Precious Metals Market Report

Thursday 04 May, 2017

Fundamentals and News*

Bonds Slip with U.S. Stocks as Fed Lifts Dollar: Markets Wrap

FOMC leaves rates unchanged, sees inflation near target

The dollar rose along with U.S. Treasury yields after the Federal Reserve signaled it’s looking past a recent deceleration in economic growth. The Aussie held losses as materials producers were hit by a slump in industrial metals.

Australian equity futures pointed lower, while markets in Hong Kong and South Korea are due to reopen after holidays. Ten-year Treasury yields rose above 2.30 percent and the greenback advanced against major peers after the Fed reiterated plans for gradual interest-rate increases despite last quarter’s slowdown. Facebook Inc. shares fell in after-hours U.S. trading on concern about its sales growth.

Fed Chair Janet Yellen and at least five other central bank officials are scheduled to speak on Friday, giving policy makers a chance to explain their decision more fully.

A U.S. report Wednesday showed private payroll gains slowed in April, ahead of Friday’s key official employment report amid concern around the U.S. economy’s tepid start to the year. The next hurdle for investors to clear is the French presidential election on Sunday. A disjointed trading week for Asian markets sees Japan’s stocks remaining closed until Monday.

Here are key upcoming events and data releases due:

Brexit talks begin, the European Union is expected to publish legislative proposals on Thursday that would force London’s euro clearing operations to either accept EU oversight or relocate to the continent.

Voters in France go to the polls on Sunday for the second round of presidential elections.

Companies scheduled to release earnings this week include: HSBC Holdings Plc, Time Warner Inc., and Royal Dutch Shell Plc.

The yen was little changed at 112.72 per dollar as of 8:33 a.m. in Sydney, after declining 0.7 percent Wednesday. The Bloomberg Dollar Spot Index rose 0.4 percent Wednesday, while yields on 10-year Treasuries rose four basis points to 2.32 percent.

Futures on the S&P 500 Index were little changed after the underlying gauge slid 0.1 percent Wednesday. The Stoxx Europe 600 Index closed little changed.

Futures on Australia’s S&P/ASX 200 Index lost 0.1 percent.

The Aussie traded at 74.29 U.S. cents, having slumped 1.5 percent against the dollar Wednesday

(*source Bloomberg)

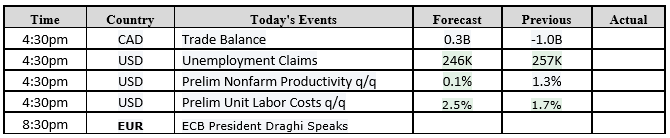

Data – Forthcoming Release

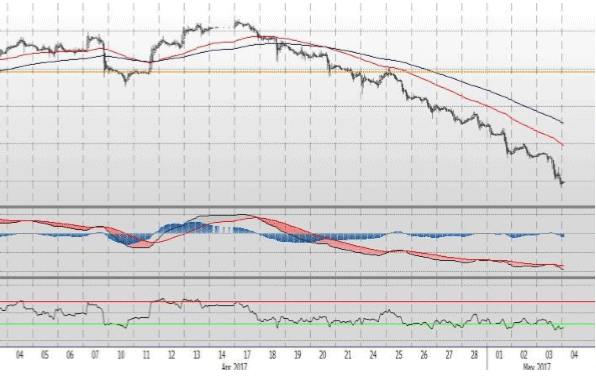

Technical Outlook and Commentary: Gold

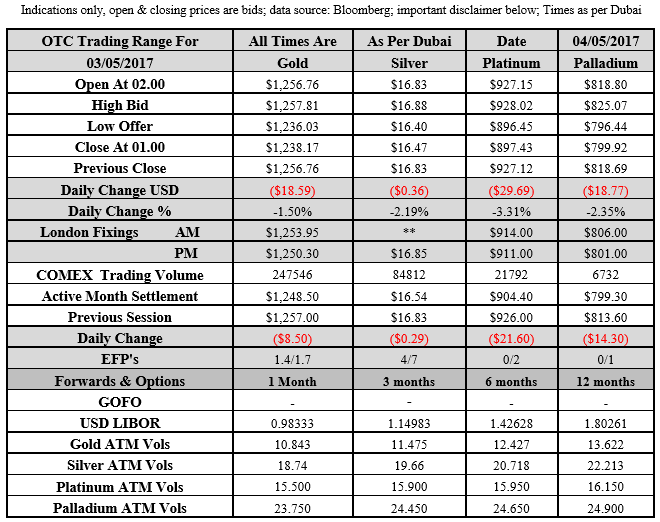

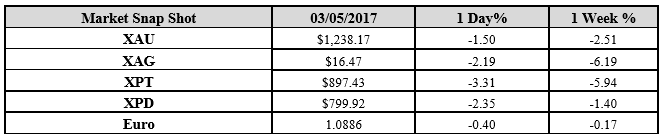

Gold for Spot delivery was closed at $1238.17 an ounce; with loss of $18.59 or 1.50 percent at 1.00 a.m. Dubai time closing, from its previous close of $1256.76

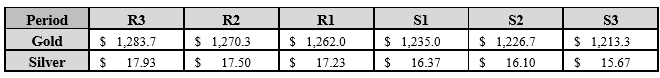

Spot Gold technically seems having resistance levels at 1262.0 and 1270.3 respectively, while the supports are seen at $1235.0 and 1226.7 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.47 with loss of $0.36 or -2.19 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.83

The Fibonacci levels on chart are showing resistance at $17.23 and $17.50 while the supports are seen at $16.37 and $ 16.10 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply