Precious Metals Market Report

Tuesday 18 April, 2017

Fundamentals and News*

Sibanye Gets U.S. Security Nod to Buy Stillwater Mines (2)

The U.S. cleared the sale of the country’s sole provider of platinum and palladium to a miner whose biggest investor is Chinese, providing the first indication that the Trump administration’s tough talk on China won’t necessarily translate into blocking Beijing-linked deals.

Sibanye Gold Ltd.’s $2.2 billion deal to purchase Colorado-based Stillwater Mining Co. will go ahead after the companies received notice from the Committee on Foreign Investment in the U.S., known as CFIUS, that the tie-up posed no unresolved national security issues, Stillwater said Monday in astatement.

Sibanye also confirmed the news. “We are obviously very pleased to have received CFIUS approval and, now that all regulatory conditions have been met, look forward to the shareholder vote on 25 April 2017,” James Wellsted, a spokesman, said in an email Monday.

The transaction won approval despite President Donald Trump’s criticism of China’s trade practices. In addition to its Chinese ownership, Stillwater is the sole U.S. source of platinum and palladium, materials that the Defense Department regards as strategic. Its Montana operations are also about 200 miles (322 kilometers) from Malmstrom Air Force Base, which maintains and operates part of the country’s nuclear arsenal.

The rally that’s made the rupee Asia’s best performer in the past three months is threatened as the Indian currency enters a seasonally weak period.

The rupee has declined in each of the last seven April-June quarters, with its performance often marred by a periodic increase in India’s gold demand. This time, rising Brent crude prices are also seen weighing down the currency. Asia’s third-largest economy is the world’s second-biggest buyer of the precious metal and relies on imports for about three quarters of its oil needs.

“Gold prices are going up, plus we expect oil prices to stay firm, which may put pressure on India’s current account,” said Vishnu Varathan, a senior economist at Mizuho Bank Ltd. in Singapore. Broad dollar strength — due to a weaker euro and geopolitical risks — will weigh on the rupee, he said.

(*source Bloomberg)

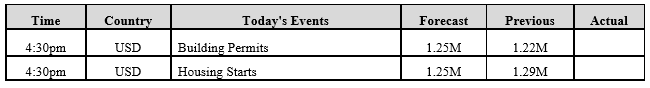

Data – Forthcoming Release

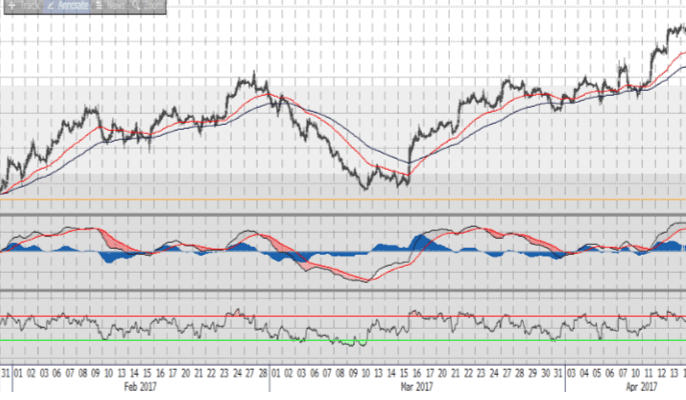

Technical Outlook and Commentary: Gold

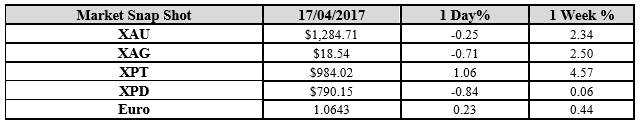

Gold for Spot delivery was closed at $1284.71 an ounce; with loss of $3.21 or 0.25 percent at 1.00 a.m. Dubai time, from its previous close of $1287.92

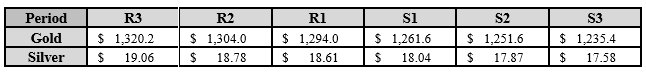

Spot Gold technically seems having resistance levels at 1294 and 1304 respectively, while the supports are seen at $1261.6 and 1251.6 respectively.

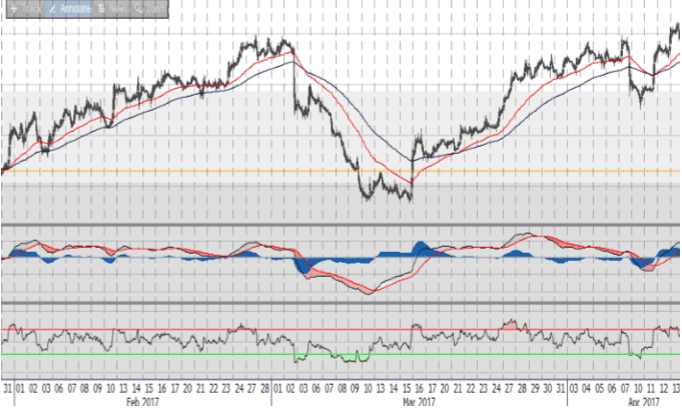

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.41 an ounce; with loss of 0.13 cent or -0.71 percent at 1.00 a.m. Dubai time, from its previous close of $18.54

The Fibonacci levels on chart are showing resistance at $18.61 and $18.78 while the supports are seen at $18.04 and $ 17.87 respectively.

Resistance and Support Levels

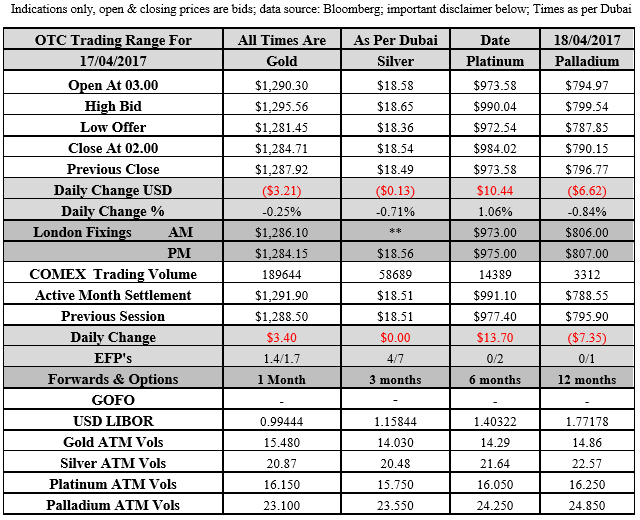

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply