Precious Metals Market Report

Wednesday 15 March, 2017

Fundamentals and News

Distressed Gold Bulls May Find Solace in Fed Rates Record

Investors betting that this year’s gold rally will falter as the Federal Reserve raises U.S. interest rates may want to consider recent history.

While gold’s rally has sputtered this month amid concern that higher borrowing costs curb the appeal of non-interest-bearing assets, the metal fared well in earlier rounds of rate increases. Gold gained 52 percent in the June 2004 to June 2006 tightening cycle, when the Fed raised rates to 5.25 percent from 1 percent. It rose 5 percent from June 1999 to May 2000, when borrowing rates climbed to 6.5 percent from 4.75 percent.

One reason for the gains: The Fed tightens monetary policy when it’s concerned about inflation, and that’s a good environment for gold, which is often used as a hedge against rising prices, said Mike McGlone, a Bloomberg Intelligence strategist. Some investors also see value in the sell-off amid concern about fallout from Brexit, Europe’s elections and U.S. President Donald Trump’s trade policies, which could underpin demand for haven assets.

“There’s a decent amount of negative short-term sentiment expressed in the gold asset class, which may present an opportunity from a longer-term investment standpoint,” said Joe Wickwire, who oversees the $1.5 billion Fidelity Select Gold Portfolio fund at Fidelity Investments in Boston. “If you have ongoing friction between different countries, that’s going to be a double-check for the gold price.”

Gold capped the biggest weekly loss since November on Friday, cutting this year’s gains to about 5 percent. Investors bailed as data showing solid U.S. jobs growth fueled speculation that the Fed will boost rates at least three times this year.

The metal touched a 10-month low on Dec. 15, a day after the Fed raised rates and forecast a steeper path for borrowing costs in 2017. Prices rose as much as 13 percent from that level by late February, only to slip again with renewed concerns over the Fed rate outlook.

“While these short-term adjustments are painful, once we’re through that period we will go back to start normalizing again,” said Dan Denbow, money manager at the $600 million USAA Precious Metals & Minerals Fund in San Antonio. “Gold is more likely to go up than down.”

Gold should again strengthen “convincingly” after the Fed’s March meeting,Wayne Gordon, commodities, rates and FX strategist at UBS Group AG’s wealth management unit, said in a note to clients March 13. The metal should “move higher as real yields fall back and the first round of the French presidential election triggers new uncertainties.”

He has a 12-month price target of $1,300 an ounce for gold. The metal fell 0.5 percent to $1,198.15 at 4:23 p.m. Tuesday in New York.

(*source Bloomberg)

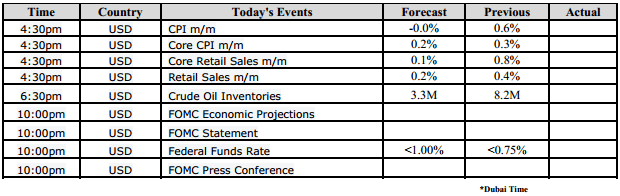

Data – Forthcoming Release

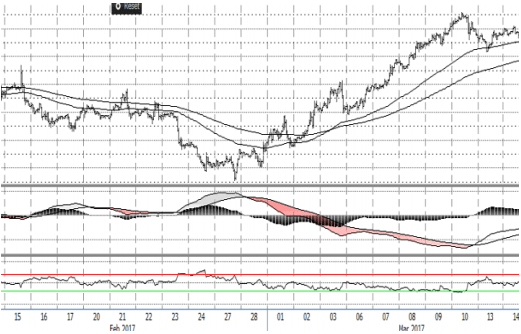

Technical Outlook and Commentary: Gold

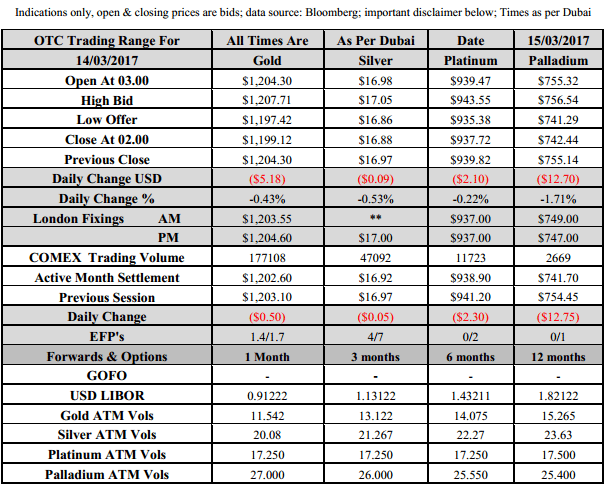

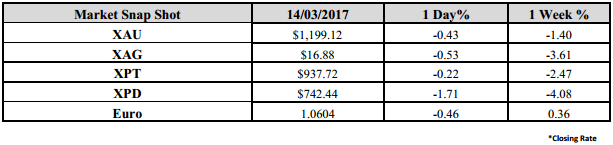

Gold for Spot delivery was closed at $1199.12 an ounce; with loss of $5.18 or 0.43 percent at 2.00 a.m. Dubai time closing, from its previous close of $1204.3

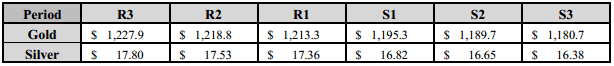

Spot Gold technically seems having resistance levels at 1213.3 and 1218.8 respectively, while the supports are seen at $1195.3 and 1189.7 respectively.

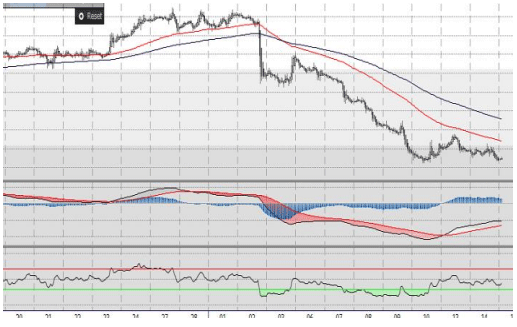

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.96 an ounce; with loss of $0.09 or 0.53 percent at 2.00 a.m. Dubai time closing, from its previous close of $16.97

The Fibonacci levels on chart are showing resistance at $17.36 and $17.53 while the supports are seen at $16.82 and $ 16.65 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply