Precious Metals Market Report

Monday 10 July, 2017

Fundamentals and News*

Gold Buyers Fleeing a Month After Their Most Bullish Bet of 2017

A month ago, money managers were the most optimistic on gold this year. Now, they can’t seem to unload bullion fast enough.

Hedge funds’ net-long positions, or the difference between bets on a price increase and wagers on a decline, fell last week by more than half, the biggest reduction since 2015. Exchange-traded products backed by precious metals saw cash outflows over the past month, while most other commodity funds took in more investor money. Total assets in SPDR Gold Shares, the world’s top bullion ETF, fell to the lowest since March last week.

Even with signs of escalating geopolitical tensions — often a spur for buying gold as a haven — prices that reached an almost seven-month high in June have now dropped for five straight weeks, the longest slump this year. Investors are exiting in part because the Federal Reserve and other central banks are indicating more interest-rate increases, which can curb the appeal of gold because the metal pays no interest.

“I struggle to make a particularly bullish case on gold,” said Rob Haworth, a senior investment strategist at U.S. Bank Wealth Management, which oversees $145 billion in assets. “We think the Fed is on track and continuing to increase rates, and I think that puts a lid on gold.”

The net-long position in gold futures and options dropped 51 percent to 37,776 futures and options for the week ended July 3, according to the Commodity Futures Trading Commission data released four days later. It was the least-bullish holding since January. As recently as June 6, the holdings were at 174,658, the most since November. Short positions, or bets on price declines, surged 31 percent to the highest since January 2016.

Futures traded on the Comex in New York fell 2.6 percent last week to $1,209.70 an ounce on Friday, marking the longest streak of weekly declines since December. Prices rose 7.9 percent through the first half of this year amid uneven economic growth in the U.S. and geopolitical tensions such as Brexit and the French election. The metal was also aided by speculation that the world’s central banks would remain ready to prop up economic growth.

(*source Bloomberg)

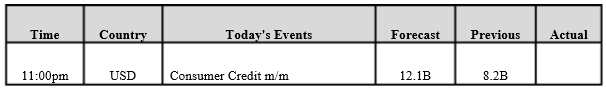

Data – Forthcoming Release

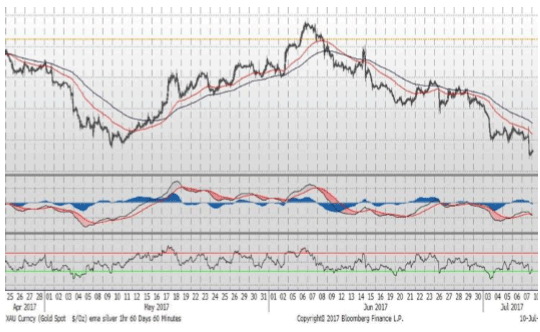

Technical Outlook and Commentary: Gold

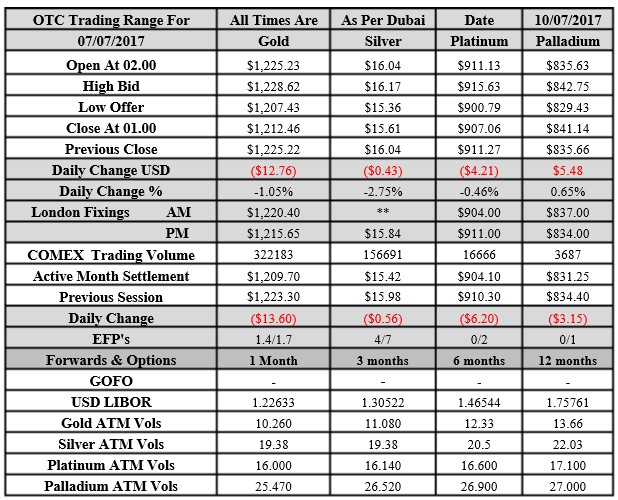

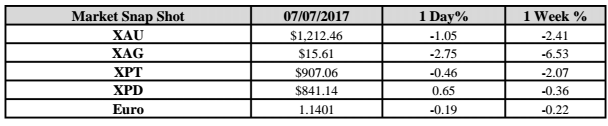

Gold for Spot delivery was closed at $1212.46 an ounce; with loss of $12.75 or -1.05 percent at 1.00 a.m. Dubai time closing, from its previous close of $1225.22

Spot Gold technically seems having resistance levels at 1234.4 and 1242.8 respectively, while the supports are seen at $1207.4 and 1199 respectively.

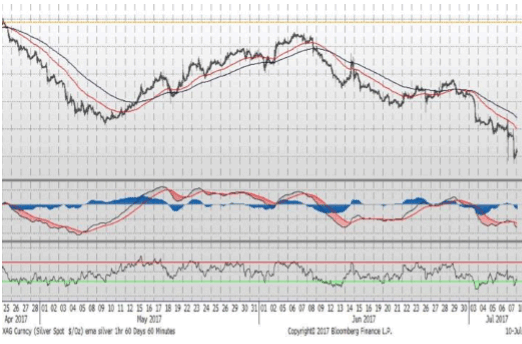

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $15.61 with loss of $0.43 or -2.75 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.04

The Fibonacci levels on chart are showing resistance at $16.37 and $16.67 while the supports are seen at $15.38 and $ 15.08 respectively.

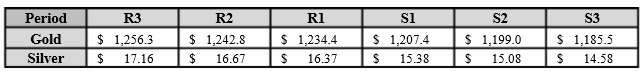

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply