Precious Metals Market Report

Monday 17 April, 2017

Fundamentals and News*

$1,400 Gold Resistance May Be the New $1,300

Gold looks poised to stake its claim again as the asset-class performance leader. It withstood a substantial U.S. dollar rally in the run-up to the current Federal Reserve rate-tightening cycle that’s pressuring the greenback. Gold’s other key adversary — the stock market — is entering the time of year where it often underperforms, and may be due for some return to normalization as euphoria over the Trump administration subsides. The VIX volatility 26-week average is near the lowest since pre-crisis 2008.

Gold and the S&P 500 total return are both up almost 20% to April 11 in the current ratetightening cycle. If stocks stall or decline, rate hikes could too — an additional support factor for gold. Declining bond yields despite increasing rates could signal no more rate hikes

Down about 10 bps in 2017 and 5 bps in the current rate-tightening cycle, declining U.S. 30-year bond yields may be the canary in the coal mine that supports gold prices. Decreasing bond yields indicate reduced inflation expectations. Despite Federal Reserve rate tightening and warnings of reduced Fed bond holdings, sustained lower yields are a substantial statement of bond-price strength. Bond yields and one-year federal funds rate expectations were close companions until year-end 2016, but have diverged in 2017.

The divergence comes as yields decline and rate expectations have increased. This trend is unsustainable, but could last until one side gives. Left by the wayside for the past few years, U.S. Treasury long bonds are a good longer-term, highly sensitive indicator of U.S. inflation

If gold can hold its own despite a 20% rally in the U.S. Dollar Spot Index and 38% jump in the S&P 500 since the start of 2014, it should perform well when its traditional adversaries falter. Toppish activity appears clear in the dollar, down 3.3% in 2017 despite the U.S. interest-rate cycle well on its way. With a beta of minus 1.2x to the dollar in the past 10 years, gold should be a prime beneficiary if the dollar is done rallying.

Historically zero-correlated to the stock market, the relationship to gold is likely to be much more negative in the near future. A declining stock market is a prime factor to reduce rate-hike expectations and thus the dollar’s value, supporting gold and silver, as occurred in 1Q16.

(*source Bloomberg)

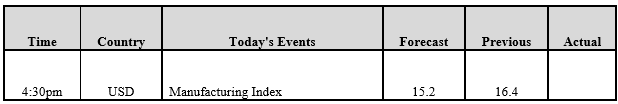

Data – Forthcoming Release

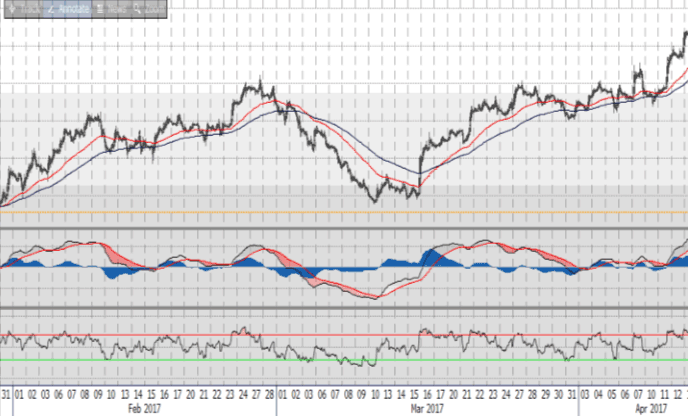

Technical Outlook and Commentary: Gold

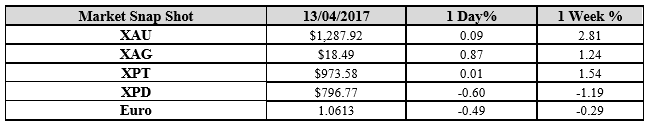

Gold for Spot delivery was closed at $1287.92 an ounce; with gain of $1.14 or 0.09 percent at 1.00 a.m. Dubai time, from its previous close of $1286.78

Spot Gold technically seems having resistance levels at 1290.4 and 1300.2 respectively, while the supports are seen at $1258.8 and 1249 respectively.

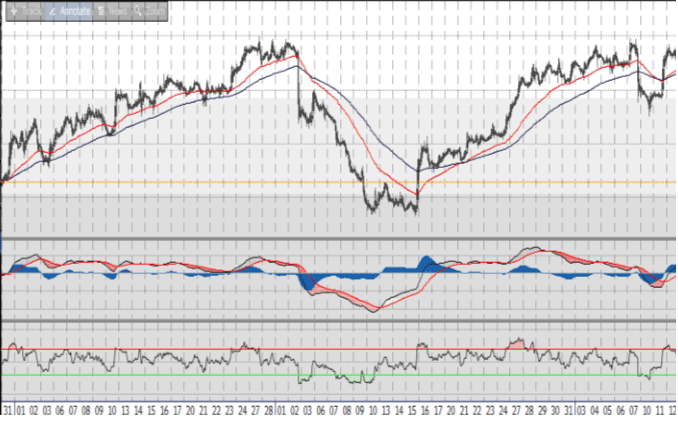

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.54 an ounce; with gain of 16 cent or 0.87 percent at 1.00 a.m. Dubai time, from its previous close of $18.49

The Fibonacci levels on chart are showing resistance at $18.61 and $18.81 while the supports are seen at $17.95 and $ 17.75 respectively.

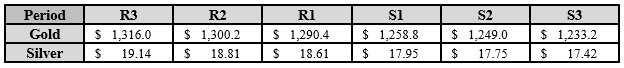

Resistance and Support Levels

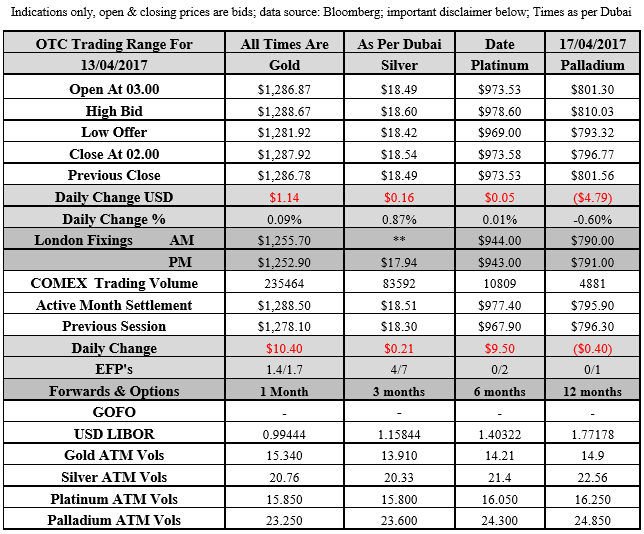

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply