Inflation supports gold, the expected Fed’s reaction to price pressure – not. Since gold ended November with a small gain, what will December bring?

Bullion.Directory precious metals analysis 09 December, 2021

Bullion.Directory precious metals analysis 09 December, 2021

By Arkadiusz Sieroń, PhD

Lead Economist and Overview Editor at Sunshine Profits

However, if we focus on the fact that US consumer inflation rose in October to its highest level in 30 years, and that real interest rates have stayed deeply in negative territory, gold’s inability to move and stay above $1,800 looks discouraging.

We can also look at it differently. The good news would be that gold jumped to $1,865 in mid-November. The bad news, on the other hand, would be that this rally was short-lived with gold prices returning to their trading range of $1,750-$1,800 in the second half of the month, as the chart below shows.

Now, according to the newest WGC’s Gold Market Commentary, gold’s performance in November resulted from the fact that higher inflation expectations were offset by a stronger dollar and rising bond yields that followed Powell’s nomination for the Fed Chair for the second term.

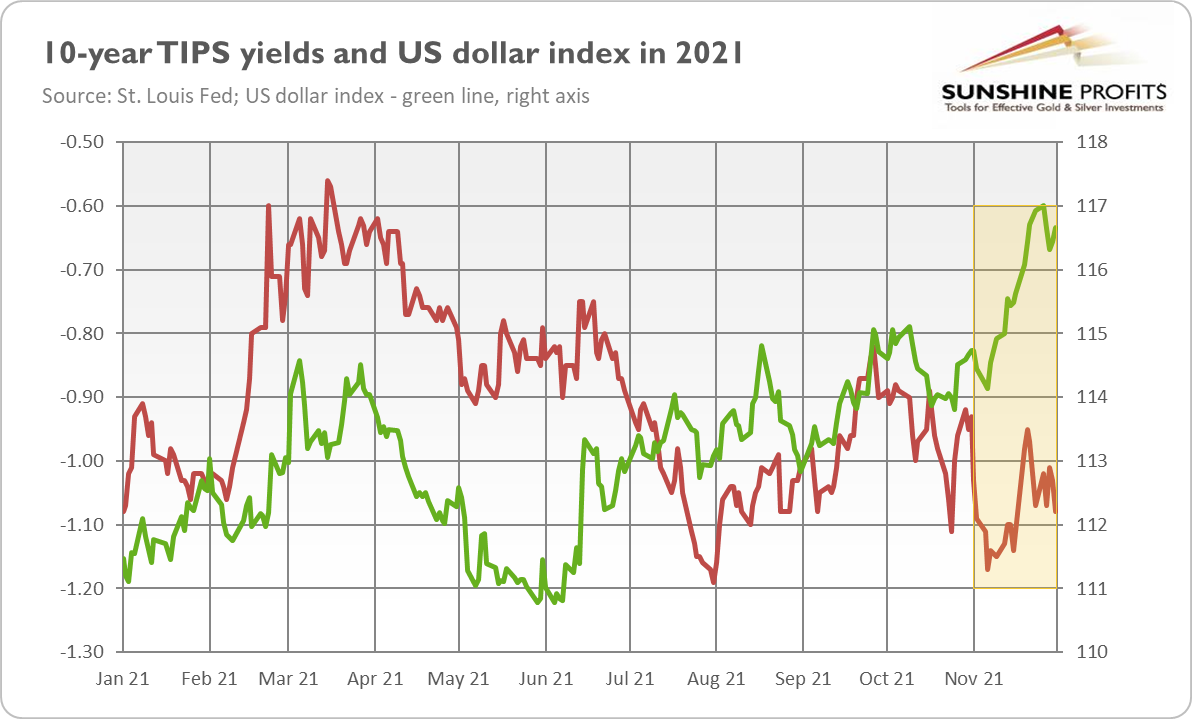

Indeed, as you can see in the chart below, the greenback strengthened significantly in November, and real interest rates rallied for a while. Given the scale of the upward move in the dollar, and that it was combined with a surge in yields, gold’s performance last month indicates strength rather than weakness. As the WGC notes, “dollar strength was a headwind in November, acting as a drag on gold’s performance, but not enough to outweigh inflation concerns.”

Implications for Gold

Great, but what’s next for the gold market in December and 2022? Well, that’s a good question. The WGC points out that “gold remains heavily influenced by investors’ continued focus on the path of inflation (…) and the Fed’s and other central banks’ potential reaction to it.” I agree. Inflation worries increase demand for gold as an inflation hedge, supporting gold, but they also create expectations for a more hawkish Fed, hitting the yellow metal.

It seems that the upcoming days will be crucial for gold. Tomorrow (December 10, 2021), we will get to know CPI data for November. And on Wednesday (December 15, 2021), the FOMC will release its statement on monetary policy and updated dot plot. My bet is that inflation will stay elevated or that it could actually intensify further. In any case, the persistence of high inflation could trigger some worries and boost the safe-haven demand for gold.

However, I’m afraid that gold bulls’ joy would be – to use a trendy word – transitory. The December FOMC meeting will probably be hawkish and will send gold prices down. Given the persistence of inflation, the Fed is likely to turn more hawkish and accelerate the pace of tapering.

Of course, if the Fed surprises us on a dovish side, gold should shine. What’s more, the hawkish tone is widely expected, so it might be the case that all the nasty implications are already priced in. We might see a “sell the rumor, buy the fact” scenario, but I’m not so sure about it. The few last dot-plots surprised the markets on a hawkish side, pushing gold prices down. I’m afraid that this is what will happen again. Next week, the Fed could open the door to earlier rate hikes than previously projected. Hence, bond yields could surge again, making gold move in the opposite direction. You’ve been warned!

Arkadiusz Sieroń

Arkadiusz Sieroń – is a certified Investment Adviser, long-time precious metals market enthusiast, Ph.D. candidate and a free market advocate who believes in the power of peaceful and voluntary cooperation of people.

He is an economist and board member at the Polish Mises Institute think tank, a Laureate of the 6th International Vernon Smith Prize and the author of Sunshine Profits’ bi-weekly Fundamental Gold Report and monthly Gold Market Overview.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply