Gold Prices at 200-Day Moving Average as US Fed Meets on Rates

Bullion.Directory precious metals analysis 03 May, 2017

Bullion.Directory precious metals analysis 03 May, 2017

By Adrian Ash

Head of Research at Bullion Vault

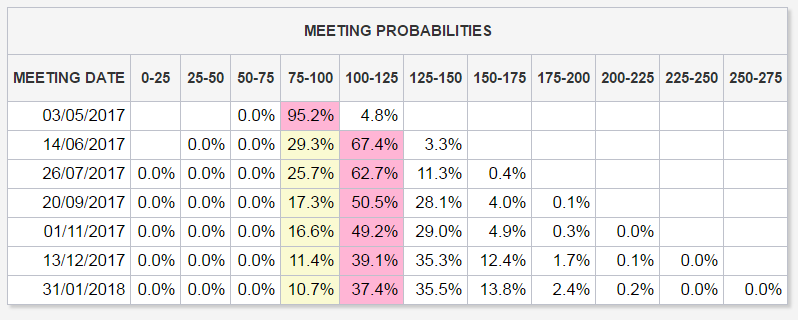

Widely expected to start slowly winding down its $4 trillion of QE asset purchases later this year, the Fed will today leave rates unchanged according to 95% of all bets on CME interest-rate futures.

Over two-thirds of CME rates bets on next month’s decision, in contrast, see the Fed making its second rate hike of 2017 and its fourth hike since moving off zero in December 2015.

>Gold priced in Dollars has risen by one-fifth since then – exactly the same gain as the S&P500 index of US-listed equities.

“Gold is trading virtually unchanged at $1255 per troy ounce this morning,” says the daily commodities note from German financial services group Commerzbank, “which leaves it right on the technically important 200-day moving average.”

“Which way the gold price will go in the near future will no doubt depend mainly on the interest rate outlook indicated by the US Federal Reserve [in its ‘no change’ statement] this evening.”

Current betting sees only a 1-in-8 chance that the Fed will raise rates another 3 times before the end of 2017, thereby meeting the policy committee’s own New Year forecast.

“Should we see any surprises from the Fed push gold below the 200-day moving average,” says Swiss refiner MKS Pamp’s trader Sam Laughlin to Reuters, ” expect the next target on the down-side to sit around $1230-35.

“Risks surrounding the upcoming French election should temper declines.”

Gold priced in the single Euro currency today slipped to €1147 per ounce, dropping to late-March levels and down more than 6% from mid-April’s 8-month high, reached before the first round of the French presidential election saw anti-Euro candidate Marine Le Pen come second to new centrist party En Marche’s Emmanuel Macron, whom she now faces in Sunday’s final vote.

Fresh wrangling between Westminster and Brussels over the terms of reference for the UK-EU Brexit negotiations meantime saw the Pound continue to rally against the Euro, also pushing the gold price in Sterling down below £970 for the first time since February.

Gold prices in China – the world’s No.1 consumer nation – slipped overnight but again held above ¥280 per gram overnight in Shanghai, trading at levels last seen before start-April’s Ching Ming festival holidays.

Gold sales in No.2 consumer India meantime rose 30% last week from the same festive gold-buying season of Akshaya Tritiya last year, according to retailers quoted by local media.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply