The Bernanke Theory: specific economic catastrophes will not happen because they never have before.

Bullion.Directory precious metals analysis 27 May, 2015

Bullion.Directory precious metals analysis 27 May, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Twitter @Lemieux_26

In response to the 2008-09 financial crisis, Bernanke lowered the Fed funds rate to near zero, a policy known as ZIRP. Bernanke was heralded a hero after asset prices began to rise when ZIRP was coupled by several rounds of quantitative easing because one, two, or three were not enough.

The problem is, as it were during Alan Greenspan’s tenure, who was dubbed “the Maestro,” that these policies are great in the very short-term. They stop blunt force trauma to the financial markets. However, instead of healing the economy as central bankers seem to think this policy will, it keeps the economy on life support.

Sure, unemployment is low, yet participation in the labor force still hover over multi-decade lows. Non-farm payrolls usher in jobs, which to the misinformed, look great as if the labor market is growing. However, full-time jobs continue to get slashed and part-time work picks up the slack.

There is a growing divergence between what central bankers want to happen and what actually happens.

Bernanke was part of an open-forum in Seoul, Korea held by the Brookings Institute. The divergence of hopes and dreams to reality were ever present.

The former central bank chair thought that when, or if, the Federal Reserve began to raise rates, it would be “anticlamatic.” Has Bernanke watched risk priced assets on the mere assumption a rate hike is looming? The rise in the US dollar has not been anticlimactic, surging to a new eight-year high against the euro and yen.

As the dollar strengthens on rate hike optimism, short-sellers cut through equities like a hot knife to butter. Couple with the fact there is extremely low volume – participation that mirrors the labor force – this could be a problem.

The strength in the dollar has been contributed to the potential for a rate hike, and the Fed knows this. A strong dollar is a wooden stake to Count Fed, which has sucked the life force from any true economic strength.

“I don’t know when (the rate hike will come), but when that begins, that’s good news, not bad news because it means the US economy is strong enough,” said Bernanke.

That’s probably why the Fed has yet to raise rates with ZIRP now in its seventh year.

At the forum, Bernanke hits us with another gem: “China was growing 10 percent a year. And it was doing that through heavy capital investment, steel plants and so on. Very export oriented.”

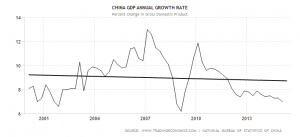

Another problem: China is not growing at 10 percent. Many analysts do not even believe China is actually growing the seven percent that Chinese government claims.

China’s GDP is trending to the lowest levels since the financial crisis, and the unemployment picture looks “fixed”:

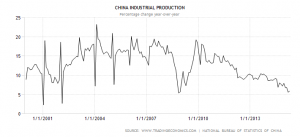

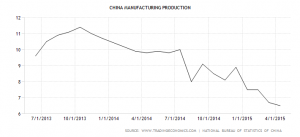

Both industrial and manufacturing production is tumbling hard. Capital flows sink:

Even with consumer prices under two percent, retail sales in China are suffering; and the Fed can relate:

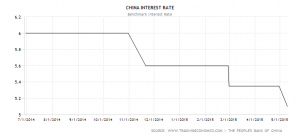

The People’s Bank of China (PBoC) is stressing the economic situation because they have cut rates several times this year alone. It is hard to get a clear indication of how the black box economy is doing, but if the PBOC continues to try an stimulate it must mean things are not looking on the up-and-up. (Imagine needing economic stimulus if China is actually growing at seven percent, silly).

Central bankers, like Bernanke, love to have positive headline numbers on their talking points, yet no one is really talking about the massive debt problem.

The Chinese government cited it wanted reforms to address malinvestment and aim to tackle the debt problem China faces. While push comes to shove, it is the only way they know how to grow.

The Chinese debt-to-GDP is manageable at 63.5 percent, but the rate at which it is rising is troubling. And the PBoC is doing nothing to help stem the massive debt loading done by regional governments.

The Chinese central bank is holding the Shanghai interbank offered rate (SHIBOR) to its lowest level since 2008. This only encourages the regional governments to borrow and malinvest more and more. (For updated SHIBOR).

Chinese rates trending lower:

Do central banks cut rates on transitory set-backs?

To further increase the debt bubble, the Chinese government wants lax lending criteria to toxic borrowers, which, of course, leads to only good things, right?

It is much easier to prolong the inevitable than to just face reality. Chinese President XI Jinping is no different than any official at the Fed. Jinping wants credit expansion at any cost necessary to goose the growth numbers. Without easy credit, China has absolutely no hope in achieving that murky, headline of seven percent growth.

According to Bernanke, China will not have a hard landing. Then again, according to the Bernanke Theory: the hard landing will not happen because it never has before. Much like the US housing collapse (Keeping in mind what Bernanke said in the video, the Fed continues to state now):

You believe China’s economy is in trouble? Bernanke does not buy your premise.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply