Precious Metals Market Report

Wednesday 7 June, 2017

Fundamentals and News*

Gold Makes Run toward $1,300 as Risk Flares From U.K. to Mideast

Comey testimony, Qatar crisis also spurring demand for havens

‘Rising political uncertainty’ providing support, ANZ says

Gold’s making a run toward $1,300 an ounce. The metal has rallied to the highest since November as investors position themselves for the outcome of the U.K. election and potential drama of former FBI Director James Comey’s testimony, while also tracking tensions in the Middle East.

Bullion for immediate delivery was steady at $1,293.71 an ounce at 7:49 a.m. in Singapore after rising on Tuesday to $1,296.15, the highest level since Nov. 9, according to Bloomberg generic pricing. The gains have also been supported by a decline in the dollar, which has dropped to the lowest since October.

Gold has surged 13 percent in 2017, eking out gains every month in the best run since 2010. The latest leg up has been supported by an increase in haven demand as U.K. voters head to the polls on Thursday, with the outcome set to dictate how the country handles Brexit. On the same day, Comey is set to appear before a Congressional panel to testify about his investigation intoDonald Trump campaign’s ties to Russia.

“Rising political uncertainty continues to provide support for gold,” Australia & New Zealand Banking Group Ltd. said in a note, citing Comey and the U.K. polls. “This comes as the diplomatic crisis in the Middle East involving Saudi Arabia and Qatar intensifies. This has seen a continued rise in safe-haven buying of the precious metal. A weaker dollar is also playing its part.”

Saudi Arabia, the United Arab Emirates, Bahrain and Egypt severed ties with Qatar on Monday citing its support for rival Iran and for extremist groups. The crisis pits U.S. allies against each other, disrupting trade, flights and business activity in one of the world’s most strategically important regions.

(*source Bloomberg)

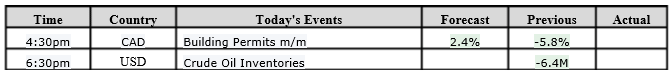

Data – Forthcoming Release

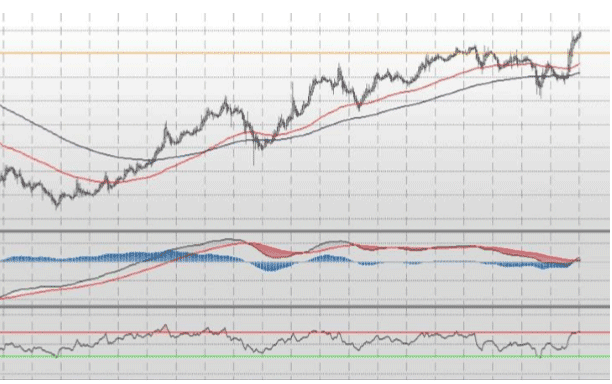

Technical Outlook and Commentary: Gold

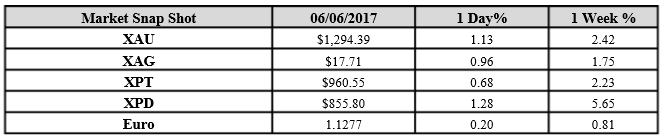

Gold for Spot delivery was closed at $1294.39 an ounce; with gain of $14.59 or 1.13 percent at 1.00 a.m. Dubai time closing, from its previous close of $1279.8

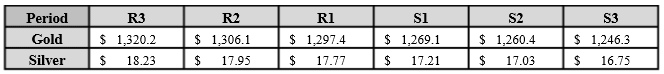

Spot Gold technically seems having resistance levels at 1297.4 and 1306.1 respectively, while the supports are seen at $1269.1 and 1260.4 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.71 with gain of $0.17 or 0.96 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.54

The Fibonacci levels on chart are showing resistance at $17.77 and $17.95 while the supports are seen at $17.21 and $ 17.03 respectively.

Resistance and Support Levels

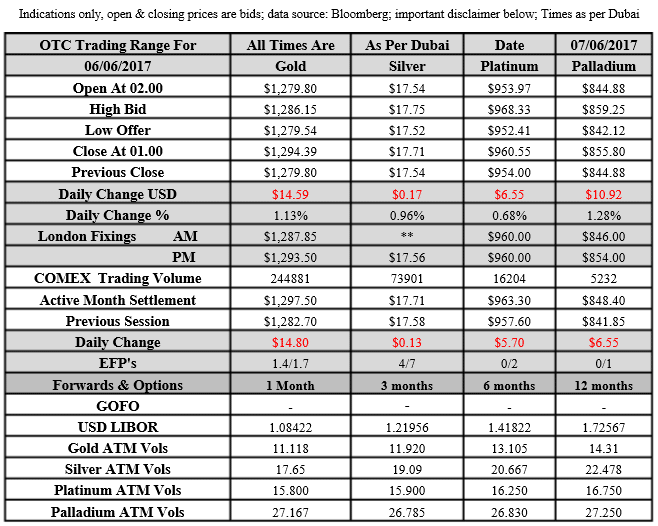

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply