Precious Metals Market Report

Wednesday 29 March, 2017

Fundamentals and News

Goldcorp-Barrick Partnership Shows Miners Tip-Toeing to Growth

(Bloomberg)

In the dark days of the commodities meltdown, mining companies turned to partnerships to lower costs and survive. Now, as prices recover, they’re hooking up for growth — or at least the possibility of it.

Canada’s two biggest gold miners, Barrick Gold Corp. and Goldcorp Inc., are teaming up to develop a gold-copper deposit in Chile as part of a complex chain of transactions.

The cultures of the two companies are, in many ways, opposites. Where Goldcorp has been focused on boosting production, Barrick has repeatedly stressed that its priority is improving cash flow through better margins.

Barrick’s latest joint venture with Goldcorp means it’s off the hook for the initial development costs associated with a large project in the Maricunga mineral belt, in exchange for handing over control of part of the asset.

Under terms of separate deals announced Tuesday, Goldcorp will acquire 25 percent of the Barrick-controlled Cerro Casale project in Chile. Goldcorp will also buy Kinross Gold Corp.’s 25 percent total interest in the deposit for $260 million upfront, as well as other deferred payments and a royalty, making Barrick and Goldcorp equal partners at the site.

Meanwhile, through the acquisition of Exeter Resource Corp., Goldcorp will buy the Caspiche project just 10 kilometers (6.2 miles) from Cerro Casale, adding it to the new venture’s project mix.

By combining Cerro Casale and Caspiche, Goldcorp believes it can reduce the capital burden to develop the area and eventually generate a better return, Chief Executive Officer David Garofalo said in an interview.

“It will be a long time before we put a shovel in the ground on these properties,” Garofalo said Tuesday by phone. “But if we don’t tuck them into our portfolios and advance them, we’re never going to get them to a point where we actually can make an investment case.”

Goldcorp fell 6 percent to C$20.16 at 1:15 p.m. in Toronto, after tumbling 6.3 percent, the biggest intraday drop since Nov. 10. Barrick declined 1.7 percent and Kinross was down 2.5 percent

(*source Bloomberg)

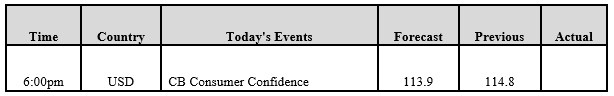

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1251.82 an ounce; with loss of $3.04 or -0.24 percent at 2.00 a.m. Dubai time closing, from its previous close of $1254.86

Spot Gold technically seems having resistance levels at 1259 and 1263.7 respectively, while the supports are seen at $1243.7 and 1238.9 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.19 an ounce; with gain of $0.08 or 0.44 percent at 2.00 a.m. Dubai time closing, from its previous close of $18.11

The Fibonacci levels on chart are showing resistance at $18.26 and $18.45 while the supports are seen at $17.66 and $ 17.47 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply