Precious Metals Market Report

Wednesday 03 May, 2017

Fundamentals and News*

Gold Resurrected as Commodities Wilt in First 100 Days of Trump

Commodity markets that celebrated Donald Trump’s election in November are showing signs of fatigue after the U.S. president’s first 100 days in office. Following an 11 percent surge in 2016, the Bloomberg Commodity Index has slipped since Trump’s inauguration, with every sector except precious metals showing declines.

Initially, raw materials used in construction surged as Trump reiterated a pledge to set in motion $1 trillion in infrastructure spending. Other pro-growth policies such as tax cuts added further fuel. On the flip side, gold and other haven assets sank as stocks and the dollar rallied.

Then the money flows reversed as missteps such as an unsuccessful attempt to push through health-care reform fanned concern that pro-growth policies would also face obstacles. These charts highlight some of the biggest moves in commodities over the 100 days.

Copper: All Eyes on Infrastructure

Copper has declined about 0.7 percent since the Jan. 20 inauguration, even though it’s still up more than 5 percent this year. “The momentum has dried up a bit,” Bart Melek, head of commodity strategy at TD Securities in Toronto, said in a telephone interview. Investors are saying “we’re not quite sure what’s going on here.”

Bullion Bliss

Gold bulls are still optimistic that the fallout from the U.S. health-care bill, Trump’s rift with North Korea and skepticism on U.S. trade policies will continue to bolster demand for the metal as a haven. Bullion rose 5.3 percent during the 100 days as the U.S. dollar fell and traders reduced expectations for the pace of rate hikes.

Oil Disappoints

Oil has fallen amid concern that increasing U.S. crude output will offset efforts by the Organization of Petroleum Exporting Countries to eliminate a global supply glut. “Investors are apparently unimpressed by the OPEC cutbacks given that stocks are hardly decreasing,” Edward Meir, an analyst at INTL FCStone Inc. in New York, said in a note to clients April 30.

Commodity Returns Drop

The Bloomberg Commodity Index lost almost 5 percent in Trump’s first 100 days. Despite the setback, Goldman Sachs Group Inc. remains bullish on commodities. “Demand levels are starting to get high enough to exceed supply and begin creating inventory draws,” Goldman analysts wrote in a note last month.

(*source Bloomberg)

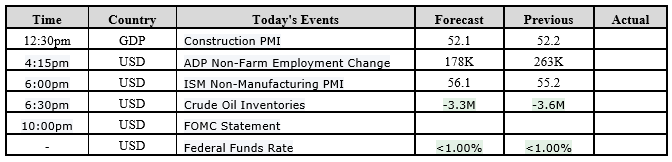

Data – Forthcoming Release

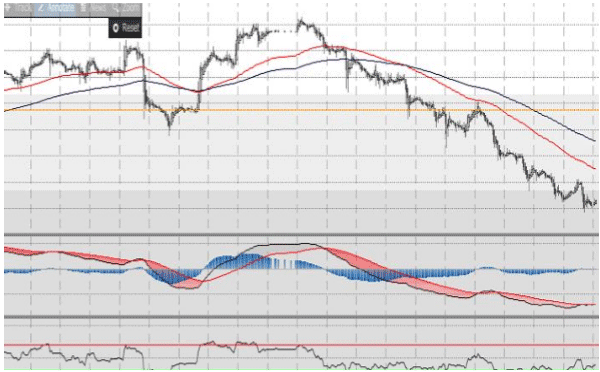

Technical Outlook and Commentary: Gold

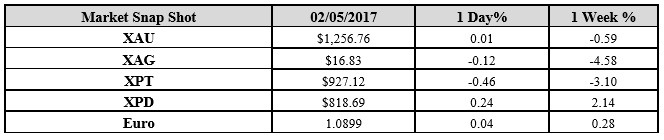

Gold for Spot delivery was closed at $1256.76 an ounce; with little gain of $0.18 or 0.01 percent at 1.00 a.m. Dubai time closing, from its previous close of $1256.58

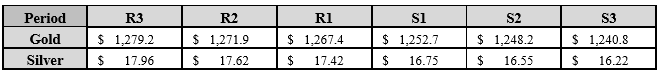

Spot Gold technically seems having resistance levels at 1267.4 and 1271.9 respectively, while the supports are seen at $1252.7 and 1248.2 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.83 with loss of $0.02 or -0.12 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.85

The Fibonacci levels on chart are showing resistance at $17.42 and $17.62 while the supports are seen at $16.75 and $ 16.55 respectively.

Resistance and Support Levels

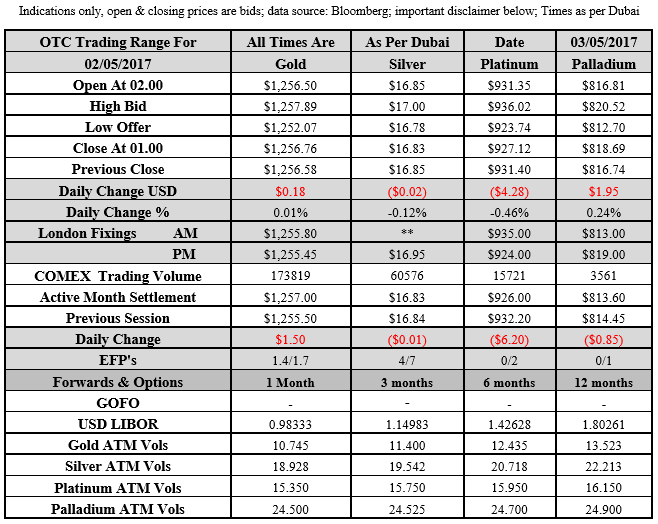

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply