Precious Metals Market Report

Thursday 13 July, 2017

Fundamentals and News*

Gold Near Four-Month Low as Yellen Testimony Awaited

Gold holds near lowest level in almost four months as investors await testimony from Federal Reserve Chair Janet Yellen, which starts Wednesday, for further clues on the central bank’s monetary policy tightening path.

Bullion for immediate delivery -0.3% to $1,210.79/oz by 1:17pm in Singapore; after touching $1,204.90 on Monday, lowest intraday level since March 15: Bloomberg generic pricing

Bloomberg Dollar Spot Index +0.1%

Yellen delivers semi-annual Monetary Policy Report to the House Financial Services Committee on Wednesday and to the Senate Banking Committee on Thursday

Though no longer the market-mover it was once was, Yellen’s statement and the Q&A will be keenly watched, analysts at Macquarie Wealth Management write in emailed note received Tuesday

U.S. inflation data due Friday is also important as recently both headline and core inflation have undershot: Macquarie

“For gold the current backdrop is unhelpful,” report says. “A global recovery, without inflation, but still prompting tighter policy, is just about the worst scenario. We don’t think it will last, but while it does, gold is vulnerable”

In Hong Kong and Shanghai:

Hong Kong Exchanges and Clearing launched first deliverable gold futures contracts on Monday, denominated in offshore yuan and USD, with total volumes exceeding 3,000 contracts on 1st day o Futures for 1 kilogram gold bars of 99.99% purity for August delivery trades at 265.65 yuan/gram on HKEX

Silver for Dec. touched 3,666 yuan/kg, lowest intraday level since June 2016, before trading +1.7% to 3,732 yuan on Shanghai Futures Exchange

(*source Bloomberg)

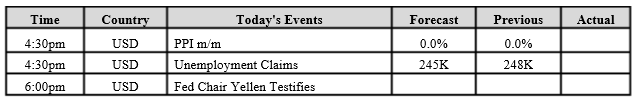

Data – Forthcoming Release

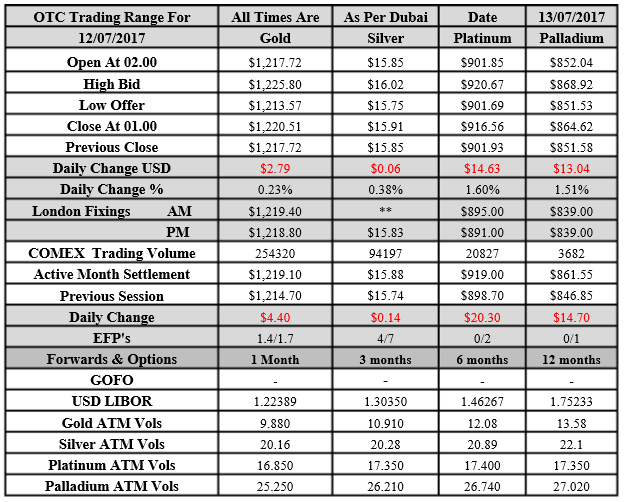

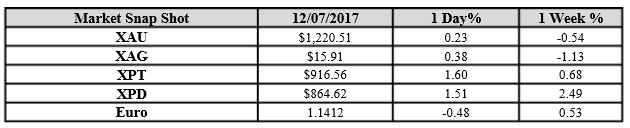

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1220.51 an ounce; with gain of $2.79 or 0.23 percent at 1.00 a.m. Dubai time closing, from its previous close of $1217.22

Spot Gold technically seems having resistance levels at 1227.6 and 1233.3 respectively, while the supports are seen at $1209.1 and 1203.3 respectively.

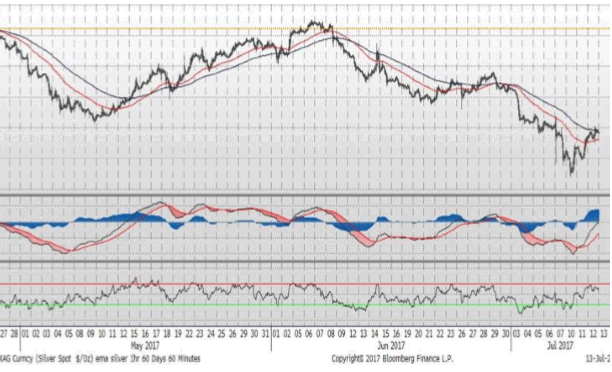

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $15.91 with gain of $0.06 or 0.38 percent at 1.00 a.m. Dubai time closing, from its previous close of $15.85

The Fibonacci levels on chart are showing resistance at $16.13 and $16.37 while the supports are seen at $15.38 and $ 15.14 respectively.

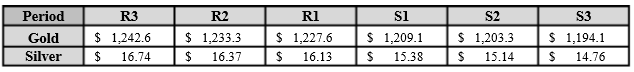

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply