Precious Metals Market Report

Tuesday 13 June, 2017

Fundamentals and News*

Gold and Fed Tightening, Good Companions

Gold appears increasingly favored in this Federal Reserve rate-tightening cycle. Neck and neck with stocks and crude oil since the first rate increase, gold should have a tailwind with this week’s expected quarter-point hike by the Fed, if history is a guide. Gold opponents may have more headwinds. The CBOE Volatility Index (VIX) has rarely stayed lower for longer. Crude oil, which is rebalancing and due for a recovery from the lower end of the range, should have limited upside with oversupply.

Higher stocks are more likely to increase the Fed’s tightening resolve. Since crude futures began trading in 1983, a rate-hike cycle has never been sustained with Treasury bond yields and oil in decline. They’re both trending down in 2017, which likely needs to shift for gold to be pressured.

If the trend of the current interest-rate tightening cycle is sustained, gold should bottom within a few days of June 14’s FOMC meeting. March 14, the day before the last increase, was when spot gold last marked less than $1,200 an ounce ($1,199). The six-year low of $1,051 was on Dec. 17, 2015 — the day after the first hike this cycle. Gold bottomed six days after the second rate increase (Dec. 14, 2016). What’s different this time is that gold isn’t at a healthy discount to its 250-day moving average.

“Sell the rumor, buy the fact” mean reversion appears at play in the gold price-to-rate hike relationship. Increasing gold and a declining dollar appear to be anticipating a tightening endgame, or some inflation — both gold-supportive. Gold and stocks may be ripe to shift to a negative correlation.

Gold and crude oil may be set to break from stocks in this interest-rate tightening cycle’s spotperformance race.

Since the first rate increase, the S&P 500 Index, spot gold and front crude oil futures are all up about 20% through June 9. Gold will likely have a rate hike in the rearview mirror this week, typically a support factor. Looking ahead, stock-market volatility is near the highest risk of mean reversion since the inception of the CBOE Volatility Index (VIX) in 1990, based on its 26-week moving average.

(*source Bloomberg)

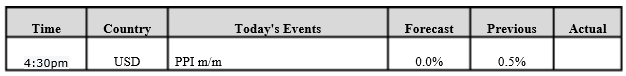

Data – Forthcoming Release

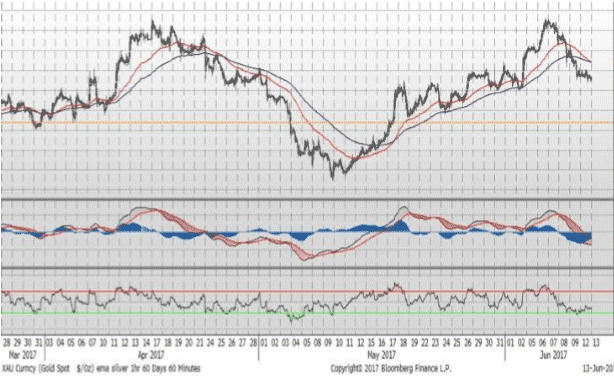

Technical Outlook and Commentary: Gold

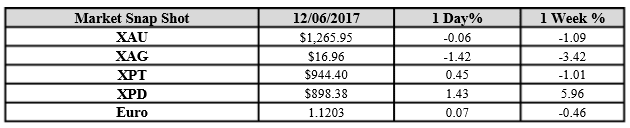

Gold for Spot delivery was closed at $1265.95 an ounce; with loss of $0.81 or 0.06 percent at 1.00 a.m. Dubai time closing, from its previous close of $1266.76

Spot Gold technically seems having resistance levels at 1287.7 and 1295.3 respectively, while the supports are seen at $1262.9 and 1255.2 respectively.

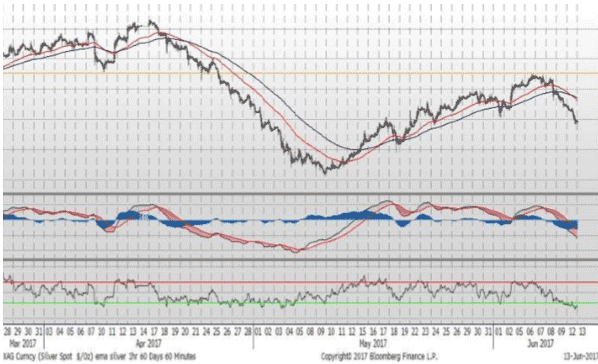

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.96 with loss of $0.24 or -1.42 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.20

The Fibonacci levels on chart are showing resistance at $17.53 and $17.73 while the supports are seen at $16.89 and $ 16.69 respectively.

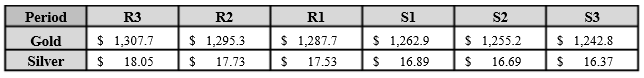

Resistance and Support Levels

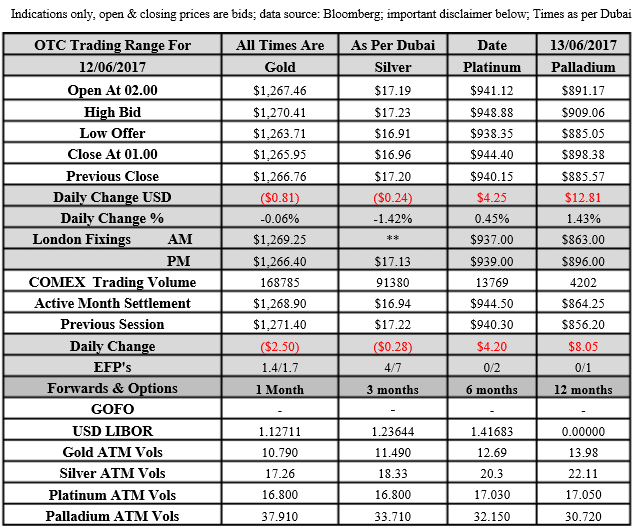

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply