Precious Metals Market Report

Thursday 13 April, 2017

Fundamentals and News*

Political Risks Push Gold to Five-Month High on Haven Demand

Concerns about rising global tensions surrounding Syria and North Korea are revitalizing demand for gold as a haven, with the metal trading near the highest since Donald Trump was elected U.S. president.

Bullion touched a five-month high Wednesday. A standoff between the U.S. and Russia after an American missile strike on Syria and Trump’s pledge to solve the North Korean “problem” with or without China have deepened concerns about political stability. There are also signs that Russia and the U.S. are increasingly at odds over Afghanistan.

The metal slumped after Trump’s election on his promises of tax cuts and more infrastructures spending, but rebounded since mid-December amid worries about the unpredictability of his presidency. While gold may extend gains in the next few weeks, better U.S. data and higher real interest rates will then push prices lower, Goldman Sachs Group Inc. said.

Trump “did it again,” David Govett, head of precious metals trading at Marex Spectron Group in London, said by email. “Just continue to hold gold as a hedge against all this uncertainty, but be very aware that if diplomats can reach agreements, the price will fall back again.”

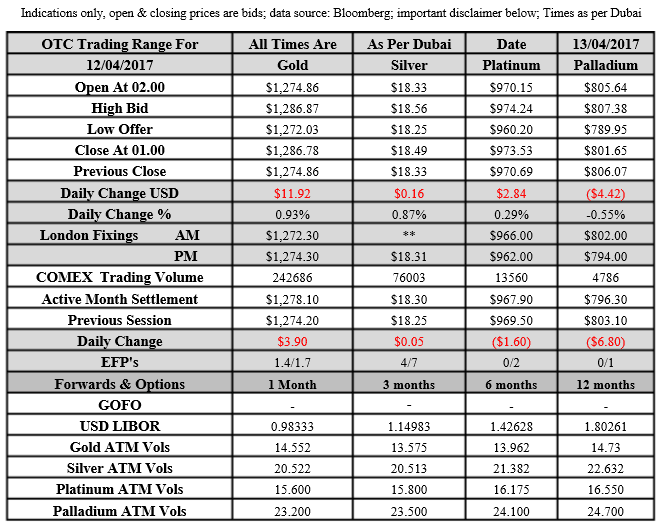

Gold futures for June delivery gained 0.3 percent to settle at $1,278.10 an ounce at 1:39 p.m. on the Comex in New York, after touching $1,281.80, the highest for a most-active contract since Nov. 10. On Tuesday, the price closed above its 200-day moving average for the first time since November.

The U.S. said evidence showed Syria was behind a chemical attack on civilians, and Secretary of State Rex Tillerson urged Russia to abandon its support of Syrian President Bashar al-Assad’s regime. America has moved a naval battle group closer to North Korea amid fears it may conduct a nuclear or missile test, and the Asian country warned of a nuclear strike if provoked.

The uncertainty is supporting physical demand for gold, with holdings in SPDR Gold Shares, the largest exchange-traded fund backed by gold, rising 4.2 metric tons to 842.4 tons as of Tuesday. That’s the highest in more than a month.

Goldman remains cautions. While a further unwinding of Trump-related equity trades and geopolitical risks may push prices higher in the next few weeks, the metal will retreat to $1,200 in three and six months, it said in a report dated Wednesday.

In other precious metals:

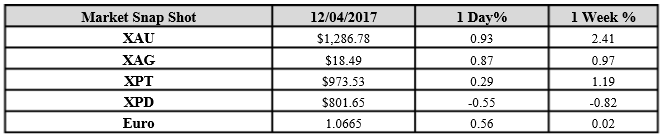

Silver futures also rose on the Comex, while platinum and palladium declined on the New York Mercantile Exchange.

(*source Bloomberg)

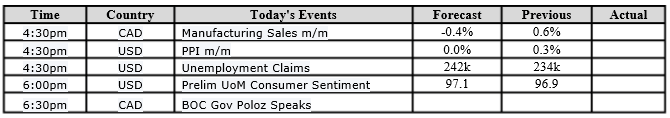

Data – Forthcoming Release

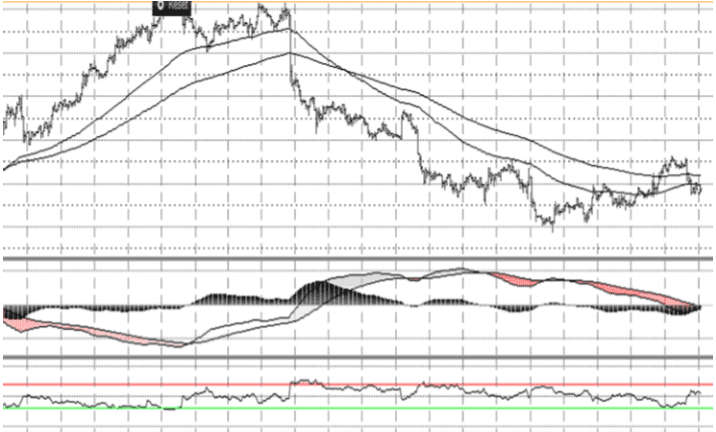

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1286.78 an ounce; with gain of $11.92 or 0.93 percent at 1.00 a.m. Dubai time, from its previous close of $1274.86

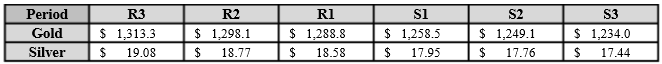

Spot Gold technically seems having resistance levels at 1288.8 and 1298.1 respectively, while the supports are seen at $1258.5 and 1249.1 respectively.

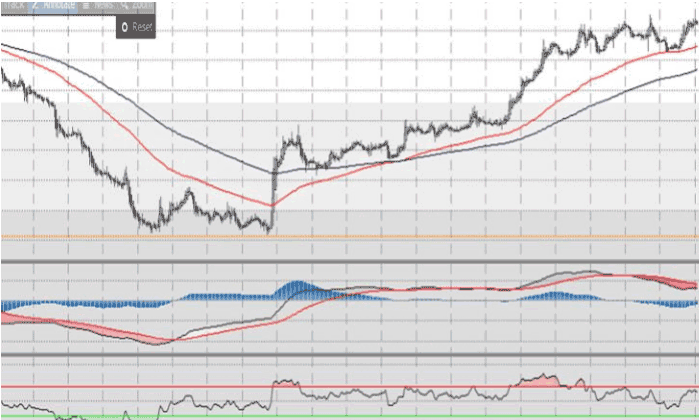

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.49 an ounce; with gain of 16 cent or 0.87 percent at 1.00 a.m. Dubai time, from its previous close of $18.33

The Fibonacci levels on chart are showing resistance at $18.58 and $18.77 while the supports are seen at $17.95 and $ 17.76 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply