As Precious Metals Prices Spike, Analysts Warn on ‘Demand Fundamentals’

Bullion.Directory precious metals analysis 21 April, 2016

Bullion.Directory precious metals analysis 21 April, 2016

By Adrian Ash

Head of Research at Bullion Vault

Silver meantime leapt more than 2% for the third day running, touching new 11-month highs against both Dollars and Euros as European stock markets fell and New York equities pointed lower.

Gold and silver prices then retreated sharply, erasing all of their respective 1.8% and 4.3% gains in earlier London trade.

“Overall, we think that gold fundamentals are broadly stable,” says Swiss banking group and bullion market-maker UBS, maintaining its 2016 average gold price forecast of $1225 and repeating its view “that a re-allocation into gold is warranted given macro risks, but not to call for a fresh bull run.”

New trade data from Switzerland today showed 44 tonnes of gold exports to London last month, confirming bullion-industry reports that a lack of Asian demand for 1-kilo investment bars has seen the world’s largest refineries converting investment products back into large 400-ounce bars for wholesale storage in the UK.

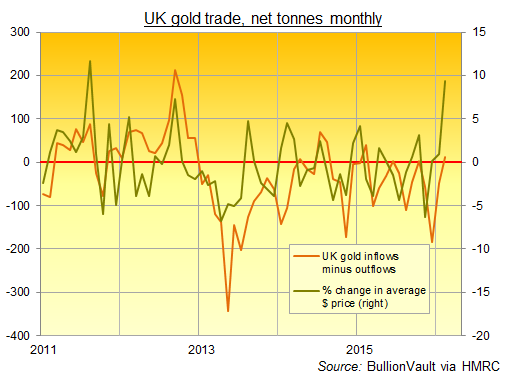

Latest UK trade data said February marked only the 7th net inflow of gold bullion to London vaults in 38 months.

With gold priced in Australian Dollars dropping 10% yesterday from February’s new record highs, Australian investment bank Macquarie today downgraded its outlook on 5 gold mining stocks, reports the Sydney Morning Herald, and tips gold bullion “to edge down slightly this year to $US1199″ per ounce.

Looking at silver,”Despite encouraging figures in the Chinese market,” says French investment and bullion bank Natixis’ precious metals analyst Bernard Dahdah, “the recent surge in the price is not backed by strong fundamental demand that can justify such high prices.”

Indeed, US sales of electronics – a key industrial use of silver – fell 2% per year in March, says Dahdah, marking the 12th such successive fall, while Singapore’s electronics exports fell 9% from the same month in 2015.

Noting how silver-backed ETF trust fund vehicles have added 1,300 tonnes pf metal since the start of March, Dahdah repeats his average 2016 price forecast of $14.50 per ounce, warning that “Just as quickly as investors turned into a source of demand for silver earlier in March, so they are able turn into a source of supply of the metal.”

Dahdah won 2015’s professional LBMA forecast competition in gold, and said at the start of this year that gold would trade below $1000 per ounce by the end of March, forecasting then as now that the US Fed will raise Dollar interest rates again after December’s “lift off” from 0% “in the second half of this year.”

Gold peaked instead above $1282 during the first 3 months of 2016, rising at the fastest quarterly pace in 30 years.

The ECB today held its monetary stimulus for the 335-million citizen Eurozone at the €80 billion per month in QE asset purchases announced in March, and held the negative interest rate on commercial banks’ surplus deposits with the central bank at minus 0.4% – almost equal to the annual management cost of trust-fund gold ETF products, and 3 times the cost of storing and insuring physical gold at BullionVault.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply