Precious Metals Market Report

Wednesday 19 July, 2017

Fundamentals and News*

S&P 500, Nasdaq Composite Hit Records; Gold Climbs

The dollar slid to an 11-month low and U.S. stocks clawed back earlier losses to reach record levels, as President Donald Trump’s economic revitalization agenda once again faltered. European shares dropped amid earnings disappointments, and gold rose to the highest level this month.

The greenback lost ground against all but one of its G-10 peers on signs Trump’s healthcare reform bill is effectively dead in its current form, after two more Republican senators announced their opposition to the plan. Sterling bucked the trend, slipping against the dollar as U.K. inflation unexpectedly slowed in June, while the euro surged ahead of this week’s ECB meeting.

The S&P 500 Index rose slightly to reach an all-time high, while the Nasdaq Composite Index also climbed to a record close. The Stoxx Europe 600 Index fell following a grim earnings report from Ericsson AB. Iron ore futures hit their highest since May on strong demand from Chinese steel mills.

While many traders had already dialed back their expectations Trump will be able to execute his pro-growth policies, the apparent death of the health-care bill lent a risk-off tone to markets. Some notable investors have become less sanguine as global equities continue to trade near record highs.

“Any hopes of dollar support from a successful vote on the Senate’s health-care bill look to be vanishing,” said Rodrigo Catril, a currency strategist at National Australia Bank Ltd. in Sydney. “Near term, the dollar path of least resistance is down. We still think the data — inflation in particular — will provide the Fed with enough ammunition to hike in December and boost the dollar, but this is a fourth-quarter story.”

(*source Bloomberg)

Data – Forthcoming Release

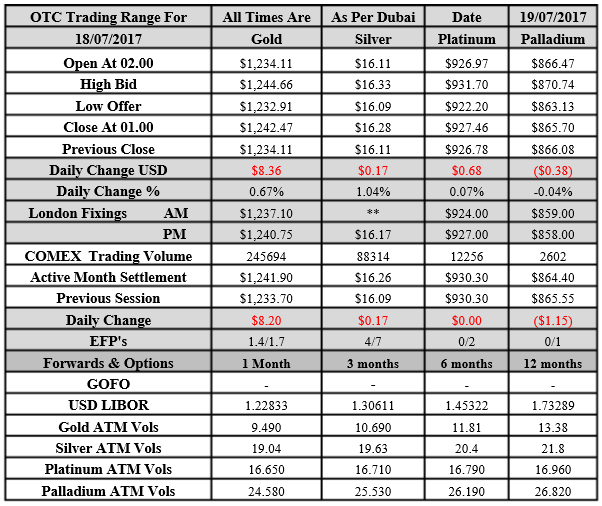

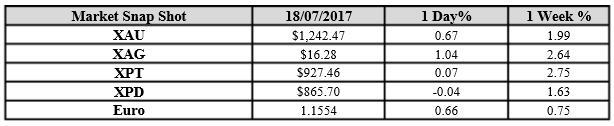

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1242.47 an ounce; with gain of $8.36 or 0.67 percent at 1.00 a.m. Dubai time closing, from its previous close of $1234.11

Spot Gold technically seems having resistance levels at 1245.4 and 1252.8 respectively, while the supports are seen at $1221.7 and 1214.4 respectively.

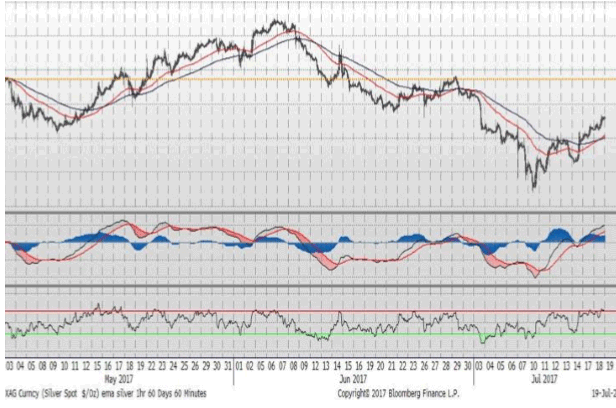

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.28 with gain of $0.17 or 1.04 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.11

The Fibonacci levels on chart are showing resistance at $16.35 and $16.52 while the supports are seen at $15.80 and $ 15.63 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply