The latest official update revealed that inflation came in lower than expected. If you read the mainstream media’s spin, you might think inflation is actually cooling.

Bullion.Directory precious metals analysis 17 November, 2022

Bullion.Directory precious metals analysis 17 November, 2022

By Peter Reagan

Financial Market Strategist at Birch Gold Group

The consumer price index, a key inflation barometer, jumped 7.7% in October versus a year ago. It rose 0.4% during the month. Both were cooler than expected, a sign inflation may be moderating. [emphasis added]

Keep in mind that the consumer price index (CPI) is an abstract — it’s a nationwide average. You and your family’s personal rate of rising costs will be different, and extremely unlikely to match the official numbers.

For example, I recently saw a report that, in many regions, inflation is significantly higher, topping 12% in some major metro areas (including Phoenix.) Hopefully, you live in one of the places where regional inflation is below the national average.

Your personal rate of inflation is highly idiosyncratic and depends on a lot of factors… But a key factor that drives purchasing behavior, consumer inflation expectations, is not.

According to Wolf Richter, the idea is fairly simple:

when inflation expectations remain “anchored,” even raging inflation will start settling down again; but when inflation expectations become “unanchored,” it’s a sign that the inflationary mindset is becoming entrenched in the decision-making process of consumers and businesses, and thereby is turning inflation into something with a life of its own.

(We’ve discussed this “self-fulfilling prophecy” before.) You can see that the one-year, three-year, and even five-year expectations for inflation have all taken a sharp uptick.

And it looks like the near-term inflation data confirms this…

In reality, slightly lower inflation is still far too high

If mainstream reports like the CNBC article above point to the slightly lower rate of inflation as “cooling” or “moderating,” but expectations and some states contradict that fact, what is really going on?

I talked about this recently:

Inflation is still orders of magnitude too high, and not declining appreciably. (Should CPI continue to come in 0.2% lower every month, we’re still looking at over two and a half years of prices rising faster than the Fed’s targeted rate.)

On top of that, the prices of categories that don’t matter as much for everyday shopping – like used vehicles and some medical care – only dropped slightly (2.4% and 0.6% respectively). But the prices of necessities like shelter, groceries, and gasoline are all still red-hot.

From the latest Bureau of Labor and Statistics (BLS) report, we find that shelter is the main culprit:

The index for shelter contributed over half of the monthly all items increase, with the indexes for gasoline and food also increasing.

(It’s worth reading Ron Paul’s take on just how far from reality BLS shelter costs are…)

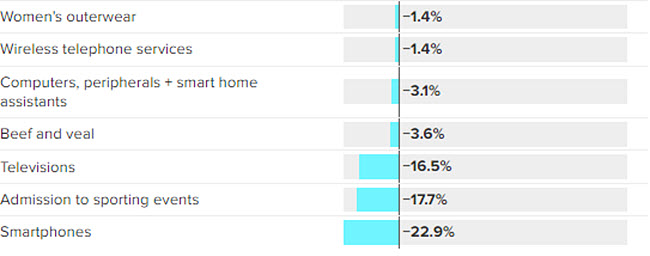

Always leading with the good news, CNBC showed us the specific categories where prices dropped the most. When you look at this chart, I want you to really consider just how important these sorts of purchases are in your family’s budget:

As far as I’m concerned, the only meaningful category in that chart is “Beef and veal.”

How much money do you spend on tickets to baseball games? TVs? Have you seen your cell phone bill decline by as much as a nickel? I certainly haven’t.

Ultimately, prices declining at all is great news! But not as important lower prices on essentials, on the things we’re going to buy regardless of price (in economics, what we’d call “inelastic demand”): food, fuel and shelter.

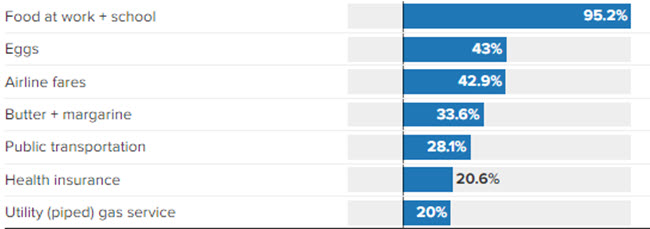

And that’s exactly where prices increased the most:

I can’t believe I’m saying this – but it’s important to note that the surge in “Food at work + school” prices are some 8x higher than “Food at home” which costs us merely 12.4% more this year vs. last year.

Let me ask you a few questions – don’t worry, the answers should be pretty easy…

- If your grocery bills go up 12.4%, do you care how much the price of Dodgers tickets are?

- If gas prices are 17.5% higher than last year, does a 5% decline in new TV prices help you balance your budget?

Here’s the pattern I see in the numbers, category by category…

Prices on essentials (food, fuel and housing) keep going up while prices on most discretionary spending items (entertainment, luxuries) are flat, at best, and in some cases declining.

My colleague Phillip Patrick helped me understand what’s going on here…

Phil says these prices are showing a recessionary pattern. Essentially, American families are being forced to transfer money from their discretionary spending budget (jewelry down 3.2%, men’s suits down 2%, televisions, sports tickets etc.) just to afford higher prices on the essentials (food, fuel and shelter).

That’s bad news for individual families – and it’s bad news for the nation.

The bottom line is, inflation overall hasn’t really “cooled” – it’s just heating up a little slower.

To be clear, this is progress. At least we’re heading in the right direction – very slowly. At the current rate of improvement, -0.2% a month, that trend just won’t have a meaningful impact for quite some time.

Meanwhile, inflation robs our dollars of purchasing power month after month. Which means we need to consider how to insulate our savings from this corrosive effect…

When prices fluctuate, look for stable value

If you’re asking yourself “How can I protect my spending power from inflation?” then congratulations! You’re asking the right question.

As I’ve written many times in the past, there’s no point in planning your future spending in today’s dollars. There’s just no way to know what today’s dollar will be worth a decade or even a year from today.

That’s why I believe physical gold is a crucial asset for saving (and planning!) for the future.

Recently, gold’s price had its best week in 30 months. And that’s rather odd (I talked about it earlier this week) but, ultimately, I just don’t think it matters.

As much as we talk about the gold price, what really matters is the value of gold. And the value of gold is incredibly stable, even over the longest periods of time.

Here’s what I think: diversifying with physical precious metals makes planning for the long-term easier. I believe that’s why central banks are loading up on gold.

They’re thinking about their long-term financial stability over the months, the years and the decades ahead.

I think that’s very wise, and I encourage you to learn more about the benefits of diversifying with physical precious metals.

(Unless you believe you’re better served “investing” in a new TV or a season ticket to the Oakland Athletics… I hear they’re a real bargain.)

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply