Platinum Betting Turns Positive as Gold Bullion Finds Another ‘Event-Driven Bid’

Bullion.Directory precious metals analysis 20 November, 2017

Bullion.Directory precious metals analysis 20 November, 2017

By Adrian Ash

Head of Research at Bullion Vault

With pundits calling it Germany’s “worst political crisis in decades”, current Chancellor Angela Merkel met this morning with President Frank-Walter Steinmeier after the Free Democratic Party’s walk-out threatened to force a second election following September’s inconclusive result.

Gold bullion initially spiked back above EUR1000 per ounce as the single currency fell on the FX market, but it then retreated 0.7% from Monday morning’s 1-week highs.

European stock markets regained earlier losses by lunchtime, but Wall Street futures pointed lower once more.

Latest data show that money managers grew their speculative betting on Comex gold futures and options by 4.3% last week, net of that group’s bearish bets.

That took the ‘net long position’ in Comex gold to its highest in 6 weeks.

Bullish betting on silver also grew for a second week running, the same data say, taking the net long to its highest in 9 weeks.

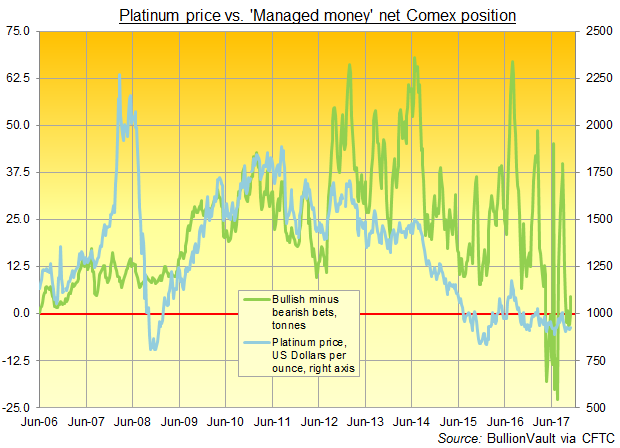

Platinum betting among the ‘Managed Money’ category meantime turned positive for the first time in 4 weeks, having first turned negative – with more bearish than bullish bets – this May.

Speculators have so far been negative overall on platinum almost two-thirds of the time in 2017.

The price of platinum today traded $10 below Friday’s spike to 2-month highs at $954 per ounce.

“Platinum continues to portray signs of stabilization,” says the latest technical analysis from French investment and bullion market-making bank Societe Generale, pointing to graphical support at $900 per ounce.

“It has formed multiple double bottoms near those levels, however confirmation [of a] corrective recovery is still awaited.”

Looking at gold bullion’s Asian action Monday, “The initial knee-jerk reaction to the [Germany coalition] headlines saw the Euro lower and a move into the Yen and precious metals,” says Swiss refining and finance group MKS Pamp.

“However flows soon tempered and bullion spent the remainder of the session easing back from opening levels.

“Sizeable open interest in December gold [futures contracts] around $1300, coupled with [the US] Thanks Giving holidays this week is likely to see the market capped around [that] figure.

“Event-driven bids seem to be occurring more frequently and may be the new normal,” says a note from US financial services giant Citigroup.

“Even as the rates and forex channel dominate the outlook for gold pricing, the yellow metal is increasingly being used by investors as a policy and tail risk hedge.”

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply