Precious Metals Market Report

Thursday 20 July, 2017

Fundamentals and News*

LME’s Silver Contract Languishes in Second Place as Gold Shines

The London Metal Exchange’s silver contract is off to a slower start than gold.

Silver trading since the contract launched on July 11 has averaged about 782 contracts, compared with about 4,879 for gold, according to data from the exchange. On the Comex in New York, average gold volume is usually 3 times higher than silver.

“Gold had an exceptional start and silver had the more normal start you’d expect to see at a launch,” said Andy Pfaff, chief investment officer of Vanguard Derivatives, a South Africa-based broker. “I wouldn’t write it off over a bad couple of days.”

It’s common for silver trading to be lighter than gold because it’s a smaller market and there’s less demand for the precious metal, often called poor man’s gold. It can be difficult for exchanges to launch new contracts in commodities and recent gold products by CME Group Inc. and Intercontinental Exchange Inc. in Singapore have failed to attract regular trading

We’re not worried about silver, it’s very dependent on market activity and risk appetite,” Kate Eged, head of precious metals at the LME, said by phone on Monday. “Silver’s results probably look worse than they are because we had such a good week in gold.”

Open interest in spot gold was 2,110 contracts, compared with 61 in silver as of Monday.

The LME plans to expand in precious metals by adding futures and options for platinum and palladium by the end of the year.

The activity in the LME’s contracts has attracted other participants including Bernard Sin, head of precious metals trading at refiner MKS (Switzerland) SA, who plans to start trading on the LME. He expects the firm will become a non-clearing participant.

“We want to get on as quickly as we can,” he said by phone from Geneva.

Spot silver rose 0.1 percent to $16.3114 an ounce at 2:26 p.m. in New York, heading for a fourth straight gain, according to Bloomberg generic pricing.

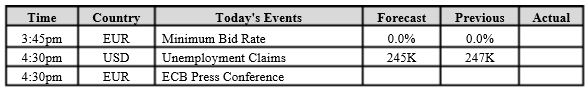

Data – Forthcoming Release

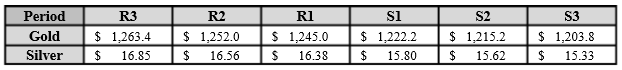

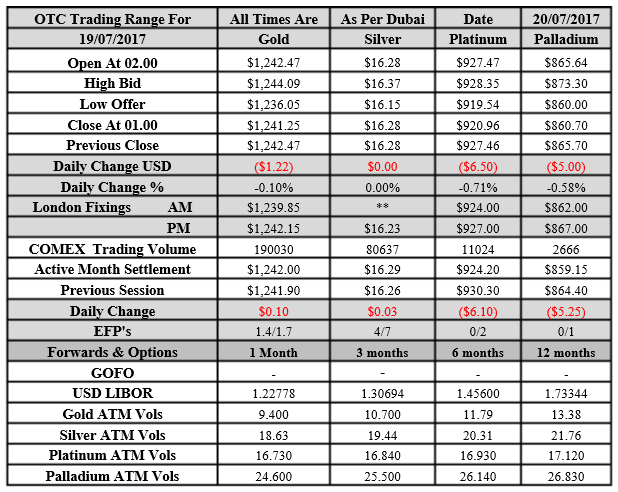

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1241.25 an ounce; with gain of $1.22 or -0.10 percent at 1.00 a.m. Dubai time closing, from its previous close of $1242.47

Spot Gold technically seems having resistance levels at 1245 and 1252 respectively, while the supports are seen at $1222.2 and 1215.2 respectively.

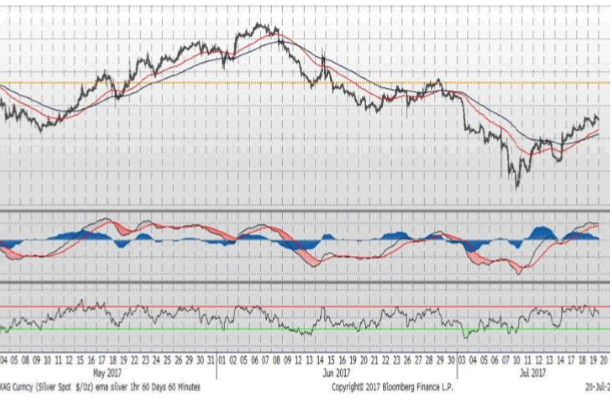

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.28 with gain of $0.00 or 0.0 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.28

The Fibonacci levels on chart are showing resistance at $16.38 and $16.56 while the supports are seen at $15.80 and $ 15.62 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply