Precious Metals Market Report

Thursday 30 March, 2017

Fundamentals and News

Return of Brexit Fears Helps Send Gold to Best Quarter in a Year

(Bloomberg)

Angst over possible fallout from Brexit has crept back into the market, helping send gold toward its biggest quarterly gain in a year.

Prime Minister Theresa May set the U.K. on course for leaving the European Union in two years, weakening the pound and bolstering demand for bullion as a haven. Gold priced in sterling rose to the highest in almost four weeks Wednesday, while bullion futures traded in New York headed for the best quarter since the first three months of 2016.

Battle lines are becoming evident nine months after Britons unexpectedly voted to quit the EU. May’s actions trigger two years of talks and come days after the failure of a U.S. health-care bill stoked concerns about prospects for the Trump administration’s economic agenda.

“Traders do not believe that the U.K.’s economy will fare well as negotiations start,” said Naeem Aslam, the chief market analyst at Think Markets U.K. Ltd. “We are seeing more interest in gold. Traders want to hedge themselves.”

Spot gold gained 0.3 percent to 1,008.50 pounds per ounce at 7:09 p.m. in London, according to Bloomberg generic price. Bullion in sterling is on course for an 8.5 percent rally this quarter, the best such performance since the second quarter of 2016.

On the Comex in New York, gold futures priced in dollars are poised for an 9.1 percent gain this quarter, the biggest since March 2016. The metal for June delivery slipped 0.2 percent on Wednesday.

In other precious metals:

Spot silver priced in pounds and dollars is set for the steepest quarterly advance since June, while palladium and platinum priced in dollars are also poised for quarterly gains.

Exchange-traded funds tracking semiconductors, Brazil, technology, banks and gold and uranium miners are exhibiting the strongest momentum, according to a Bloomberg Intelligence ranking. Value characteristics are greatest for ETFs following sectors such as energy, Italy and mortgage REITs. Financial and Russia ETFs scored high on both measures. Momentum investing seeks to capitalize on investors’ tendency to buy securities that are rising. Value investors look for assets that may be undervalued.

The momentum ranking is based on three- and 12-month returns, excluding the past month. ETFs with high returns during those periods tend to continue outperforming for the next few months. The value screen ranks ETFs with the lowest price-to-book ratio.

(*source Bloomberg)

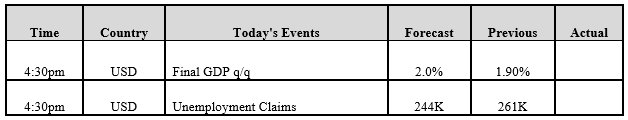

Data – Forthcoming Release

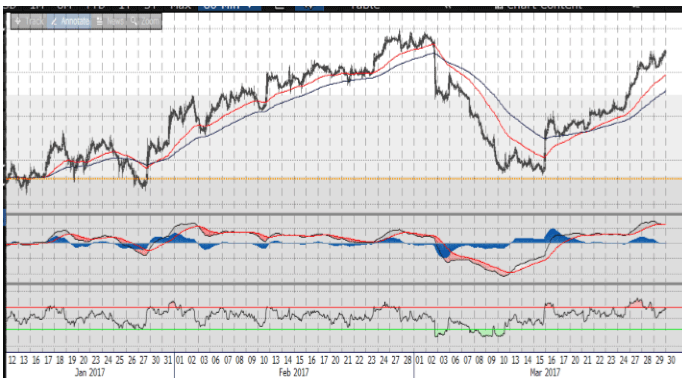

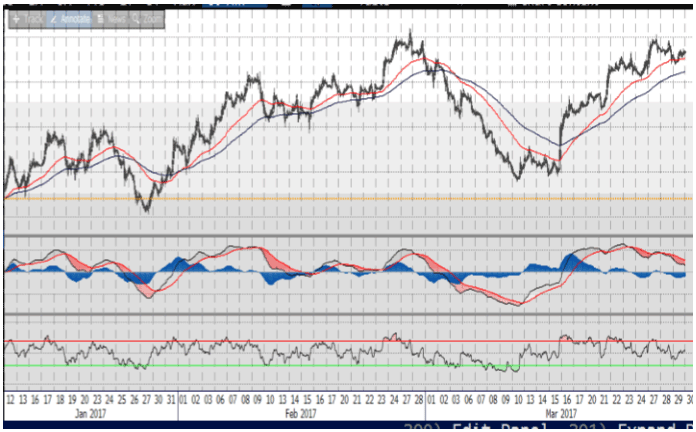

Technical Outlook and Commentary: Gold

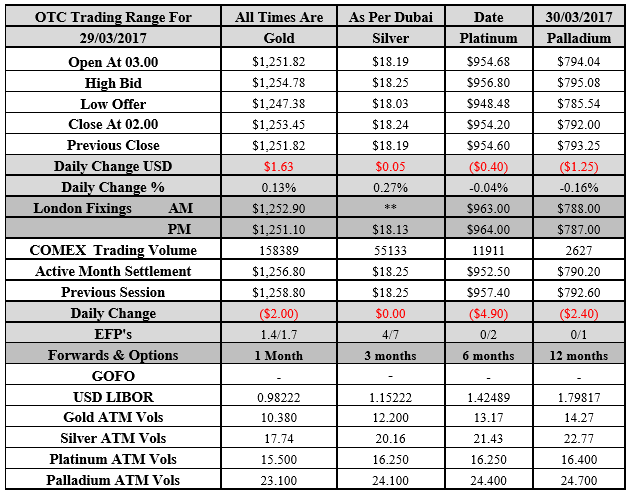

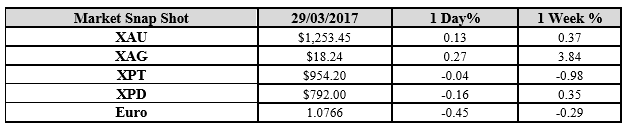

Gold for Spot delivery was closed at $1253.45 an ounce; with gain of $1.63 or 0.13 percent at 2.00 a.m. Dubai time closing, from its previous close of $1251.82

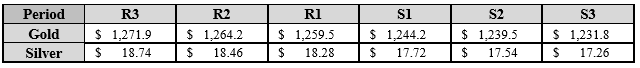

Spot Gold technically seems having resistance levels at 1259.5 and 1264.2 respectively, while the supports are seen at $1244.20 and 1239.50 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.24 an ounce; with gain of $0.05 or 0.27 percent at 2.00 a.m. Dubai time closing, from its previous close of $18.19

The Fibonacci levels on chart are showing resistance at $18.28 and $18.47 while the supports are seen at $17.72 and $ 17.54 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply