Against gold, currencies aren’t just losing value, they’re losing relevance

Bullion.Directory precious metals analysis 04 June, 2024

Bullion.Directory precious metals analysis 04 June, 2024

By Peter Reagan

Financial Market Strategist at Birch Gold Group

The peso comes to mind, since Mexico is nearby. The Turkish lira, mostly due to its recent and infamous hyperinflation.

And that’s basically it! Other than the International Monetary Fund (IMF)’s Special Drawing Rights, or SDR. The SDR is a synthetic “currency,” really a basket holding proportional shares of what the IMF considers the five major currencies: The U.S. dollar, euro, pound sterling, the Chinese yuan and the Japanese yen.

Even though these are supposed to have a lot of clout on the global stage, two out of five on this very short list are almost worthless as well. Would you be happy if someone gave you a stack of yuan or a stack of yen? (The yuan trades at seven to the dollar, the yen at 155 to the dollar.)

So we have exactly four currencies in the entire world that have any value, temporary as it might be. Of these four, the Swiss franc ends up being mostly forgotten due to its relatively small global presence, leaving us with three.

And when gold overtakes one of these three currencies among central banks, it’s a very big deal. That is exactly what has happened with the euro recently, and Jan Nieuwenhuijs believes the U.S. dollar is next.

Can it happen? There are two important takeaways before we move into Jan’s details. The euro is shared by over 20 countries, including some of the most developed in the world, and is worth more than the U.S. dollar. So overtaking it is no small thing.

But Nieuwenhuijs thinks there is much more to this story, and that gold is being undersold as usual. As he notes:

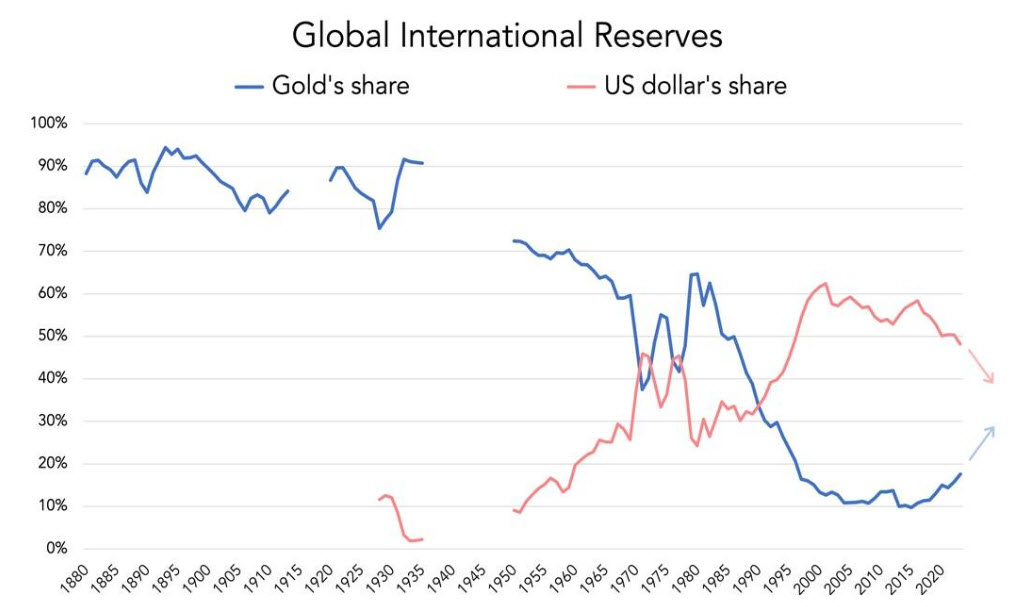

It’s not the dollar that normally backs the international monetary system, it’s gold. Gold used to make up the majority of international reserves, even when sterling was said to be the world reserve currency before the dollar.

The argument is certainly there. Gold has been there the entire time as an unbiased gauge of sovereign currency values and, thanks to inflation, their persistent decline. The official tether to gold went away, but who could possibly argue that this made gold irrelevant?

Nieuwenhuijs , a big proponent of the “covert acquisitions” theory, says global gold reserves now sit at 18% compared to just 11% in 2008. Obviously central bank gold buying, or as they call it, “portfolio rebalancing” or “diversification,” is responsible. It’s clear that the global financial system is different now than it was in 2008.

For a century, gold was the #1 reserve asset worldwide. Now it’s #2 but the trend is clear… Graph via Jan Nieuwenhuijs

Faith in currencies is at an all-time low. That’s why anyone interested in creating a valuable currency has to talk about a gold standard. High inflation is becoming the norm, and central banks have grown increasingly enthusiastic in their willingness to inflate away their debts.

This is of course an issue here in the U.S. We aren’t alone in that struggle.

The same mechanisms that pushed the euro out of second place are gaining more and more steam, which is why Jan believes we will see the same thing happen with the greenback in the next decade. After all, what does the U.S. dollar really have going for it to avoid the euro’s fate? Faith and prominence in the front, not much beyond that.

There is still hope for the U.S. dollar if even a partial tether to gold is re-introduced, such as the one we had before Nixon destroyed it. Remember, friends, that was the first time in human history the world’s global reserve currency wasn’t based on gold. Ever since 1971, the concept of money has entered a new and completely experimental phase. How much longer can it last?

Could the dollar return to a gold standard? While not impossible, it’s unlikely. The Federal Reserve and other sovereign currency-printers will likely continue pretending that gold is no longer money for as long as they’re able. No one who has a license to print currency is going to give it up without a fight…

For those of us who see the writing on the wall, we can put our finances on our own personal gold standard. That won’t save the nation or the dollar, but it may save us.

India repatriates gold reserves – are they the next BRICS to watch?

India is very clearly becoming the next nation to watch regarding gold developments, right up there with usual suspects Russia and China. In a sense, India was always there due to its massive consumer gold purchases.

But while Russia and China were getting busy hoarding gold and hinting towards their own gold standards, India’s government seemed to care little.

That has changed quickly, and in ways that are capturing worldwide attention. As we recently noted, there appears to be a 60-some ton discrepancy between India’s officially-reported central bank gold purchases and the actual increase of its reserve.

To say the least, we believe this ties into the growing popularity of “gold loans,” where citizens lease their gold to the government in exchange for rupees. This happens through private banks, but as we know, the line between private and official sector often blurs, and in less developed nations is often little more than an appearance’s sake.

Then there’s the whole gold bond scheme, where India sells sovereign bonds whose value grows proportionally to gold’s price. (Pretty strange for a country whose officials scarcely mention the yellow metal.)

And in the latest bombshell story, India’s central bank repatriated 100 tons of gold from the vaults of the Bank of England. But according to inside sources of Business Today, this appears to be just the start: India looks to want all of its overseas gold back. It’s very reminiscent of what Germany did a few years ago.

It’s worth pointing out that India holds one third of its gold domestically, one third with the BoE and another third with the Bank of International Settlements (BIS). This is India’s most significant gold move in over 30 years.

No explanation was given. Business Today suggests India will no longer have to pay the costs of storing gold abroad. Somehow, we don’t think storage fees are a big problem for the government of India.

The reason is obvious: Countries want their gold stockpile domestically. And, of course, want to increase it as much as possible. We have to assume something is brewing. Britain isn’t exactly under martial law. The BoE’s vaults have gotten more secure, not less. So there is a reason behind this move, and we suspect it ties into central bank purchases, inflation, and India’s place in the BRICS alliance.

The same article also notes that central banks have acquired most the gold they own in the last 14 years, which is 17% of the gold ever mined. If we entertain the idea that central bank policies aren’t always reactionary, and that they sometimes act with decades-long agendas, lots of enticing speculation abounds.

If you’re in China, chances are you can’t just go out and buy gold

We have recently covered what can rightly be called the horrors of Chinese gold consumerism, and things appear to only be getting worse. Back then, there was still the idea that it only happens in some shops which were fake to begin with and that it’s mostly resigned to orders that don’t get fulfilled.

But apparently, the story is far more layered. This detailed report shows the reality of Chinese gold investment. In short, the Chinese citizen has to treat gold buying like going through a minefield. If they’re ordering gold online, they have to wonder if they’ll ever receive it. But that’s easily solved with brick-and-mortar purchases, right? Check out the video:

Apparently, fake investment gold is so commonplace that it appears everywhere, including seemingly reputable shops. The shops that sell you any real metal grossly overprice it when bought in the form of jewelry, sometimes selling for double than what is the standard price for a piece based on its gold weight.

Then there are the high premiums and the curbed imports, which obviously complement each other quite well. For that matter, Chinese gold premiums are so high that we’ve wondered if they’re the ones pricing gold bullion right, and the West underpricing it.

But by far the most noteworthy thing in all of this is that none of this is doing anything to stop consumer demand. The Chinese are buying left and right, expensive and underweight. Even amid all these difficulties, we’re hearing ongoing claims that China is behind the gold performance we’re seeing in the West. And these claims hardly lack evidence.

We’re tempted to be a little cynical here and say that there is one set of rules for the rich and one for everyone else. In this case, the rich would be the Chinese government, which is piling the best available investment-grade gold while the citizens are happy to not torch their gold bar and see a green tint under it.

But despite Governor Beshear’s recent comments, that is not the case in America. Gold has always symbolized liberty, and America has always tried to follow along those tracks. To that point, you don’t need to have excellent connections or be a government official to get the best gold bullion available. Opening our website does the trick.

We as humans habitually take things for granted, and it seems we’ve done the same with gold investment. Sure, we’ve all heard of gold scams. But how many of us can envision a situation like in China, where investment-grade gold is getting out of reach of the citizen, and not because they can’t afford it? We might envision it, if central banks end up buying all of it…

That Chinese consumers have supported gold’s price as much as they have even with all these difficulties shows just how aware they are of gold’s value and fiat’s near-worthlessness.

In the meantime, despite everything pointing up, Western demand for coin and bars has actually been lagging.

Perhaps another sign of complacence, along with excessive faith in the issuers of first-world currencies.

Peter Reagan

Peter Reagan is a financial market strategist at Birch Gold Group, one of America’s leading precious metals dealers, specializing in providing gold IRAs and retirement-focused precious metals portfolios.

Peter’s in-depth analysis and commentary is published across major investment portals, news channels, popular US conservative websites and most frequently on Birch Gold Group’s own website.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply