Precious Metals Market Report

Wednesday 05 July, 2017

Fundamentals and News*

Yen Rises With Gold as Asia Stocks Open Mixed

Geopolitical concerns loomed over financial markets for a second day, as sabre-rattling over North Korea’s nuclear weapons program sent investors seeking out haven assets such as the yen and gold, while stocks opened mixed.

Equities in Australia slipped, while Japanese and South Korean shares were slightly lower, with U.S. equity and bond markets set to reopen after the July 4 holiday. The yen and gold climbed for a second day after the missile launch fanned concern North Korea is closer to building a device capable of hitting the U.S. Oil continued its rebound.

The U.S. confirmed the rocket launched on July 4 was an intercontinental ballistic missile. North Korea now may be capable of striking the U.S. — possibly Hawaii or Alaska — though it’s believed to be some way from the capability to deliver a nuclear payload to the U.S. mainland. Kim Jong Un is “firmly determined and committed” to test an ICBM that can hit the U.S. mainland within this year, the state-run Korean Central News Agency said in a statement.

Markets in the past have shown a capacity to quickly move beyond periods of tension on the Korean peninsula following short bouts of risk aversion. The stock market opening in Hong Kong will be closely watched after a pronounced sell-off there on Tuesday saw technology shares tumble.

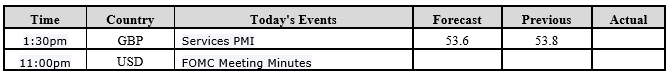

Elsewhere, the Federal Reserve is due to release minutes from its June policy meeting, the latest clues for investors on the path for U.S. interest rates ahead of Friday’s key jobs report. Equity investors this year have put their faith in a global economic recovery, helping spur all-time highs in global stocks, whereas bond buyers appear less sanguine on the outlook, doubting Fed rate hike plans.

Adair Turner, Jon Moulton and Mark Gilbert discuss the outlook for the global economy and monetary policy.

Political turmoil on the Korean peninsula comes ahead of the G-20 summit in Hamburg this week as the United Nations Security Council prepares to host an emergency meeting Wednesday. U.S. President Donald Trump will attend the G-20 and is expected to hold his first meeting with Russia’s Vladimir Putin as well as meet his Chinese counterpart Xi Jinping. Read more on U.S.-China relations and North Korea here.

The big economic event of Asia’s day will be the release of China’s Caixin Services Purchasing Managers’ Index, which came at 51.5 in May. Both theprivate and official readings for the manufacturing sector in the world’s second-largest economy were better than expected in June. Also coming are the Bank of Thailand’s interest-rate decision, Philippines inflation data for June, and Japan’s Services PMI for June.

The yen rose 0.3 percent to 112.93 per dollar as of 9:12 a.m. in Tokyo after climbing as much as 0.6 percent during Tuesday’s session.

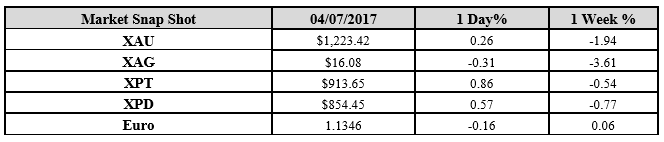

Gold advanced 0.3 percent to $1,227.28 an ounce following its 0.3 percent climb on Tuesday.

(*source Bloomberg)

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

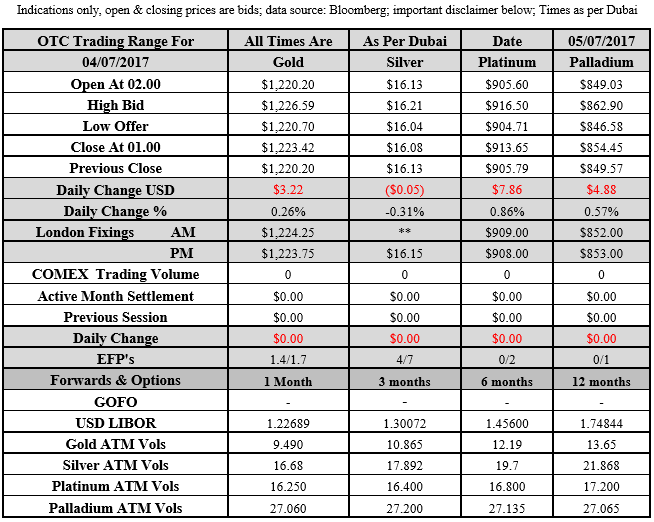

Gold for Spot delivery was closed at $1223.42 an ounce; with gain of $3.22 or 0.26 percent at 1.00 a.m. Dubai time closing, from its previous close of $1220.2

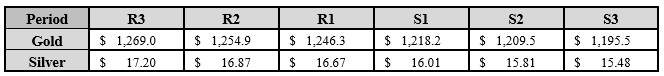

Spot Gold technically seems having resistance levels at 1246.3 and 1254.9 respectively, while the supports are seen at $1218.2 and 1209.5 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.08 with loss of $0.05 or 0.31 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.13

The Fibonacci levels on chart are showing resistance at $16.67 and $16.87 while the supports are seen at $16.01 and $ 15.81 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply