Precious Metals Market Report

Friday 31 March, 2017

Fundamentals and News

Treasuries Fall as Stocks Pare Gains, Gold Slumps: Markets Wrap

(Bloomberg)

Treasuries fell with gold, while the dollar advanced as central bank officials in Europe and the U.S. signaled divergent policy paths. U.S. stocks pared gains.

The S&P 500 Index trimmed its advance as the benchmark for American equity heads for a quarterly gain of more than 5 percent. The greenback dipped after CNBC cited unnamed sources that multiple U.S. agencies were looking into currency penalties. The dollar earlier rose as Fed speakers suggested rates may need to rise faster than the market currently anticipates, while the euro weakened and core European government bonds rose as investors weighed the prospect of the ECB sticking with its loose monetary policy.

While European central bank officials doused expectations policy makers were planning to withdraw monetary support, Fed officials shifted to a more hawkish tone, as the world’s biggest economy progresses toward goals for full employment and 2 percent inflation. Investors remained focused on Washington, where Republicans hinted they may revisit health-care reform, raising concern that tax cut attempts may take a back seat.

“The ECB is likely to tread very carefully in the coming months, and not adjust their forward guidance or tone significantly before they feel more comfortable about the economy and inflationary pressure,” Bas van Geffen, an analyst at Rabobank International, wrote in a note.

Indonesia’s government said the local unit of Freeport-McMoRan Inc. has agreed to convert its longterm contract into a mining license, potentially enabling the company to resume overseas sales of copper concentrate from the Grasberg complex.

However, a Freeport spokesman said the company’s Contract of Work will continue to stand “until a mutually satisfactory replacement agreement is completed.” In the meantime, the company did confirm it’s making progress on a deal that would allow it to resume copper concentrate exports, Eric Kinneberg, a Phoenix-based company spokesman, said Thursday in an emailed statement

(*source Bloomberg)

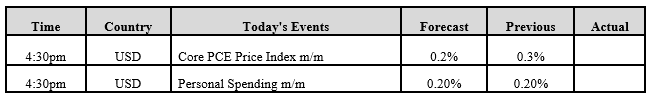

Data – Forthcoming Release

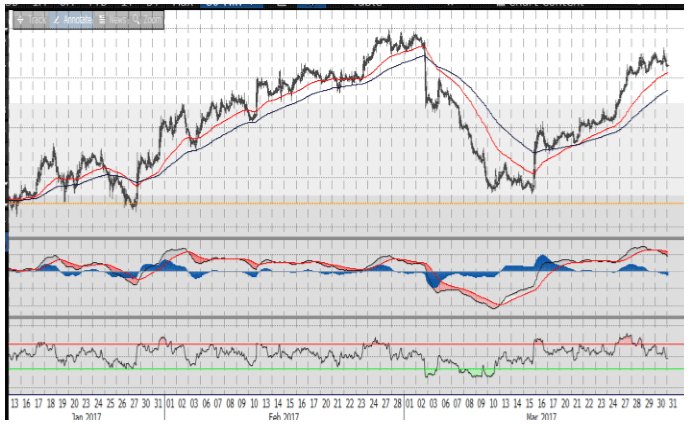

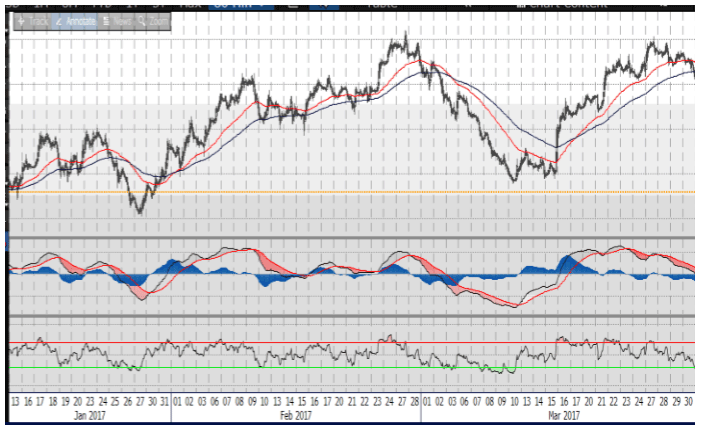

Technical Outlook and Commentary: Gold

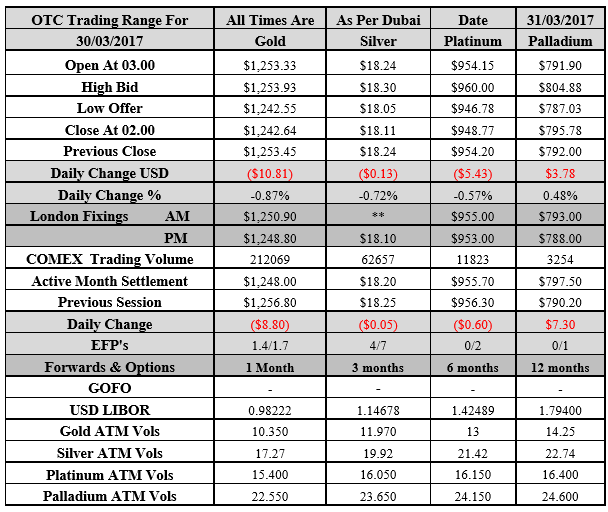

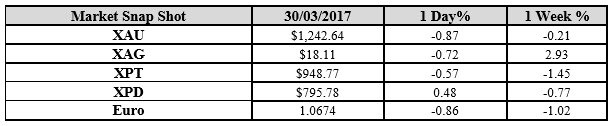

Gold for Spot delivery was closed at $1242.64 an ounce; with loss of $10.81 or -0.87 percent at 2.00 a.m. Dubai time closing, from its previous close of $1253.45

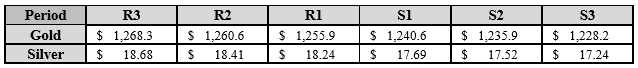

Spot Gold technically seems having resistance levels at 1255.9 and 1260.6 respectively, while the supports are seen at $1240.6 and 1235.9 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.11 an ounce; with loss of $0.13 or -0.72 percent at 2.00 a.m. Dubai time closing, from its previous close of $18.24

The Fibonacci levels on chart are showing resistance at $18.24 and $18.41 while the supports are seen at $17.69 and $ 17.52 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply