Precious Metals Market Report

Wednesday 16 August, 2017

Fundamentals and News*

Gold Posts Biggest Loss in Five Weeks as Dollar Rises

Gold futures fall, the largest loss in five weeks as the dollar rallied, while tensions between U.S. and North Korea moved off center stage, curbing demand for haven assets.

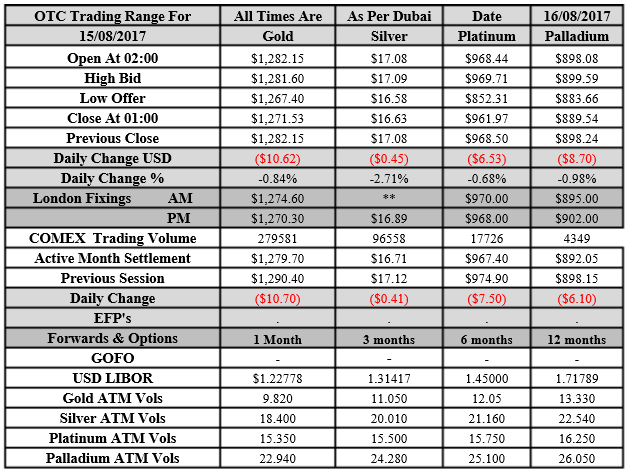

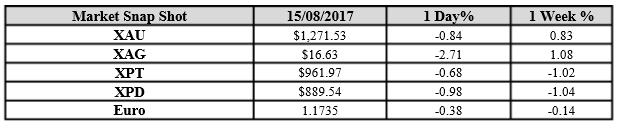

Bullion for delivery in Dec. -0.8% to settle at $1,279.70/oz at 1:44pm on Comex in N.Y., the biggest decline since July 7

A report by Korean Central News Agency said Kim Jong Un will watch the U.S.’s conduct “a little more,” signaling fading risks of a threatened missile attack on Guam

“The firmer dollar is weighing on gold, as is the declining risk aversion now that tensions between North Korea and the U.S. have eased somewhat,” Commerzbank AG analysts including Eugen Weinberg say in note

NOTE: Dollar Extends Gain as Yen Slides Amid Improving Risk Appetite Gold heading toward $1,200 in weeks on dollar recovery; Fed seen raising rates more than markets expect: ABN

NOTE: Fed’s Dudley Says He Still Favors Another Rate Hike in 2017

Gold ETF holdings tracked by Bloomberg jumped 0.3 percent Monday, biggest increase since end-June

Gold Miners

gauge of 15 large global gold producers tracked by Bloomberg Intelligence -1.5%; Losers include Harmony Gold Mining, Sibanye Gold and Randgold Resources

Druckenmiller sold his whole stake in Barrick Gold in second quarter

Other precious metals futures

Silver futures, down 2.4%, biggest loss since July 7 on Comex

Platinum, palladium slump on N.Y. Mercantile Exchange Gold drops for second day as tensions between U.S. and North Korea subside, reducing appeal of haven assets, and as Federal Reserve Bank of New York chief William Dudley signals he still favors another interest rate increase this year, which boosted dollar and Treasury yields.

(*source Bloomberg)

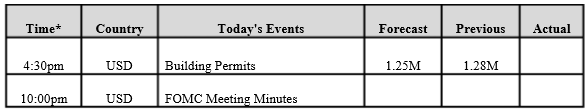

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1282.15 an ounce; with loss of $10.62 or -0.84 percent at 1.00 a.m. Dubai time closing, from its previous close of $1271.53

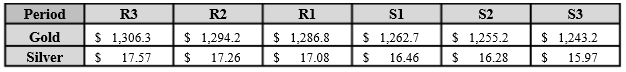

Spot Gold technically seems having resistance levels at 1286.8 and 1284.2 respectively, while the supports are seen at $1262.7 and 1255.2 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.63 with LOSS of $0.45 or -2.71 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.08

The Fibonacci levels on chart are showing resistance at $17.08 and $17.26 while the supports are seen at $16.46 and $ 16.28 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply