Precious Metals Market Report

Wednesday 31 May, 2017

Fundamentals and News*

U.S. Stocks Slip From Records, Treasuries Advance

U.S. stocks halted a seven-day advance as data showing a rebound in consumer spending offset a wider selloff in commodities. Treasuries advanced amid month-end buying.

The S&P 500 Index edged lower from all-time high banks paced gains while energy producers slumped amid a retreat in crude. Tech shares lifted the Nasdaq 100 Index to a fresh record. The 10year Treasury note yield fell to 2.21 percent. The Stoxx Europe 600 Index declined a fourth day as data showed euro-area economic confidence fell for the first time this year.

The euro-area’s preliminary headline inflation rate will come on Wednesday.

Fed speakers are out and about as the FOMC’s June 13-14 meeting approaches. Robert Kaplan will be in New York Wednesday.

The U.S. jobs report Friday may bolster the case for a rate hike, with a gain of 185,000 positions expected.

Brazil’s central-bank decision on Wednesday will probably see a cut of 75 to 100 basis points from the current 11.25 percent, according to economists.

China’s May manufacturing PMIs on Wednesday might indicate that the nation’s 2017 growth has already peaked.

Stocks

The S&P 500 slipped 0.1 percent to 2,412.93 at 4 p.m. in New York. The index retreated for the first time in eight days after the longest rally since February.

The Nasdaq 100 Index advanced for an eighth day to an all-time high. Amazon.com Inc. briefly topped $1,000 a share for the first time before trading little changed.

The Stoxx Europe 600 Index declined 0.2 percent and emerging-market shares slipped 0.4 percent.

Currencies

The Bloomberg Dollar Spot Index was little changed after initially rising data. It’s near the lowest level since November.

The euro rose 0.2 percent to $1.1189. The shared currency swung between gains and losses as traders weighed Germany’s inflation miss against a Reuters report that the ECB will likely discuss removing its easing bias in June. It recovered early losses sparked by speculation Greece could forego its next bailout payment.

The yen strengthened 0.5 percent to 110.767 per dollar.

Commodities

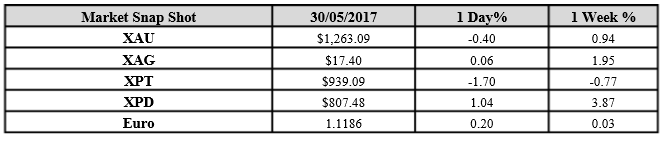

Gold futures fell for the first time in three days, losing 0.4 percent to settle at $1,265.70 an ounce.

West Texas oil fell 14 cents to settle at $49.66 per barrel. OPEC and Russia’s deal last week to extend output limits through March was met with a sell-off as it didn’t include deeper cuts, a plan for the rest of 2018 or a new ally.

(*source Bloomberg)

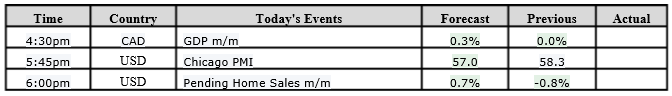

Data – Forthcoming Release

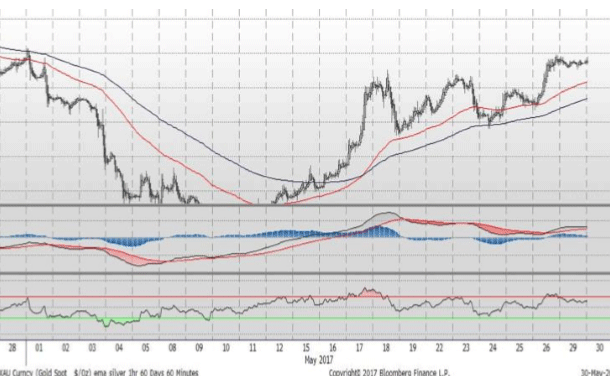

Technical Outlook and Commentary: Gold

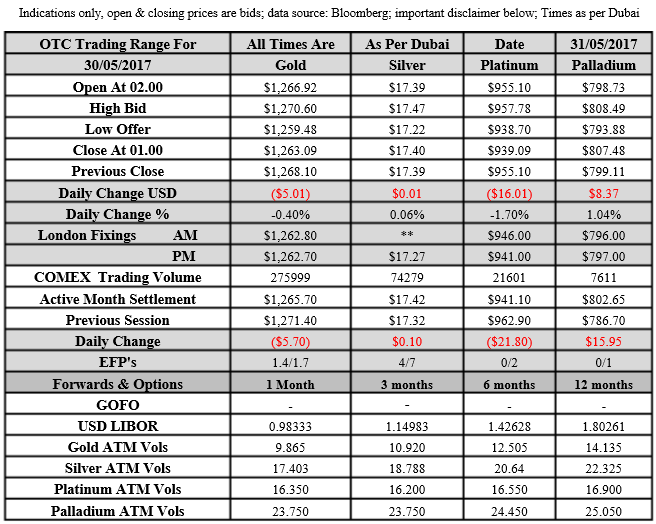

Gold for Spot delivery was closed at $1263.09 an ounce; with loss of $5.01 or 0.40 percent at 1.00 a.m. Dubai time closing, from its previous close of $1268.10

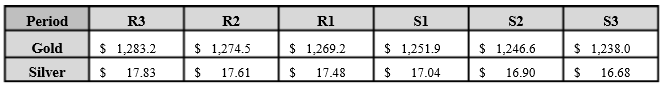

Spot Gold technically seems having resistance levels at 1269.2 and 1274.5 respectively, while the supports are seen at $1251.9 and 1246.6 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.40 with gain of $0.01 or 0.06 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.39

The Fibonacci levels on chart are showing resistance at $17.48 and $17.61 while the supports are seen at $17.04 and $ 16.90 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply