Precious Metals Market Report

Tuesday 25 July, 2017

Fundamentals and News*

Gold Trades at Highest in Month as Dollar Holds Slump

Gold futures reach the highest since mid-June as the dollar held near the lowest in more than a year before this week’s U.S. Federal Reserve meeting. Silver advances in longest run in 3 years.

Gold for Dec. delivery +0.1% to $1,262.20/oz at 9:32am on Comex in New York

Price earlier reached highest for a most-active contract since June 15

Futures +2.7% last week, most since April 2016

“It’s the weaker dollar overall,” says Bob Haberkorn, a senior market strategist at RJO Futures in Chicago

“After we get through the Fed, you may see more weakness in the dollar, which should help gold”

There’s also the existing “turmoil in Washington“leading to a “flight to quality,” he says. U.S. President Donald Trump’s “agenda is running up against a wall in Congress”

Silver +0.4% at $16.52/oz

Earlier touched highest since July 3

7th daily gain is longest run for most-active contract since June 2014

Trump’s son-in-law and senior adviser Jared Kushner will be interviewed by Senate Intelligence Committee Monday, and Donald Trump Jr. and former Trump campaign Chairman Paul Manafort will go before Senate committees Wednesday

Fed policy decision due Wednesday; no rate change expected

As Fed ponders inflation, bond traders have made up their minds

Dollar slumps as leveraged funds brace for Kushner-event risk

In other precious metals

Platinum little changed at $937.30/oz

Palladium +0.3% to $847/oz

(*source Bloomberg)

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

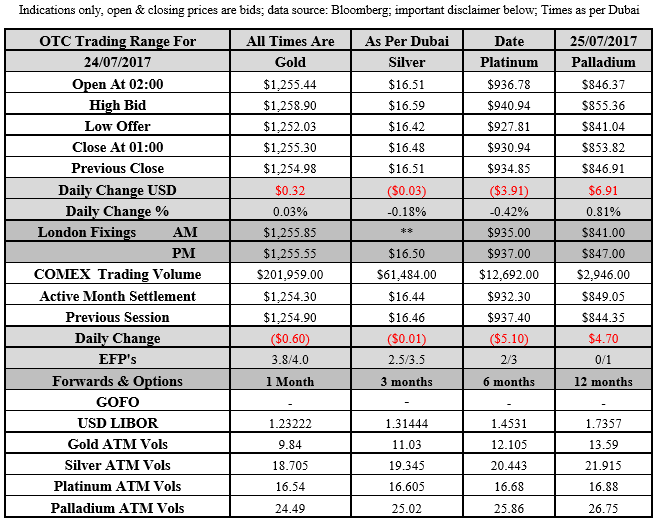

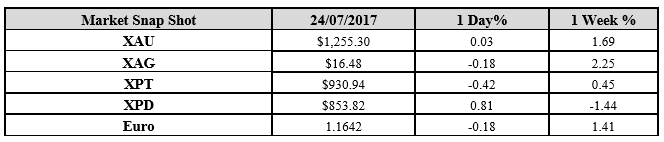

Gold for Spot delivery was closed at $1255.30 an ounce; with little change of $0.32 or 0.03 percent at 1.00 a.m. Dubai time closing, from its previous close of $154.98

Spot Gold technically seems having resistance levels at 1259 and 1265.1 respectively, while the supports are seen at $1239.1 and 1233 respectively.

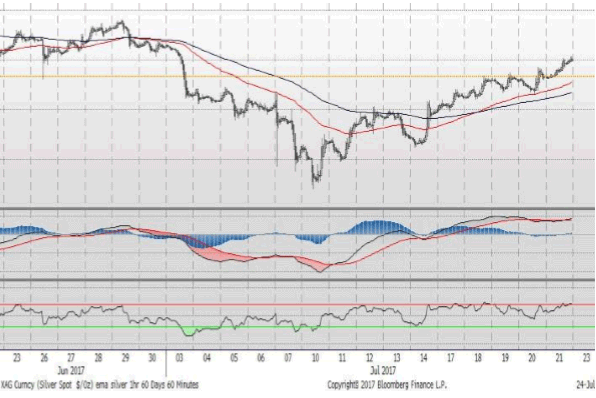

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.48 with gain of $0.03 or 0.18 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.51

The Fibonacci levels on chart are showing resistance at $16.54 and $16.67 while the supports are seen at $16.12and $ 15.99 respectively.

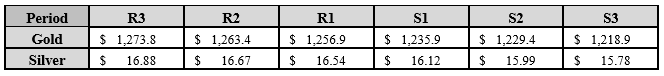

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply