unless you decide to move it.

Businesses get reliable gold financing, without all the engineering and complexity of a bullion bank lease.

It’s a win-win.

Keith Weiner

Keith Weiner is founder and CEO of Monetary Metals, the groundbreaking investment company monetizing physical gold into an interest-bearing asset, paying yields in gold, not paper currency.

Keith writes and speaks extensively, based on his unique views of gold, the dollar, credit, the bond market, and interest rates. He’s also the founder and President of the Gold Standard Institute USA. His work was instrumental in the passing of gold legal tender laws in the state of Arizona in 2017, and he regularly meets with central bankers, legislators, and government officials around the world.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply